[ad_1]

New Age Beverages (NBEV) was the type of company you probably will never know … until she announces that she is embarking on cannabis. Sound familiar? During the Bitcoin Celebrations (BTC-USD), a Nasdaq-listed company, Long Island Iced Tea, decided one day to enter the crypto business and change its name to "Long Blockchain". We all know how it ended: the stock price climbed early, but eventually collapsed, which eventually led to delisting. As someone from Bloomberg once wrote, if Long Island Iced Tea had waited a few more months, it would have been perfectly positioned to pivot to cannabis and potentially be more successful. But do not worry, New Age Beverages is here to do what Long Island has not been able to do.

Overview of the situation

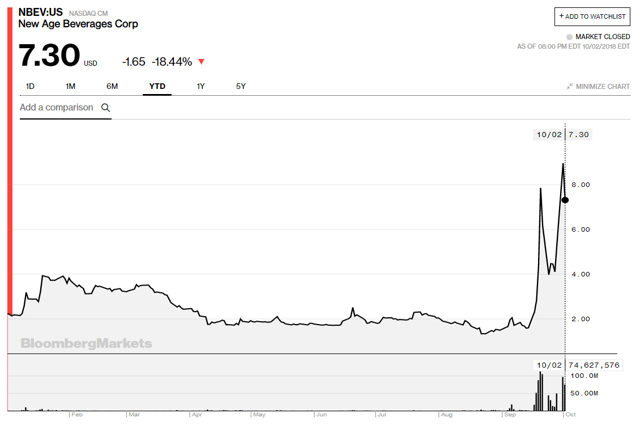

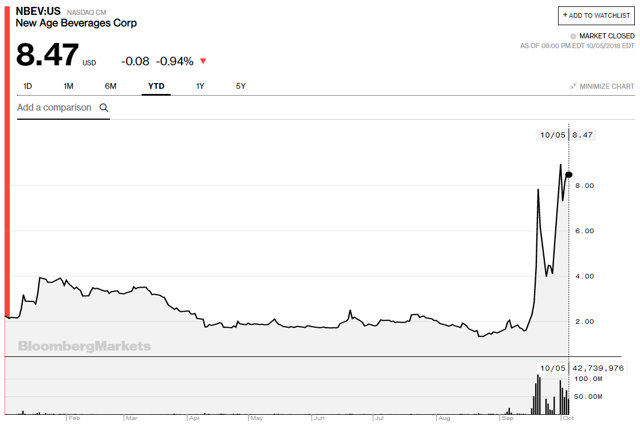

New Age Beverages has been trading on the Nasdaq Capital Markets for a few years and its shares are coming off the strongest rise in its history recently, when the company announced that it was embarking on the CBD drinks. On September 19, 2018, the company issued a press release announcing its intention to unveil its CBD product line at the North American Convenience Store Show on October 8 in Las Vegas. The company announced that after conducting tests in its home market in Colorado, its product development team was able to refine the formula and tastes to the point of being able to present these products to its distribution partners. The stock was trading at $ 1.59 before the news and she jumped to trade at $ 8.47 last Friday.

Part of the reason why speculators have infiltrated the New Age is that larger players such as Cola-Cola (KO) or PepsiCo (PEP) may be interested in acquiring the company as a point of entry. entry into the market for CBD-based drinks. We have already written about similar situations, such as David's Tea (DTEA) in "TEA DAVIDs: The Last Victim of the Current Cannabis Frenzy", where the CEO even stated that he had been approached by several major cannabis producers, but denied any immediate plans to enter the space. The difference is that New Age is actually trying to get into DBC and the extreme price fluctuations have been fueled primarily by their announcement of the launch of DBC-based products.

CBD drinks?

We believe that the underlying business of New Age Beverages is actually a small, strong company that has been growing strongly since the current management took over in 2015. The company has acquired several brands of beverages in the past:

- Acquisition of Xing in 2016 for $ 20 million

- Acquisition of Maverick Brands in 2017 for $ 11 million

- Acquisition of Marley in 2017 with 3 million shares and additional price supplements

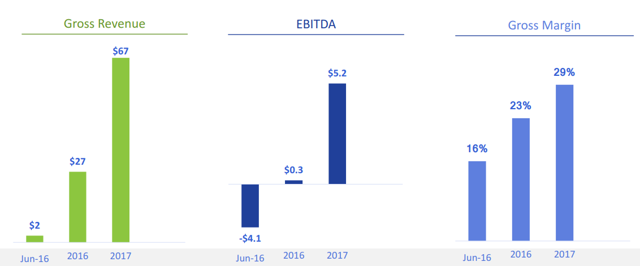

The company also posted impressive revenue growth through acquisitions and improved acquired assets. The company has real potential in its growth plan, while EBITDA has reached positive territory and gross margin continues to grow. We would really like this title because of its historical performance and management's ability to generate significant value creation from M & A activities.

(Presentation to investors)

However, society seems to have found an even faster way to achieve growth. The company announced this month its intention to launch its CBD-based beverage line at the North American Convenience Store Show in October. The stock has been on steroids since speculators inflate it to dazzling levels. The stock has gained more than 400% since the announcement, but we believe investors should stay away from this title for three reasons.

First and foremost, it's too late. Speculators and day traders have already earned a lot of money and will one day decide to take profits and leave. When this happens, the stock will probably return to Earth, as we have seen in many other cases. We believe that New Age has legitimate business and has a lot of potential with its health-focused beverage products, but the recent rally is pure speculation and does not reflect any fundamental development. Investors entering this stock are now at risk of becoming bag holders when the wind turns.

Second, the products were not disclosed and no orders were placed by retailers. CBD drinks have been around for years and many small businesses have been selling them for many years. According to rumors, in states that have legalized marijuana in recent years, CBD-based drinks are a slower-selling category of products, based on anecdotal evidence. We think that part of the reason is that people looking for a buzz will not be thrilled after consuming CBD-based drinks. CBD is an animal totally different from THC and you should read more about it in one of our recent articles here.

Finally, let's really think about the timing and impact of CBD products on New Age's future earnings. Despite the success of its revenues and profitability, New Age remains a small beverage distributor with a small market share in the United States. Actors such as Coco-Cola (KO) will also compete. licensed producers such as Aurora (OTCQX: ACBFF). New Age has 49 million shares outstanding, which means that its market capitalization has gained nearly $ 350 million since the announcement of the CBD. Does this opportunity represent $ 350 million even before it is launched? We doubt this and believe that the market is imposed in this case. New Age also agrees that the firm is quick to launch a $ 50 million offering of common shares. Although inconclusive, we believe that companies rushing to cash in after soaring stock prices generally point to a lack of self-confidence and an opportunistic state of mind. This may be the right thing to do for the company by management, but it also gives investors a warning that they are cautious at current prices.

It should also be mentioned that the shares are trading at a market value of $ 415 million, which implies EBITDA 80x EV / 2017 (with a minimum debt). Since cannabis-based beverages are not expected to generate any income so early, the multiple seems very high and hypothetical.

Put everything together

Overall, we believe that the announcement of New Age Beverages to incorporate CBD-based beverages is a plausible and rational decision, given the portfolio of beverage-based beverage brands. the society. However, the current frenzy of cannabis has pushed the price of its action to unfathomable levels and investors should not enter the stock now. In our opinion, any increase is largely overestimated and the stock has become a playground for day traders. Investors looking for CBD games should also be interested in stocks with stronger fundamentals, such as Aurora and Hexo (OTCPK: HYYDF). Aurora would be in talks with Coke about a partnership in the development of CBD-based beverages, and Hexo has just signed a joint venture agreement with Molson (TAP) to develop cannabis beverages (although most likely THC beverages). Canopy (CGC) also has a close relationship with Constellation (STZ). In conclusion, we believe that New Age Beverages is negotiating unrealistic expectations and that investors should avoid it until the current craze fades before re-evaluating the value proposition of its DBC strategy.

Note from the author: Follow us to receive our latest publications on the sector. We also publish a weekly report on cannabis, widely read, which is your best way to stay informed about the cannabis sector.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Editor's Note: This article deals with one or more securities that are not traded in a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link