[ad_1]

Introduction

Berkshire Hathaway (BRK.A) (BRK.B) recently announced that it was amending its buyback plan to give greater flexibility to Warren Buffett and Charlie Munger for redemptions. # 39; s shares. Previously, the plan provided for stock repurchases only if the stock was trading at less than 120% of the company's book value. This plan was commonly called "The Buffett Put."

My relationship with the Buffett Put On Seeking Alpha came in March of this year when I wrote a series of articles suggesting that Berkshire Hathaway was a good alternative for a defensive A handful of service sector stocks that I thought could fall further than investors expected if we had a bear market or a recession. My reasoning was that it was unlikely that Berkshire 's share price would remain below 1.2 times the book value with as much money as Berkshire held, especially since In my opinion, most large-cap companies were overvalued and if their prices dropped at the same pace As Berkshires in a downturn, Berkshire's stock would be at 1.2x well before most of these other companies do not look like business to Buffett. (At the time Berkshire was trading at around 1.4 times book value.)

Although I've never written a full article on Berkshire, those who follow my monthly updates know that I've been pretty puzzled year. I have written on various theories in my updates from April, May and June, where I am performing my SA ideas. I spent a lot of time trying to pinpoint the key factors of stock price lately because my basic thesis for recommending Berkshire is still intact (the furthest was 1.3 times the book value a few weeks ago)

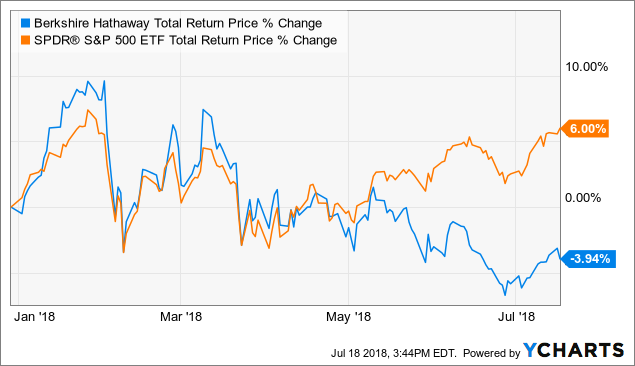

BRK.B Data on total return by YCharts

This is Berkshire's performance against the S & S index P 500 (SPY) since its creation. the beginning of the year, until the day before the Berkshire announcement on 17/07/18. For a company like Berkshire, which I judge both superior to ESP and having had a better course when I recommended it in March, a 10% deviation from the ESP over 4 months is very unexpected considering the fact that there was no specific news to Berkshire that came out that could bring down the price. It is worth noting that the gap began just after the annual shareholders' meeting (more information later).

I expected the Berkshire stock to trade fairly close to the S & P 500 while the market was enjoying it. Berkshire declined less than the market and less than stocks that were traditionally more cyclical or more leveraged.

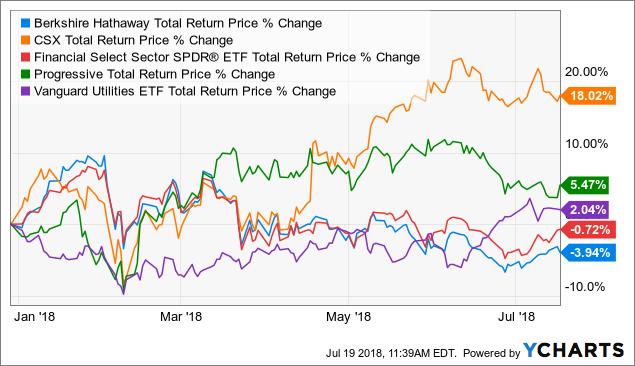

] There have been many good articles on the different ways to evaluate Berkshire's action on SA, and there seems to be a consensus that something close to $ 240 per share for equities B is reasonable. But another way that I like to think about the recent underperformance of the stock is to compare some of the leading companies that Berkshire has to their market counterparts. As I have not seen anything that suggests that Berkshire is losing a significant market share in one or the other of its large companies, I would expect that the components will 39, exchange at least in the same way as similar stocks or indices. For example, I think GEICO could be evaluated in the same way as Progressive (PGR), Burlington Northern, to trade in the same way as CSX (CSX), Berkshire's important financial assets to trade in the same way as the Financial Select Sector SPDR ETF (XLF). Trade similar to Vanguard Utilities ETF (VPU), and so on. Now, if there was an obvious reason why we would not expect much correlation between many of them, then this comparison does not make much sense. But for now, I have found no reason to believe that there is a rational reason associated with these companies themselves to justify a lot of deviation.

BRK.B Total return price data by YCharts

could have chosen different or better examples, but the model would be essentially the same. I think it might be an argument that Berkshire is trading similarly to the broader financial index, but even then, before the announcement of the redemption, Berkshire was trading 3% more down as the XLF. Does anyone think that during this year, Berkshire became less valuable than the banks that it bailed out during the financial crisis? (I know I do not do it.)

I think there are three reasons why the Berkshire title sees an unusual selling pressure. One is that Buffett has consistently poured his personal actions into the market via his charitable donations. The second is that we are going through a period of unprecedented, irrational political zeal in my life, and that it is difficult for Berkshire to attract new investors. The third is that this business cycle is one of the longest in history and creates a problem of long-term underperformance compared to the S & P 500 index. In this article, I'll explain why the buyback policy change can help

Question 1: Buffett actually sells shares

Warren Buffett has never sold any of the shares of Berkshire Hathaway. It is another well-known fact that he is giving most of his actions to charity, the biggest beneficiary being the Bill and Melinda Gate Foundation. I think Warren has tried to do it in the least disruptive way possible, by giving the foundation a certain number of actions each year and then having the Foundation sell a fixed amount every year.

Until they fell: May Service Sector Edition "article that the Gates Foundation has very regularly sold about 5 million shares per quarter for the last few years.

| Filing Date | # ~ Actions in millions |

| 11/2015 | 79 |

| 2/2016 | 74 |

| 5/2016 | 69 |

| 8/2016 | 64 |

| 11 / 2016 | 74 |

| 2/2017 | 69 |

| 5/2017 | 64 |

| 8/2017 | 59 |

| 11/2017 | 68 |

| 2 / 2018 | 63 |

| 5/2018 | 58 |

You will notice that once a year, the number of shares climbs by 10 million, representing an annual donation of 15 million Buffett shares, less a sale of 5 million shares., The Bill and Melinda The Gates Foundation has always sold 20 million shares a year .If the current model continues in the future , we can expect that the Fondatio Gates continues to sell Berkshire shares in the open market for at least the next 12 years (15 million shares a year and 20 million shares). Things may change, of course, but they have been very consistent up to here. The only event that could potentially change this trend is the death of Mr. Buffett (who, in my opinion, still holds about 400 million shares assuming that they are converted into Class B shares.) [19659043] So while Buffett does not sell his shares directly, they are actually sold by the Gates Foundation. This does not explain the recent divergence in the price of the ESP action since May, but it must be admitted that without this sale, the course of action would probably be higher. The important thing here is that this sale is not a short-term bomb on the radar. We can expect these stocks to continue to penetrate the market over the next 10 to 20 years.

While the shares are sold on the market in an orderly fashion, I am of the opinion that it is quite reasonable. Berkshire repurchases some of these shares and withdraws them as long as the stock price is at fair value or below. Until 2006, Berkshire's long-term shareholders did not know that Buffett's plan was to donate almost all of his shares to charities, which in turn would sell them on the open market. It is right for them if this action seems to depress the value of the stock over a long period of time, as Berkshire takes steps to mitigate some of the lost market value.

Issue # 2: Political Irrationality

I have never seen America as politically irrational as it is today. National politics, whether we like it or not, have invaded our lives in a way that is just not healthy. All you have to do is read a thread of comments here on SA that even remotely touches anything that, in the least way, can be interpreted as political in order to see an example. And I think Berkshire's stock has suffered in this environment.

There are two reasons why I think some people on the right side of the political spectrum could avoid Berkshire. The first is Buffett and Munger's support for Planned Parenthood. For some right, it is a moral issue that appears to be slavery and they do not want to have anything to do with people, or a company, associated with abortion. Personally, even though I do not agree with the personal support of Buffett and Munger's abortion providers, I am of the opinion that as long as Berkshire does not spend the money on it. Company, so we agree not to agree. But there are many people who can not separate the two. They could avoid the Berkshire stock no matter how cheap it was on this issue.

As controversial as the issue of abortion may be, I think potential Berkshire shareholders have escaped the stock because of Buffett's support. Democratic presidential candidates like Barack Obama and Hillary Clinton, as well as his vocal support to raise taxes on the rich. In fact, while I've heard a lot of Republicans criticizing Buffett for these things, I've never heard or read in a stream of comments about someone writing: I disagree with some political views of Buffett, but I am still a shareholder of Berkshire Berkshire is a great company and Buffett is a great money manager and an extremely ethical CEO. (Perhaps this will happen in this article. I can not be the only one to think so.)

Berkshire shareholders are a difficult question to classify and quantify, but I would challenge readers to think about it. listen to the questions and answers. from the recent shareholders meeting and pay close attention to the applause (and taunts) from the audience in response to the questions presented. On the handful of politically charged questions that were asked, it was pretty clear to me that the shareholder base in the arena inclined quite significantly to the left. Which brings me to my next point.

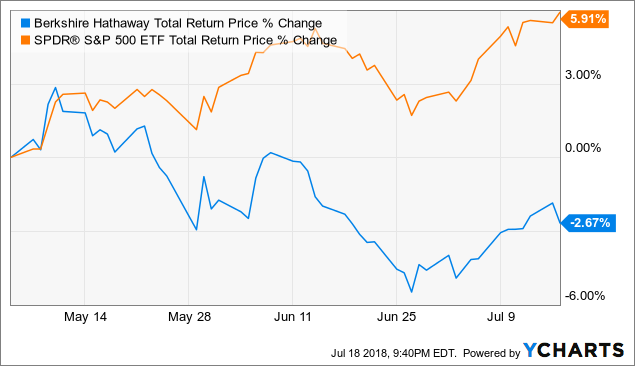

If you listen to or watch the questions and answers pay attention to the question of whether Buffett would do business with the gun makers (or the gun sellers, I forget the precise wording). Buffett's answer was essentially that Berkshire was not going to have a litmus test on this issue for the companies with which he does business. Essentially, what he meant was that he was not going to arm Berkshire in a political fight against arms manufacturers and sellers. The implication was that Buffett did not put the weapons at the same level as the cigarettes in terms of the damage they cause to the company (although he was very careful not to to say it). The audience was rather dissatisfied with this answer. These are the current shareholders of Berkshire, and I would not be surprised if after the meeting, many of them sold their Berkshire share on the subject. Until the Berkshire meeting, the actions had mainly followed espionage. Here is how they did after May 7, the first trading day after the meeting:

BRK.B Data on the total return price by YCharts

So, I think Berkshire suffers from # 39, a boycott of the buyer the political purists of the left and right of the political spectrum. People are now voting with their money, including not only the things they buy, but also the investments they make. The possibility of separating politics from other aspects of life is disappearing.

The relevance of this situation in relation to the recent announcement of the repurchase policy is that the current shareholders of Berkshire do not deserve to have a long term haircut. because of politics as mean and irrational as this one. In fact, I think that people who avoid the Berkshire stock for political reasons deserve that their alternative investments underperform. Their irrationality certainly does not deserve to be rewarded and reinforced by a Berkshire action price repressed

# 3 Explanation of long-term underperformance

There was a great article published this week by Rusty Guinn on the blog of Epsilon Theory. it was you, Charlie. about how difficult it is for financial advisors to deal with clients whose portfolios may be properly positioned and earning money, but who are underperforming the market during this long bullish period. The guiding idea of the article is that advisors must take into account this fear of disregarding just as much as they must take into consideration how their clients will react to a significant downturn in the market . I think Buffett must take these things into consideration

Choosing to invest in Berkshire Hathaway, it's like choosing a person to manage a fund for your investments. Essentially, what you say when you buy the stock, is that you think Buffett can better allocate your capital than you can. But if you're trying to decide for the first time if Buffett is better than you, or better than just buying an S & P 500, what criteria would you use?

For decades, we could have used a five-year rolling average and compared Berkshire against the S & P 500 and found that Buffett outperformed, but that was not the case. Recent times:

BRK.B YCharts' total yield data

As we can see, Berkshire has clearly underperformed has been performing the S & P 500 index over the last five years, and has been particularly hurt since the peak of the market in January of this year. Of course, in my opinion, most of the outperformance of the S & P 500 is totally unjustified. It is almost entirely fueled by huge stock repurchases with borrowed money and upbeat growth prospects from a handful of technology companies. In the meantime, here is Berkshire with a huge treasure that has not been used to redeem shares during this time. Basically, Berkshire's shareholders are punished because Buffett did things the right way.

I've already seen this with Berkshire. Just before the dot.com bankruptcy in the late 1990s, there was story after story about how Buffett was offline and how his investment approach did not work with the "new economy" etc. . They have been proven wrong in a few years, of course. It is interesting to note that this period has something in common with the one we are in now, that is, we have had a very long bullish period in the market. In fact, if we look at how Berkshire's action has behaved in relation to ESP during a full business cycle, we see a very different story.

BRK.B YCharts total return data

dates back to about two years before the last recession, representing what I consider to be approximately a complete economic cycle. As we can see, once we include a period that contains a slowdown, Berkshire is starting to look pretty good even compared to equities running all the financial engineering in the S & P 500. The problem, of course, is that many investors, especially many It is unlikely that newer investors are recovering so far back in time and do not immediately recognize how much Berkshire Hathaway is better than SPY. They are much more likely to be caught in a political history about Buffett, the story that Buffett has not performed well in the last 5 or 6 years, the lure of Netflix (NFLX) and Tesla (TSLA), or the Boglehead is approaching to just buy an index and let it be.

But it is not just potential new investors who could reject Berkshire. It would be understandable for an investor who bought Berkshire in 2012, with the hope that Berkshire would outperform at least the S & P 500 over rolling 5-year periods, to be a little impatient with stock performance. Most people do not understand how much Berkshire is more defensive than the vast majority of stocks in the index and it's easy for them to ignore what could happen when the "tide goes down." For this reason, I think Buffett is doing a favor to less sophisticated investors by using the money to buy back shares at reasonable prices. This helps Berkshire's market value better reflect its intrinsic value. Over short periods, it's not a big deal, but when people experience years of underperformance, it's understandable that some may question the wisdom of investing, especially if the media become negative and their friends stocks

Conclusion

There is little investment that the more we look at them, the better they look. I have studied Berkshire, Warren Buffett and Charlie Munger for several years, and I am more and more impressed by what they have been able to accomplish and what they continue to do. Readers who follow my writing on SA know that I focus primarily on medium term investment and rotation strategies. If this seems to be in contradiction with Buffett's favorite long-term approach, that's it. Buffett has been a long-term investor for several decades now. So it may seem strange that I admire and recommend the stock of a company that uses a different approach than the one I am doing. But for me, Berkshire is the exception that proves the rule. How many other companies whose investors make long-term projections actually think long-term? I see very little. What I see in the big cap space is that companies are borrowing money to buy stocks at inflated prices, companies are borrowing money to buy d & rsquo; Other companies at very high prices in order to mask slower growth. to afford during a slowdown. How is this good for the company or the long-term shareholders? I do not think so, and it does not make sense to invest in their long term actions.

However, Berkshire really thinks and acts in the long run. They can resist anything that is not a nuclear war or nationalization by the government. They do not do a lot of market stuff trying to temporarily support the course of their action. Any redemption that will take place under the new program will likely result in the withdrawal of shares and will be paid in cash.

In addition, it is important that Buffett understands that not everyone is multimillionaire. Many people have invested in Berkshire in the long run, but still need to sell stock to support themselves in retirement. Others may have invested in Berkshire to help pay for their children's school fees or to help buy their first home. They are long-term investors who are not rich enough to hold the title "forever". The actions that Buffett markets through the Gates Foundation can be used to reduce the price of these investors' shares unfairly over a very long period of time. It just seems that if the stock price is trading below fair value, we have to make sure that these investors are not hurt by something that they would not have. could have predicted 15 or 20 years ago.

grant to investors who deliberately avoid the stock for political reasons. It makes more sense to punish these investors with poor performance for their irrational behavior.

And finally, there are many investors who can not see the value of Berkshire because the simplest measure of Berkshire's recent performance over the next 5 or 6 years is distorted by the bull market very long that we are currently experiencing. By increasing the share price of Berkshire through redemptions to better reflect reality, Buffett will serve these investors away from some of the sharks in the market who will eventually outperform in the long run.

I see investors who have planned an average dollar in Berkshire shares over the next 10 to 20 years at depressed prices while Buffett's shares are sold on the market. They will likely have fewer opportunities to buy the stock at a price below fair value. But weighing which investors are more important, it seems fairer to reward investors who have long held Berkshire and now have to sell stocks to finance their retirement.

I first bought Berkshire shares on behalf of my daughter on 25/01/2016 priced at $ 125.67, and I recently added shares in both my children's accounts at $ 187.14 per share on July 2nd of this month. About 10% of the value of their investments is now at Berkshire Hathaway. I expect that in the long run it will serve them well, and I fully support the new buyout plan.

Disclosure: I am / we are long BRK.B.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link