[ad_1]

The markets have been selling off sharply with US stocks suffering their worst fall in 8 months. The tech-heavy Nasdaq Index dropped yesterday by 4.1%, its biggest one-day decline since June 2016, while the S&P 500 index fell 3.3%, its worst day since February. The S&P 500 index has fallen five days in a row – its longest losing streak since President Trump was elected in November 2016. So what is behind this decline and should we worry? First, I will go over the reasons behind the price decline:

1- Bond Yields: The U.S. 10-year Treasury yields moved sharply up last week by 0.2%, reaching a 7-year high of 3.25%. Although a move of 0.2% is not much, this seems to have spooked investors and the price declines hit the high-yield space first, and then the general markets. Usually, higher interest rates by the U.S. Fed should be viewed as positive because this is a vote of confidence that the U.S. economy is doing very well. However, the magnitude of the bond yields movement has resulted in panic.

2- VIX Volatility Bets: Some investors are greedy, and when the markets look very bullish, some decide to short the VIX volatility indexes to make a quick buck. If you recall what happened in February 2018, there was a huge investors money shorting the VIX Index (or volatility indexes). Of course, when we see market turbulence, volatility spikes, and those who are short the VIX get ripped to shreds. Back in February 2018, there was enormous amount of investors who were shorting the VIX, which caused a huge market turmoil. This was exacerbated by the collapse of two exchange-traded notes that bet shorting the VIX futures. Of course, when these investors try to cover their bets, this causes volatility to spiral even higher.

I believe that a similar dynamic have come into play this week. Data from the Commodity Futures Trading Commission indicates that investors are once again shorting VIX futures to the greatest degree since January 2018. Unfortunately, some investors have a very short memory, and I believe that those shorting the VIX have been trying to cover their positions once again, and this has contributed the recent market decline.

3- Computer generated trades: In our days, there are many computer-powered investment strategies that systematically scale their market exposure according to volatility. So when markets are up and volatility is down, the programs start buying stocks, but when markets turn choppier they sell. These computer generated trades tend to exacerbate both routs and rallies, and I believe they have also contributed to the market declines in the past few days.

4- Global growth Concerns: While the U.S. economy is firing on all cylinders, there has been lately concerns about economic growth elsewhere in the world. The President of the European Central Bank Mario Draghi has pointed to rising protectionism as the “major source of uncertainty” to the eurozone economy as the latest data coming from Europe shows lower business confidence and slowing exports. Furthermore, the International Monetary Fund (the IMF) this week cut its growth forecasts for many countries for this year and in 2019.

My Take on the above

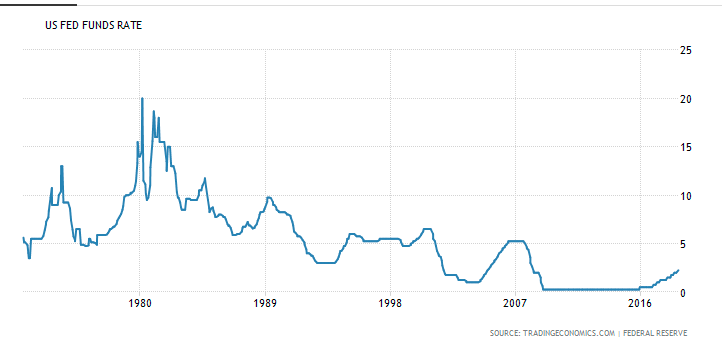

Nothing from the above 4 factors point to fundamental weaknesses that should cause investor concerns about owning equities. First, as we have noted above, rising interest rates in the United States is a sign that the U.S. economy is healthy. Furthermore, this extreme fear of rising interest rates comes at a time when interest rates remain close to historical low levels, and companies are still able to borrow at low rates that enable them to achieve highly attractive returns. Below is a chart that depicts Fed Funds Interest Rates for the past 50 years.

As we can see above, we are at historic lows, and investors’ concerns in my opinion are overblown.

Furthermore, both the current rout caused by VIX investors and computer generated trading are short-term factors that have no impact on stock fundamentals.

Finally, concerns over trade war and economic growth should resolve itself. The U.S. just struck a trade deal with Canada and Mexico. I believe that we will also see a similar deal done with China when the right time comes. Even if this does not materialize, the U.S. economy is unlikely to be affected in the short and medium term. In fact, this could result in faster economic growth in the U.S. in the next couple of years. Of course, if the trade situation with China is not resolved, this would increase recession risks in the United States, but that would take some time, and not before 2 to 3 years at least.

Most importantly, despite the recent market gains, there are no indication that we are in a market or asset bubble such as a house price bubble, which can contribute to a market crash. Valuations for the S&P 500 index remain at acceptable levels, while valuations in several high-yield stocks and sectors are close to their lowest in years. There is no indication of investors being euphoric, which could indicate that the end of the bull market is near.

What Comes Next?

I think in the very short term, we are likely to see a continued volatility; however we are clearly in oversold territory and we are likely to see a rebound soon. There are plenty of bargains around, especially in the high-yield space.

The most important point to note is that the fundamentals remain strong for equities, and technically, this bull market remains in place. I believe that in a few days, the uptrend should start again and in a couple of months, all of this would have been forgotten. I strongly investors not to panic. I do not foresee a market correction, and even if I am wrong, the worst case scenario is that we will see a mini-correction similar to what we saw in early 2016 which only lasted for 3 months and was followed by a quick market recovery. But I really doubt that we will get there.

Finally we have to take into account that the 3rd quarter earnings season will start in just a few days. I believe that this will be the catalyst to see a strong recovery and a continuation of the current market rally.

What Assets are most at risk?

Here, I would like to add that the assets that are most at risk are long-term bonds. We have been avoiding those for the past 2 years and our portfolio has no direct exposure them. We have been allocating our funds to high yielding equities as opposed to fixed income (or bonds). They are revenue- and earnings-driven investments. As the economy grows, such stocks should see their revenue and cash flow grow, and are set to outperform.

Another strategy that investors should follow is overweight U.S. stocks, and this is exactly what we have been doing. The U.S. economy remains the strongest and fastest growing economy among developing nations, and U.S. equities remain the best place to be invested in.

Note that most high-yield stocks and sectors provide a pure U.S. exposure including Property REITs, BDCs, Mortgage REITs, and Midstream MLPs. We are overweight all of these sectors.

About High-Yield Stocks and Sectors

Yesterday, we saw the decline in high-yield stocks and sectors much lower than that of the general markets. In fact, at a time the S&P 500 index closed down by 3.3% and the Nasdaq by 4.1%, Property REITs were only down by 1.4%, Midstream MLPs by 1.9%, and BDCs by 1.3%. Most High-Yield sectors, are deep-value sectors today, because they are cheap and the downside risk tend to be limited when the markets are down or in case we see a market correction.

With the 3rd quarter earnings season kick-start in just a few days, I have very high expectations for several high yield stocks and sectors which are set to post some stellar earnings. I am most bullish on Business Development Companies (‘BDCs’), and Midstream MLPs, and Property REITs, which are set to report record quarterly sales and earnings over the next six weeks. Also, I expect many Property REITs to boost their dividend yield.

I am very optimistic about these high yield sectors in the longer term. In today’s very low interest rate environment, high-yielding stocks remain very attractive to income investors as there are very little alternatives to get such investment returns. Demand for dividend stocks will only increase in the future as the general population grows older and more people enter the retirement age.

In my opinion, the yields that we are seeing today will not last very long. As demand for high-yield products grows over the next few years, yields are bound to compress. Therefore it is my opinion that taking advantage of the high yields offered today is an opportunity.

Conclusion

I remain very bullish on the prospects of a strong 3rd quarter earnings season, as well as a continuation of the current bull market. I believe that income investors who are in the right high-yield stocks and sectors should see their portfolio outperform over the next few years. Again, investors should keep a long-term view and not get discouraged by the recent volatility. The general markets are still in a long-term uptrend, and this bull market is likely to continue. Long-term investors should be very well rewarded. The best aspect of investing in dividend stocks is that no matter what happens to equities in the short-term, we keep collecting high-income until the markets recover.

If you enjoyed this article and wish to receive updates on our latest research, click “Follow” next to my name at the top of this article.

About ‘High Dividend Opportunities’

High Dividend Opportunities is the largest community of income investors and retirees with over 1500 members. We provide a comprehensive service, ranked #1, dedicated to high-yield securities trading at attractive valuations – with an overall target yield of 9-10%. Subscription includes:

- A managed portfolio of stocks currently yielding 9.8%.

- A “Dividend Tracker” which lets you know exactly when to expect your next dividend.

- A “Portfolio Tracker” to track your dividend holdings, income, and allocation by sector. For video click here.

If you are looking for the most profitable high-dividend ideas, you have come to the right place. For a very limited time, we are offering a 20% discount. For more info, click here.

Disclosure: I am/we are long THE “HIGH DIVIDEND OPPORTUNITIES” CORE PORTFOLIO + LRET + LADR + EPR + IRM.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link