[ad_1]

Legendary investment bank Lehman Brothers was on fire – and no one was coming out.

Bank of America refused to save the 158-year-old Wall Street firm without the support of Uncle Sam. The British government would not let Barclays (BCS) buy Lehman Brothers and its toxic balance. And Washington has decided against another unpopular political rescue plan.

So, Lehman Brothers was allowed to fail. On Monday, September 15, 2008 at 1:45 pm, Lehman Brothers filed an application for protection under Chapter 11 Bankruptcy.

What ensued was the largest and most complex bankruptcy in American history. But that does not do justice to the damage caused by the disappearance of Lehman from the financial system. The implosion of Lehman Brothers – and the chaos it sparked – has been the most terrifying moment for business and the US economy since the Great Depression.

"It's the moment when the financial crisis has erupted on us when panic has seized markets," CNNMoney Phil Angelides, who led the official two-party inquiry into the company, told CNN. Collapse of 2008.

The failure of Lehman shook Wall Street. The Dow Jones fell by 504 points, equivalent to 1,300 points today. Some $ 700 billion has disappeared from pension plans and other investment funds. The panic that followed plunged the US economy into a severe slowdown, known today as the Great Recession.

Today, the Lehman Brothers Group and its CEO, Dick Fuld, are the most attentive children to the thoughtless risk taking that has ruined the economy.

Frenzied interviews

Lehman's last days were marked by frantic last-minute negotiations about his fate.

Until the end, everyone thought that someone would save Lehman Brothers: the company would certainly not be allowed to fail. Bear Stearns, a small investment bank, had been saved only six months earlier by Washington and JPMorgan Chase (JPM).

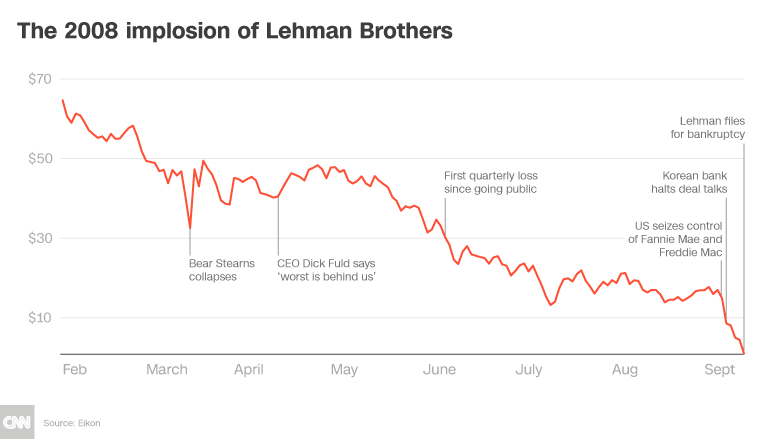

On Wednesday, September 10th, South Korea's Korean development bank abandoned the race to become Lehman Brothers. White knight. This news, combined with Lehman's announcement of a record quarterly loss of $ 3.9 billion, resulted in a 45% drop in bank shares.

South Korea, Treasury Secretary Hank Paulson, has called on Bank of America CEO Ken Lewis to ask him to find a creative way to buy Lehman Brothers. Put on your hat of imagination, urged Paulson Lewis.

But on Friday, September 12, Bank of America said it was yielding unless the government was willing to help. Lehman was simply stuck with too many "illiquid" mortgage assets, and he could not sell them fast enough to fulfill other obligations. Bank of America (LAC) decided instead to buy the next investment bank in failure: Merrill Lynch.

"You just did not know what would happen when you got to work on Monday," said Kim Brady, who worked as an analyst on Lehman's trading desk. "Are you going to work for Barclays, a Korean conglomerate?"

The only option to come was bankruptcy. "They will not just drop the bank," said Kim.

"Not a penny"

On Friday night, Paulson ordered the big Wall Street bosses to meet at the New York Fed headquarters. They were told to find a solution to the private sector to save Lehman.

US officials had little appetite for another bailout. They had just taken control of mortgage giants Fannie Mae and Freddie Mac last weekend. Fed officials said Paulson made it clear that there would be no government help this time, "not a penny".

On Saturday, the Lehman made a breakthrough: Barclays agreed to acquire Lehman – as long as Wall Street some assets of his hands. But the Barclays deal was ignited on Sunday when British regulators refused to bless the risky deal.

"Imagine if I said yes to a British bank that buys a very large US bank that collapsed the following week," said Alistair Darling, the UK Treasury Chancellor, to the Commission's investigation into the financial crisis.

"It was a pandemonium up there"

In the absence of buyers, regulators lobbied Lehman Brothers for them to go bankrupt Sunday night before opening markets in the morning.

Lehman's lawyers and executives have left the New York Fed to inform the board that no bailouts have been forthcoming.

"We went back to headquarters, and it was pandemonium up there," said Harvey Miller, Lehman Brothers' bankruptcy advisor, to the investigators.

The Fed rejected Lehman's last-minute appeal for additional help from the central bank, which led to the morning bankruptcy.

The collapse shocked the employees.

"I never thought the company would go bankrupt, it was terrible," said James Chico, who has worked for more than two decades as an analyst at Lehman's back office.

Tom Rogers was on a honeymoon in St. Lucia when the bank, his employer for seven years, went bankrupt.

"I came back and it was only a mass chaos," said Mr. Rogers, who started as a trainee at Lehman and joined the senior analyst of the Canadian reinsurance operations. firm.

"Cataclysmic proportions"

The turmoil showed how fragile and interconnected the whole system was. The situation has been exacerbated by the near-collapse of AIG (AIG), the insurance giant. Regulators feared that AIG's demise would bring down the entire system – AIG benefited from a $ 182 billion bailout.

Fear and panic spread rapidly in the financial system, leading to the freezing of credit markets. Even big iconic industrial companies such as General Motors (GM) were unable to receive short-term funding.

"The financial crisis has taken catastrophic proportions with the collapse of Lehman Brothers," concluded the crisis investigation commission.

Fuld, who had In April 2008, she told shareholders that "the worst is behind us", appeared as one of the bad guys of the crisis. He directed Lehman directly in front of an epic storm.

Between 2000 and 2007, Lehman's assets had more than tripled to $ 691 billion. And its debt ratio, known as leverage, jumped to 40 times the company's equity. The company had relatively little capital to protect itself from the problems.

Madelyn Antoncic, head of Lehman's risk management from 2004 to 2007, tried to warn Fuld against an increase in mortgage risk.

"At the top level, they were trying to push so hard that the wheels started to come off," Antoncic told the commission.

For his part, Fuld told lawmakers in 2008 that the pain of Lehman's failure "will stay with me for the rest of my life".

The former boss of Lehman Brothers, who made and lost a billion dollar fortune on Wall Street, has made few public appearances since the crisis. He spoke at an event in 2015 where he admitted that he would do some things differently.

"I missed the market's violence and its spread from one asset class to the other," said Fuld.

Where were the regulators?

Fuld does not deserve all the blame. The company's demise highlighted the savage risk taking that regulators and CEOs had allowed to become endemic across Wall Street.

Take, for example, the deregulation in 2000 of exotic financial instruments called derivatives. Regulators had little window on how these transactions linked banks to each other. When a bank has failed, other financial institutions have had a kind of domino effect.

Even a month before the Lehman bankruptcy, Fed officials were still looking for information on the bank's 900,000 derivative contracts. And they had no idea of the risk posed by the huge AIG derivatives book.

"The people in charge of overseeing our financial system were blind as the crisis unfolded," said Angelides.

It was only in 2010, with the adoption of the Dodd-Frank financial reform law, that the derivatives were to be bought and sold on the stock exchange.

The regulators have also failed to make Lehman Brothers slow down its dive into mortgages. The company continued to purchase real estate assets in the first quarter of 2008.

The Office of Thrift Supervision of the Finance Department has issued no report warning against Lehman's "disproportionate" commercial real estate up to two months before its collapse. The OTS was abolished by Dodd-Frank.

Similarly, the SEC refused to call Lehman Brothers for exceeding the risk limits – even though the agency was aware of it.

"The SEC (…) was aware of the company's disregard for risk management," the commission said.

Lehman Brothers also used accounting gadgets to hide the amount of money borrowed. Bart McDade, President and Chief Operating Officer of Lehman, wrote in an email at the time that the accounting maneuvers were "another drug we are working on".

Should Lehman have been saved?

Economists will debate for decades whether Washington should have saved Lehman to prevent the chaos that followed. Former Federal Reserve Chairman Ben Bernanke maintains that regulators do not have the power to lend to a failing Lehman.

"Essentially, we had no choice and we had to let it fail," Bernanke told the commission.

But others say Bernanke and Paulson should have realized that letting Lehman fail would aggravate the crisis.

"Our regulatory system is made up of human beings – and humans make mistakes," said James Angle, a professor of commerce at Georgetown University. "The Fed clearly could have better contain the damage."

Washington's inconsistent response – deciding not to save Lehman after rescuing Bear and helping AIG – has added to uncertainty and panic, "concluded the investigation into the financial crisis.

Could this happen again?

Today's financial system is safer because of the reforms put in place after 2008. Banks have accumulated huge amounts of capital. Regulators are more vigilant.

But some worry about the risk of a new recession, even if it does not start with the banks.

"I'm worried now," said Robert Schiller, Yale's famous professor.

"We are already ready for what could be a repeat of 2008," said Shiller. "It will look different this time, but there could be a drop in house prices and a recession."

Let's hope that the lessons of the last crisis have not been forgotten.

A decade later: It has been 10 years since the financial crisis shook the US economy. In a special year – long series, CNNMoney will examine the causes of the crisis, how the country is still feeling its effects and the lessons we have learned – and have not learned yet.

– Julia Horowitz of CNNMoney contributed to this report.

CNNMoney (New York) First published on September 14, 2018: 7h20 ET

Source link