[ad_1]

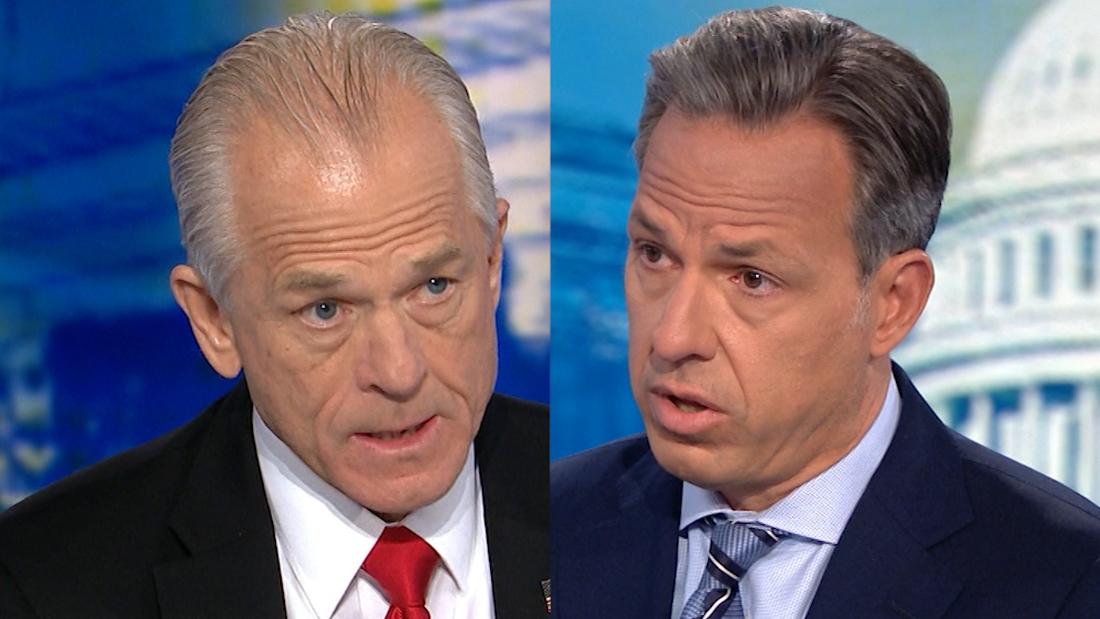

"Technically, we had no inversion of the yield curve.An inverted yield curve requires a large gap between short and long – we had a flat curve that was a weak signal of any possibility. case, the flat curve is the result of a strong economy trump ".

The facts first: Navarro is wrong on two fronts: the reversal has occurred and this is not a good sign for the economy.

Although the reversal was brief and modest, the big banks took note of it.

"The 2-year / 10-year US Treasury yield curve has been briefly reversed as a result of disappointing global data and is about to reverse." Fears of a recession have increased, "writes Bank of America in a statement. a customer note on Friday, with economists 3 chances of an economic recession in 2020.

The yield curve follows bond interest rates. This is a way to measure investor opinion on the risk and prospects for US economic growth.

Usually, longer-term loans have higher interest rates than shorter-term loans because investors take longer risks with longer-dated bonds and therefore want to be better paid. For example, there is more risk of bankruptcy of a new business over 10 years than over two years.

When investors are worried about economic growth, the yield curve comes up against a strange phenomenon: it flips (or reverses), so that short-term interest rates are higher than those at the end of the year. long term.

Last week, a reversal briefly took place for the first time since before the financial crisis, along with a closely guarded portion of the US public debt yield curve: the difference between the rates of interest and the rate of return. interest on two-year Treasury bonds and 10-year Treasury bonds.

Navarro suggested reasons other than fears of a recession caused the inversion.

The yield curve "does not give us a 100% clear indication of growth and inflation expectations," said Mark Cabana, head of US rate strategy at Bank of America's Merrill Lynch Global Research.

"But it's one of the most reliable market indicators we have and it's not sending real hot and fuzzy signals."

In addition, another part of the yield curve has already been reversed earlier this year. The gap between three-month and 10-year interest rates has been gradually reversed since the end of March, according to Bank of America.

[ad_2]

Source link