[ad_1]

By Bruce Blythe

At a glance

- Some analysts say Treasury bond yields are more favorable than treasury bond yields.

The Federal Reserve's continued efforts to prevent the US economy from overheating threaten to hinder all the rising aspirations among gold critters, at least for now.

In September, the Fed raised its reference funds benchmark rate to a target range of 2% to 2.25%. This is the third such increase in 2018 and the eighth since the start of the central bank's "tightening" cycle in late 2015. Many analysts are waiting for another increase. Fed rate in December.

Highs and lows

COMEX gold futures are already down about 12% from April's peak of $ 1,369.40 an ounce in April, based on the contract closest to expiration. In mid-August, gold had dropped to $ 1,167, its lowest level since January 2017.

At the same time, US benchmark rates continue to rise, with the 10-year Treasury yield reaching 3.24% at the beginning of October, its highest level in seven and a half years. Some analysts see the gold market as another drawback, the ever higher interest rate outlooks and higher "real" returns (adjusted for inflation) dampening the future. Attractiveness of metal for investors.

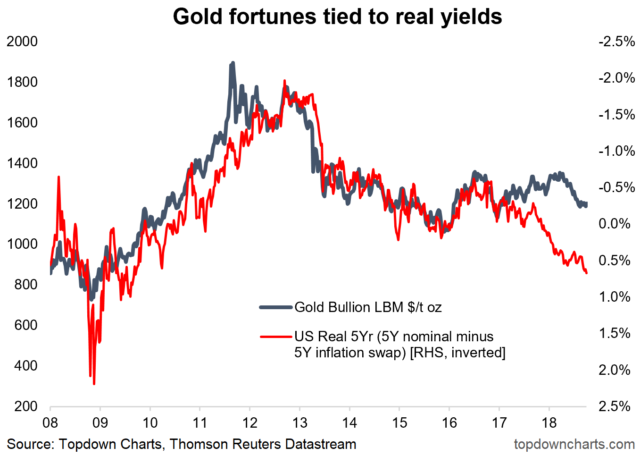

"Real returns are really essential for establishing a directional bias for gold," said Callum Thomas, head of research at Topdown Charts Limited. "Taken together, the upward trend in real yields and tighter Fed policy will likely continue to weigh on the price of gold for at least the next six to 18 months." Our charts suggest a fall gold of at least $ 1,000 or less. "

High inflation Stokes Gold Bulls

Traders and other market professionals have followed for decades the performance of the gold market relative to benchmark interest rates. Many consider gold as a haven – gold is always worth something, so it's a good place to park money during market turbulence, in others terms. Periods of high inflation, such as those of the late 1970s, have also been favorable for gold, as some view the metal as the ultimate "store of value".

David Andolfatto, an economist at the US Federal Reserve in St. Louis, believes that the distinction between nominal and real inflation-adjusted rates is essential, as is the calculation of the "opportunity cost" of gold assets. compared to fixed incomes.

"If the nominal interest rate is high because inflation is high, as in the 1970s, the real interest rate remains low.It was a good time to own money." gold because the actual yield of bonds was low, "said Andolfatto. "The reverse was true in the 1980s: the real interest rates were high and the opportunity cost of holding gold was high."

For example, unlike a bond or a share of shares, gold does not generate any income "and, indeed, it is often expensive to keep gold – among other expenses, for security and storage. "If rates go up, just holding back old money could generate better returns for investors relative to gold.

In addition, the tightening of the Fed's monetary policy (higher rates and less liquidity) often strengthens the US dollar, which may also weigh on the price of gold. "Higher interest rates make the attraction of gold against less attractive species, all other things being equal."

Gold market carve a background?

In a measure of gold's performance against rates, Thomas noted a "big bearish divergence" between gold bullion prices in London and real rates in 5-year US dollars. While gold prices have fallen and rates have risen, the gap between the two has recently reached its widest since the end of 2017.

The long-term view "suggests that we could still see a rise in real yields, and therefore a further decline for gold," Thomas said.

Some observers believe that the gold market may be close to a trough, at least in the short term, partly because of increased purchases from central banks due to falling prices. Global central banks added a net total of 193.3 tonnes of gold to their reserves in the first six months of 2018, up 8% from the same period in 2017, said MarketWatch, citing the World Gold Council.

According to the COMEX futures at the beginning of October, gold is expected to remain above $ 1,200 per ounce at least until 2019. L & # 39; For example, the June 2019 gold trade was trading around $ 1,223.

Erik Norland, a senior economist at CME Group, wrote in early October that, as long as the Fed's monetary tightening policy remains strict, gold would remain under pressure. In addition, the recent turbulence in emerging markets, if extended to other countries, could lead to the strength of the US dollar, which will weigh more heavily on gold.

Nevertheless, the economic cycles and tightening cycles of the Fed both end up following their course. At some point, the Fed will stop raising rates. There is also the risk that the central bank will go too far this time.

"If the Fed tightens too much, it could be extremely bullish for gold when the central bank will be forced to turn the tide and soften its policy," wrote Norland.

[ad_2]

Source link