[ad_1]

Ford engine (F) reported better than expected its financial results for its third quarter on Wednesday. While automakers continue to face significant challenges in increasing costs and rates, third quarter results have been quite good, particularly in North America. Ford Motor's shares are extremely cheap when selling in the market, potentially offering another buying opportunity to income-oriented investors. An investment in Ford Motor yields 7.3 percent.

With the liquidation of the shares in October and the last write off of all gains in 2018, Ford Motor was also hit hard. Ford Motor shares fell to a record low of 52 weeks (and multi-year) this month, including the most recently yesterday at $ 8.17. Ford Motor's share price fell 4.8% on Wednesday after investors turned away from risk and gave in to weakness. As a result, Ford Motor, according to the Relative Strength Index, RSI, is again oversold.

Third quarter results

Ford Motor announced $ 34.7 billion in third-quarter revenue for the automotive industry, up 3% from a year ago, as the company reported revenues of $ 33.6 billion . The consensus was for revenues of $ 33.3 billion. In terms of profits, the automobile company generated $ 1.0 billion, down $ 0.6 billion from the previous year.

On a per share basis, Ford Motor posted adjusted earnings of $ 0.29 per share, compared to $ 0.44 per share a year ago, reflecting a decrease of $ 0.15 per share. Analysts should report Ford's revenue of $ 0.28 / share. As a result, Ford Motor was able to beat both revenue and profit for its third quarter.

Here's an overview of Ford Motor's key financial results for the quarter ending September.

Source: Investor Ford Motor Introduction

Ford Motor's financial results continue to be supported by a relatively strong performance in America. Ford Motor's North American EBIT – earnings before interest and taxes, a key measure for automakers – increased $ 136 million to $ 1,960 million, driven by strong sales performance from the start of the year for trucks such as the F – 150 and SUVs. Ford Motor's other geographic regions were significantly more difficult than the US in the last quarter, due in part to pricing (Ford's activity in China), lower overall volumes, new launch costs models and the weakness of the local market in Turkey and Russia.

Here is a breakdown of the results of operations by geographic area of Ford Motor.

Ford Motor's overall adjusted EBIT margin – another key performance indicator for the company – edged up slightly to 4.4%, up from 4.3% in the prior quarter. At the same time, adjusted Ford Motor EBIT remained stable at $ 1.7 billion, while operating cash flow returned to positive.

Orientation

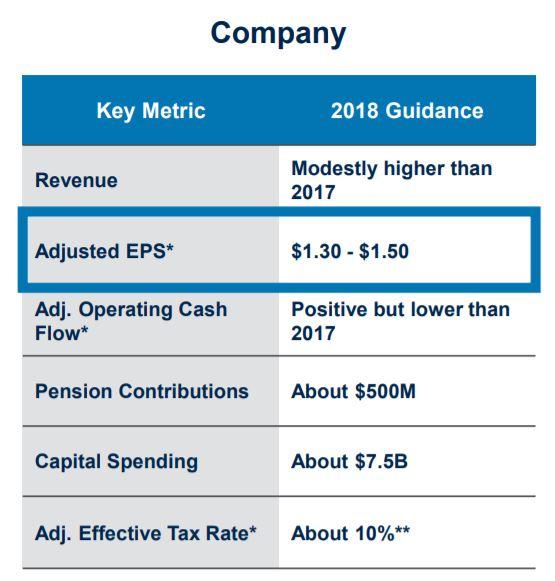

Ford Motor has reaffirmed its forecast for 2018, which the company had previously lowered by about 11%, midway through. Ford Motor continues to expect adjusted earnings of between $ 1.30 and $ 1.50 a year in 2018, on slightly higher overall revenues.

Here is an orientation breakdown.

Source: Ford Motor

With regard to Ford Motor regional cinemas, the automaker predicts weaker results in most geographic regions by 2018, as the tariff dispute between the United States and China continues to have a negative impact on sales and input costs, including steel, aluminum and auto rates.

The Asia-Pacific region, which includes China, is expected to experience a "significant loss" this year. Ford's sales in China in September, for example, dropped 43% year-on-year as a result of the trade dispute.

Source: Ford Motor

Dividend

Frightening sales recently led Ford's dividend yield to exceed the 7% threshold. On the basis of a recurring dividend payment of $ 0.15 / share, paid quarterly, Ford Motor's forward dividend yield currently stands at 7.34%.

Investors with an opposite inclination and a certain appetite for risk might consider buying the market sale and profit from Ford's outstanding dividend yield.

Ford Motor has paid special dividends in each of the past three years, too. Given the market challenges, the slightly muted growth prospects of Ford Motor and the price wars between the US and China weighing on the stock market, I do not expect Ford Motor to declare a another special dividend in Q1-2019.

Evaluation

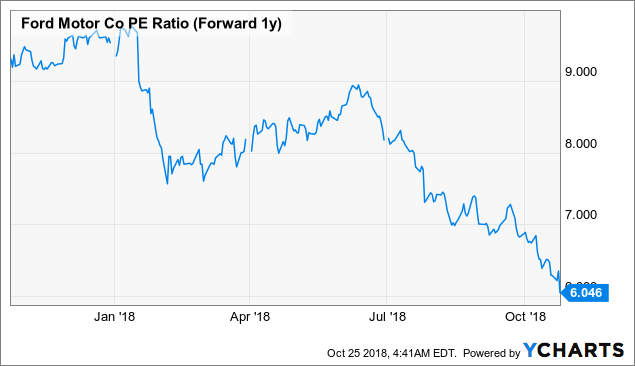

After the latest correction, Ford Motor shares can be picked up for a lower forward price / earnings ratio compared to just a month or two ago. When I covered Ford Motor in my article titled "Ford Motor is a single-digit stock: what should investors do now?", The stock was selling about 6.8 times the estimated profit of the year next, which I have classified as "cheap". Thanks to the liquidation of the October market, fixed income investors can now buy Ford Motor even cheaper: today, they pay only 6.0 times the projected profits of next year . A good deal

Ratio F PE (1y Forward) Data by YCharts

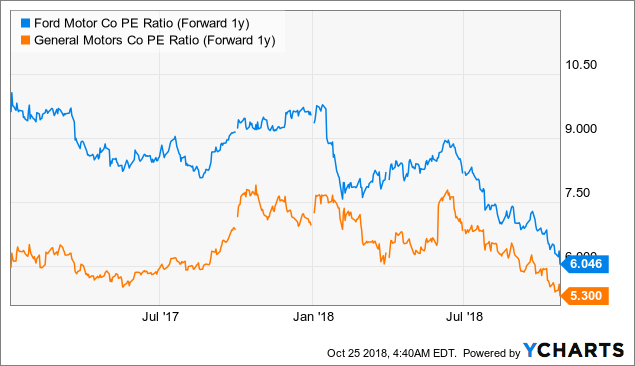

Ford Motor is not the only stock that is cheap now, by the way. General MotorsActions (GM) were also defeated.

Here's how Ford Motor compares to General Motors in terms of front-to-back ratio.

Ratio F PE (1y Forward) Data by YCharts

Risk Factors Investors Should Consider

Ford Motor is a cyclical automobile company whose profits depend on a strong economic performance in its key market, the United States. For me, a recession is the main risk factor after the escalation of the trade war. If the trade conflict between the United States and China continues to intensify and the two countries slap each other with a new set of tariffs, investors must be prepared to suffer more inconvenience. As a result, investors may limit their exposure to Ford Motor to only 1% to 2% of total portfolio assets to manage risk.

Take away

Ford Motor fell to a new low of 52 weeks at $ 8.17 Wednesday as investors were panicked and sold stocks in weakness. The latest 52-week minimum is only the latest in a series of new lows (multi-year) for the automaker this year. That said, however, there is something to be optimistic: Ford Motor has beaten the revenue and revenue forecasts of the third quarter, and the US market is doing pretty well at the moment. Ford Motor's operational cash flow has also rebounded, and equities are once again in the bargain box. In any case, Ford Motor is an appropriate investment only for investors with above average risk tolerance. Speculative purchase for income and capital appreciation.

If you like to read more of my articles and want to be kept informed of the companies I cover, please go to the top of this page and click on "to follow& # 39 ;. I invest largely in dividend paying stocks, but I also venture out on occasion and cover special situations offering attractive risk / reward ratios and offering potential for dividends. significant appreciation of capital. Above all, my goal of immediate investment is to achieve financial independence.

Disclosure: I am / we are long F, GM.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link