[ad_1]

I was looking forward to the last Wynn Resorts (WYNN) quarterly report. I was expecting the casino operator to post solid results from its China operations and weaker growth in Las Vegas, simply because that is the current trend. China continues to achieve strong results while the domestic market of Vegas weakens. All things considered, I still like casino operators who make a lot of their sales abroad. The problem is that China's economic expectations are falling, putting tremendous pressure on Wynn's share price.

It all boils down to one thing: China

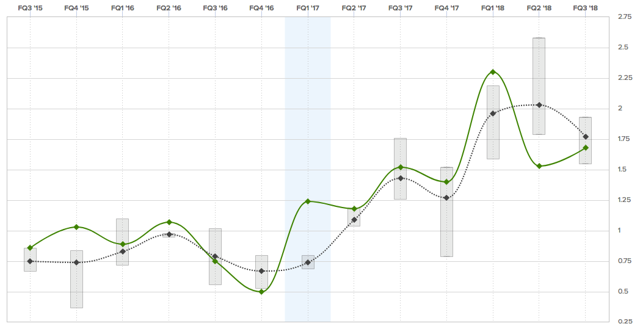

Wynn's third quarter EPS did not live up to expectations. This is the second time in a row that the company is revealing disappointing financial results. The future of a business obviously does not depend on the fact that a number of GAPs can meet expectations, but it is a warning signal given the steady outperformance recorded during the first quarter recovery. 2017. Third quarter EPS reached $ 1.68, or $ 0.09. below expectations and up 11% from the prior year quarter. It's still a good growth rate, the problem is that the growth rate has dropped to a new cycle at its lowest.

Sales totaled $ 1.71 billion, $ 70 million more than expected. Sales growth was 6%, which is also one of the lowest numbers in the current cycle.

That being said, let's look at where the growth is coming from. The Wynn Palace in Macau generated a $ 205.5 million increase in sales, while Wynn Macau posted an improvement of $ 17.6 million. This decrease was partially offset by a $ 65.4 million decline in Las Vegas. This translates into a 14.1% decrease from $ 464.3 million in the third quarter of 2017. Adjusted EBITDA from real property decreased by $ 95.3 million or 37.1% to Las Vegas. Casino revenues decreased by 28.4% and those of the table by 18.6%. The victory in table games has decreased by 34.4%. In addition, the percentage of victories in table games was 21.5%, which is 0.5 points below expectations.

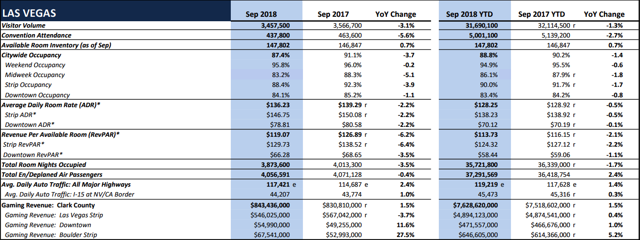

In addition, revenues of other casinos decreased by 8.5%. Revenue per available room (RevPAR) decreased by 4.8%, while food and beverage sales decreased 7.3%. Until now, I think I have covered all the key figures of Las Vegas. We find that general expenses were down in the US gambling capital. One reason is that the previous third quarter is a difficult quarter to compare. Last year, Las Vegas hosted several major sporting events that flooded the city with potential customers.

The official statistics of Las Vegas prove it. Below is an overview of the most recent data (September), which shows that sales of casinos and non-casinos are down. It is impossible to avoid a decline in sales on a comparable basis in such an environment.

Source: Las Vegas Convention & Visitors Authority

In particular, the difference in revenue growth compared to Wynn Palace is staggering. At Wynn Palace, casino revenues increased 39.9% to $ 625.6 million. VIP operations improved by 13.4%, while VIP table games, expressed as a percentage of revenue, also exceeded expectations (3.4% vs. 2.7% to 3.0%). provided).

Non-casino sales improved by 34.7%. RevPAR increased by 37.5% from $ 192 in the third quarter of 2017 to $ 264.

These numbers are absolutely stunning. Now, guess why the stock is so down? The reason is Macao and not Las Vegas.

And after?

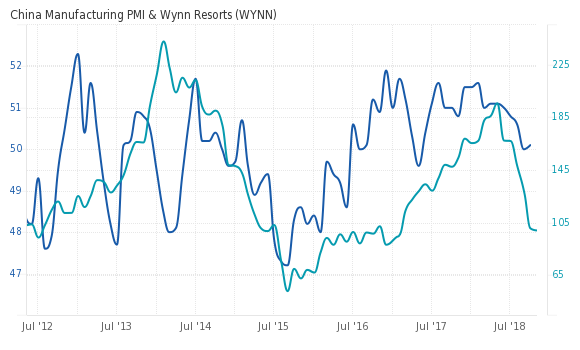

It may seem odd that the company's hottest sales are actually the main concern. The reason seems quite simple: China's economic growth is under pressure.

One of the indicators for measuring economic expectations is a manufacturing PMI. This indicator tells us what we can expect in terms of economic growth over the next 1-3 months. To measure US economic growth, I use the ISM manufacturing index. For Chinese data, I use Markit's manufacturing PMI. I've also added the stock price of Wynn Resorts to clarify my point.

What we are seeing is that economic expectations have become an obstacle after supporting the title between 2015 and the beginning of this year. It is also remarkable that the PMI index is at line 50, which means that we could even see a contraction. And that's enough to put pressure on a title like Wynn. Nor does it help that the stock is surrounded by uncertainty about the impending trade war with China. US casinos are an easy target to replicate against the United States if necessary.

Source: IECONOMICS

In addition, the stock is anything but cheap, even at current levels. The stock is trading at 59 times earnings with a forward ratio of 12, which is actually a rather cheap figure. The PEG ratio, on the other hand, is 4.0, which shows that investors have already anticipated strong growth over the next few years. I expect the downward trend to continue as China's growth forecasts fall.

That said, I do not doubt the success of the company in the long run. Wynn and Las Vegas Sands both have great strengths in Macau and are poised to capitalize on the rise of the Chinese middle class and booming tourism industry.

My strategy is to stay away for the moment. These actions will outperform massively once economic growth in China has begun to improve again. When that happens, you can expect a very strong recovery, as it did in 2011, 2013, and 2017.

I'll keep you informed!

Thank you for reading my article. Please let me know what you think of my thesis. Your contribution is very appreciated!

Disclaimer: This article is for the sole purpose of adding value to the search process. Always take care of your own risk management and asset allocation.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link