[ad_1]

In my last article, I was optimistic about Brent Oil (BNO) and WTI Crude (OIL) because I was expecting an upward rally. This occurred when Brent Oil reached the $ 79.71 mark, while WTI Crude reached the $ 70.33 price target. Therefore, in this article, I will check for the possibility that WTI Crude and Brent Oil will escape weak hands, after which they would have a new upside breakout. To establish the likelihood that this will happen, I will review the fundamental developments affecting oil while analyzing the graphs with the help of technical analysis tools.

Fundamental developments

In the coming weeks and months, we will see a horde of hurricanes in different cities as it is the most active part of the hurricane season. I think this will lead to a significant rise in oil prices in the coming months, which would mean a strong recovery.

The first facet I think hurricanes would affect is the offshore oil platforms in the Gulf of Mexico. In general, not all hurricanes enter the Gulf of Mexico, but when they enter this region, most oil companies are forced to take precautions such as closing their oil rigs. The previous week, Tuesday and Wednesday, Hurricane Gordon formed in the Gulf of Mexico, which forced the closure of offshore oil rigs. This resulted in a 9.23% drop in the level of oil supply, which resulted in a reduction of 156,907 barrels per day. This raised the price of WTI crude by 9 cents.

In my opinion, the second aspect of hurricanes is oil refineries in the Gulf of Mexico, which account for more than 50% of America's refining capacity. As the hurricane season grows, severe flooding can be expected, as we have seen in the past. This will force oil refineries to close, which would have a serious impact on the level of oil production. Hurricane "Motiva" in 2017 is an example. The hurricane shut down the largest US refinery for two weeks, resulting in a 5% drop in total US refinery production. In addition, before the hurricane hit, the October gasoline contract rose 10 cents per gallon due to the fear factor.

In my opinion, the third aspect of hurricanes is pipelines and ports. Ports around the Gulf of Mexico and the East Coast have always been closed if they appear to be on a hurricane path. This has a strong impact on the price of oil contracts, as ports in the Gulf of Mexico process most crude oil exports to other countries. Thus, a delay in these exports would lead to an unforeseen accumulation in storage facilities. This not only affects the price of oil contracts, but also forces oil companies to stop drilling.

When we put all these facets into the mix, we can certainly see a clear pattern. The trend shows traders that as the hurricane season sinks, oil prices can be expected to rise because of weather problems.

OPEC, this month, lowered its estimates of global oil demand growth for 2018 and 2019. It adjusted the growth level of global oil demand for 2018 to a 20,000 barrel a day drop . In addition, for 2019, it also lowered its demand growth estimate by 20,000 barrels per day. OPEC said it expects international oil demand to grow by 1.62 million barrels a day.

This reduced revision of demand is the main reason I see a temporary correction of oil contracts, because the market assimilates the information. However, the correction would be short-lived due to the global hurricane season.

Technical analysis

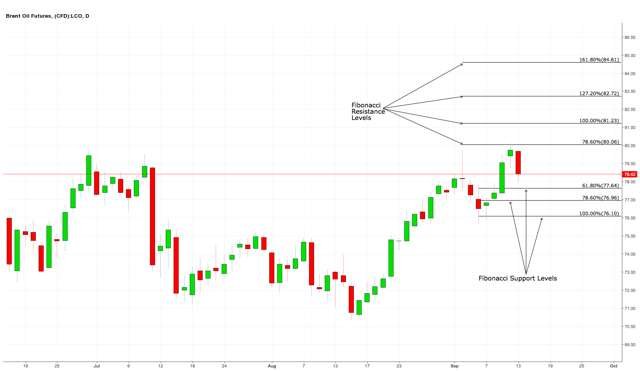

Brent oil

The daily chart of Brent Oil indicates that in the next few days we will see a temporary bearish reversal that would bring the contract down to a support level of 78.9% at $ 76.96. I say that because the oil contract formed an evening star. The model's green candle tells traders that the uptrend is in effect. However, the real body of the next candle warns us that the bullish momentum is weakening. This is then confirmed by the last bearish candle that shows the traders that the bullish rally has stagnated. However, once the product reaches the support level mentioned above, we will have a strong upward recovery, as the correction would have ended.

On the price front, I do not expect the product to fall below the 78.6% level to $ 76.96. However, if it does not meet this level, I do not expect the decline to reach the 100% level at $ 76.10. Once that level is reached, there will be a recovery, which I believe will make the oil contract between 127.2% and 161.8%. The level of 127.2% is at $ 82.72, while the level of 161.8% is at $ 84.61.

As for the indicator, the RSI is down sharply and has just fallen below the 58 mark, confirming the slight slowdown anticipated. In addition, the ADX lines have settled in the same place, demonstrating to investors that the downtrend is robust.

WTI crude oil

On the daily chart, the oil contract ended sharply after reaching the 100% Fibonacci resistance level at $ 70.19. So, in the next few days, I expect the WTI tankers to give the bulls six kicks on Sunday. I say this because the commodity structure has fallen to a key support level of $ 69.53. This psychology of models tells traders that the tide of the market has changed from that in which the bulls were in control to the one where the bears now call the shots.

On the price front, I think the product will fall to a support level of 78.6% to 100%. The 78.6% level is at $ 67.69, while the 100% level is at $ 66.71. However, once it reaches the level mentioned above, I expect a strong bullish reversal to the resistance level of 161.8% at $ 72.09. In addition, the 127.2% resistance level is 70.98.

The big picture

In conclusion, I look at the fact that bears are in the driver's seat in the short term, which would bring the goods down to the levels mentioned above. However, once the correction is complete, we will have a very strong rally as we go further into the hurricane season. Regardless of how you decide to negotiate, be sure to use follow-up judgments as this helps preserve capital, which is of paramount importance.

Good luck trading.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link