[ad_1]

June 18, 2019 12:15 pm

|

Updated on June 18, 2019 12:29

Facebook will now also have a digital currency

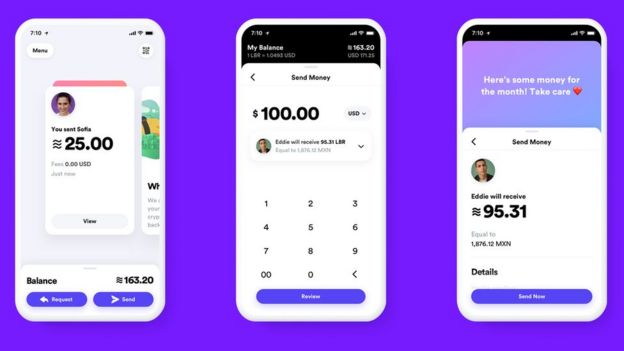

This is called Balance, it will be managed independently and will rely on real assets, and paying with it will be "as simple as sending a text message", said the social network.

According to Facebook, which launched the project on Tuesday, starting next year, users will be able to buy the currency via their platform and store it in a digital wallet called Calibra, as well as to make payments with Libra via their own application, as well as the WhatsApp messaging service.

But there are doubts about how the money and data of people will be protected, as well as the potential volatility of the currency.

We explain here what this Facebook project is and what are the main concerns it generates.

Who are you targeting?

Libra is particularly aimed at the 1.7 billion people who do not have a bank account and the high cost of transferring money to their families. But many organizations are already dealing with this problem, from the Mpesa system in Kenya to technology start-ups like WorldRemit.

What is not clear, is how Libra will approach the complex mechanism of verifying the identity of these people in order to comply with the regulations against money laundering, without entail many costs.

And this applies not only to Facebook users who do not have a bank account in Kenya, but also to lucrative markets such as the United States and the United Kingdom, where credit cards are used. National identities do not exist to easily check that someone is well what they say. .

Photo: Getty Images

If Libra allows people to send money from their phone in the same way as they send an SMS, it will be very appealing. But doing it cheaply and safely will be very difficult.

Who will accept Libra?

Facebook, perhaps aware of the reputation issues it faces, seems very interested in pointing out that Libra is a global coalition in which it is only a small player.

The social network pointed out that the currency would be managed independently by a group of companies and charitable organizations, called Libra Association.

The group currently includes:

Payment companies such as Mastercard and PayPal.

Digital companies such as eBay, Spotify and Uber.

Telecommunication companies such as Vodafone.

And charities like the Women & # 39; s World Banking microfinance group.

Facebook also said it expects Libra to be bought and sold on the foreign exchange markets in the future.

Analysis by Rory Cellan-Jones, BBC Technology correspondent

It's a very ambitious project, some might call it a megalomaniac.

The message is that it's not a small side project that a small Facebook headquarters team will try for a few months before moving on to something else.

This is both the future of Facebook and the future of money, an initiative that has allied major players such as Paypal and Visa, as well. other Silicon Valley companies, such as Uber and Lyft, and large venture capitalists, a kind of Avengers. : End of technology and financial superheroes.

But there are still many questions about Libra. The main one is: why?

How does Facebook earn money?

What Facebook describes as an "insignificant" rate for each transaction.

Through its subsidiary Calibra, the social network could potentially offer additional financial services to users.

But the real price is simply to make people spend more time on Facebook or WhatsApp to be able to receive more ads.

And what are the partners getting?

It was reported that partners such as Paypal, Mastercard and Visa each paid US $ 10 million for the privilege of operating a Libra network node. It seems odd that they wanted to support an organization whose talk is that she can do a better job than she does.

However, they will have access to the data passing through the network, which should provide them with valuable information about what is being spent and where.

What are the concerns?

US politicians have asked Facebook how money would work and what protection it would offer the consumer.

Other virtual currencies, such as Bitcoin, have seen huge fluctuations in value and have also been used to launder money.

The social network hopes to avoid sudden changes in the value of the currency by linking it to a series of known currencies, such as the British pound, the US dollar, the Japanese yen and the euro.

Facebook also said that its Calibra payment system would benefit from strong protection to protect its money and personal information.

He added that Calibra would use the same verification and anti-fraud processes as those used by banks and credit cards and would reimburse any stolen money.

And the data protection? Of course, this is the million dollar question about Libra: why, after the Cambridge Analytica scandal and other controversies over the use of data, people would like to entrust their money to Facebook or attribute to it a key role in managing a global currency?

Facebook indicates that its affiliate Calibra will keep strictly separate financial and social data and that users will not be identified by ads based on & NegativeThinSpace; & NegativeThinSpace; about their consumption habits.

But, again, Facebook's main argument is that it's a global coalition and not Mark Zuckerberg's new plan to rule the world.

"It's a Facebook-led initiative, yes," David Corus, the head of Facebook's cryptocurrency project told Rory Cellan-Jones.

"But by the time it arrives on the market next year, it will not be an initiative controlled by Facebook, we will have the same voting rights as all other members."

Facebook's speech is: "You can not trust us, but you have to trust Visa, Paypal, Uber and others".

So, do not expect Mark Zuckerberg's face to be on Libra, if they ever decide to release a commemorative coin.

[ad_2]

Source link