[ad_1]

Since its IPO in 2008, Visa (V) has increased its dividend each year in October. However, the company increased its dividend in March of this year, with a rate of 7.7%. As shareholders have become accustomed to double-digit dividend growth rates, the big question is whether Visa will announce further dividend growth next month.

Business overview

Visa is the world leader in digital payments. It operates in more than 200 countries and is able to handle more than 65,000 transactions per second. Its IPO was one of the most successful in history, as the stock was 13 times higher than the IPO price of $ 11 in 2008.

One of the main reasons for this impressive performance is the fact that Visa operates in a vital duopoly; Visa and MasterCard (MA) processes the vast majority of global electronic payments. In addition, Visa has a unique brand strength. Consumers are demanding to pay merchants via Visa cards and forcing merchants to accept these cards. As a result, merchants must pay fees to Visa in most of their transactions. If they choose not to cooperate with Visa, they risk losing a significant portion of their customers. It's one of the most important competitive advantages that a company can hope for.

Growth

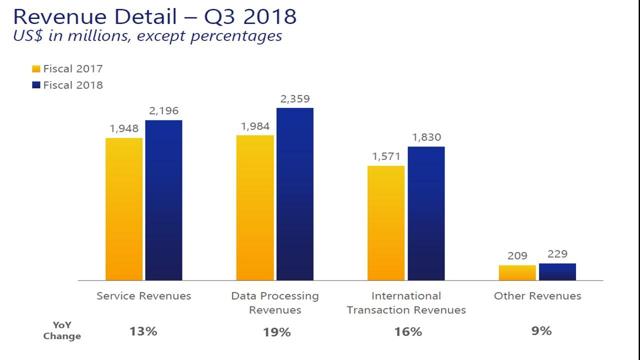

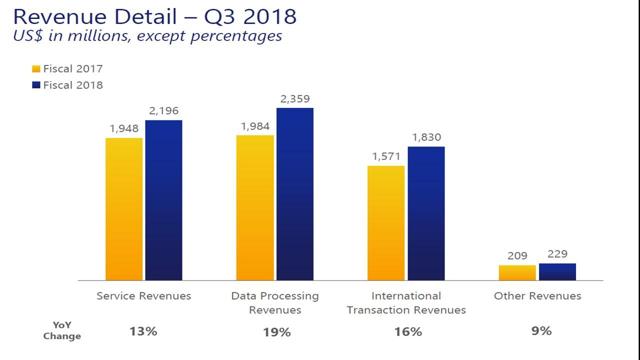

Visa has an exceptional growth record. Its revenues and adjusted earnings have increased each year over the last decade. In addition, earnings per share have increased 19-fold in the last decade, from $ 0.24 in 2008 to $ 4.59 expected this year. Better yet, there is no sign of fatigue, as the business continues to grow at a double-digit pace. Certainly, as the chart from the last conference call shows, Visa continues to grow at double-digit rates across all segments.

Visa's impressive growth record is the result of a major downtrend, namely the trend towards a cashless company. Each year, a growing number of consumers begin to use credit cards rather than cash. This is true not only in developing countries, but also in mature economies, such as national economies. The volume of Visa payments in the United States has certainly increased by 10% this year.

In addition, there are still two billion people in the world still using cash in their transactions. Last year, global digital payments exceeded cash payments for the first time in history. In addition, China and India, each with nearly 1.4 billion people, represent huge growth opportunities for Visa as they are in the early stages of a transition to a cashless economy. Three years ago, China opened its doors to foreign payment processors, which should allow Visa to take advantage of this opportunity in the coming years.

Dividend

Visa has a remarkably solid business model. It has to spend minimal amounts of capital expenditure to maintain its market share and thus benefits from excessive free cash flow. Certainly, its capital expenditures have represented less than 15% of its operating cash flow each year over the last decade. This means that almost all of its profits are available for shareholder distributions.

On the other hand, Visa has always offered a low dividend of less than 1.0%. While this may sound negative for income-oriented investors, this actually confirms the great execution of Visa's management. The most profitable use of cash in the case of Visa being to reinvest in its business, management has chosen this use of money. For example, two years ago, Visa made a major acquisition of Visa Europe for nearly $ 20 billion. If this acquisition may have seemed expensive, it has already years to come. As a result, Visa shareholders should not complain about the low dividend yield.

In addition, while the dividend yield is undeniably low, the dividend growth rate has been spectacular. Visa has increased its dividend at a double-digit rate every year since its IPO. As a result, its dividend has doubled in the last four years. In addition, with its extremely strong balance sheet and very low payout ratio of 19%, Visa can easily continue to increase its dividend at a similar pace for several years. As a result, those who buy the stock at the current dividend rate of 0.6% will likely receive a return on costs of approximately 2.4% in eight years.

Since its IPO in 2008, Visa has increased its dividend each year in October. However, this year, the company announced its dividend increase in March. In addition, it was the first time that the company was increasing its dividend at a single-digit rate (7.7%). This decision may have disappointed some investors. However, Visa is expected to announce a second dividend increase for this year next month. Its management has probably announced an anticipated increase this year thanks to the recent tax reform, which resulted in a significant drop in the tax rate, which went from about 27% to 21%. A similar trend has been observed with another shareholder-friendly company, Altria (MO), which has increased its dividend twice this year. As a result, Visa shareholders should expect a further increase in the dividend next month, likely from $ 0.21 to $ 0.225 for a total dividend of 15.4% this year (from $ 0.195 to $ 0.225).

Last thoughts

Visa has posted an exceptional growth record and continues to perform well, with attractive growth prospects. The company has announced an anticipated rise in dividends this year, likely thanks to the recent tax reform. As a result, given the strong momentum of the company, investors should anticipate further dividend growth next month.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link