[ad_1]

To no big surprise based on my previous investment thesis, Verizon Communications (VZ) beat EPS estimates of Q1-19 and the stock has declined. The stock has hit a double high at $ 60 and will likely not break before the 5G brings a significant benefit to the activity that will not happen until 2021. The stock will likely remain low for a long time.

Go nowhere fast

According to analysts, the best thing analysts can say about the first quarter results of the 19th is that Verizon is still slowing its growth. Verizon's revenue and EBITDA were up about 1% from last year.

Source of Image: Verizon Web Site

Revenues for all wireless services reached $ 22.7 billion, driven by a 4.4% increase in service revenues to $ 16.1 billion. The company continues to generate higher EBITDA through cost control.

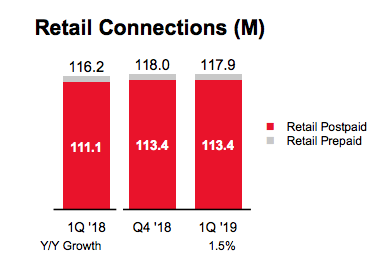

The biggest problem in this story is that Verizon has seen network connections rise from fourth-quarter levels to 117.9 million. The wireless giant has recorded an increase of 174,000 postpaid smartphones, but the total net loss of phones is 44,000.

Source: Verizon Q1 Presentation # 19

Verizon generated 261,000 net additions of connected devices, mostly handheld devices, but tablet weakness nearly offset all gains. FiOS saw an impressive increase of 52,000 Internet customers, generating revenue growth of 3.6%, but much of this gain was wasted by the 7.2% drop in revenue due to the unsuccessful medias.

Again, each category with a gain was offset by another low category. In addition, the environment will not change as long as the company will not have a catalyst to motivate customers such as the 5G mobile.

The Q1 upgrade rate of 19 was the lowest in the history of the company, suggesting that customers are not motivated to upgrade their phones. Whether due in part to waiting on 5G smartphones or new smartphone models are not exciting enough when paired with a standard 4G network, customers are upgrading two times slower than a few years ago. The lack of incentive to upgrade does not change until the iPhone 5G is available by the end of 2020.

Too expensive in comparison

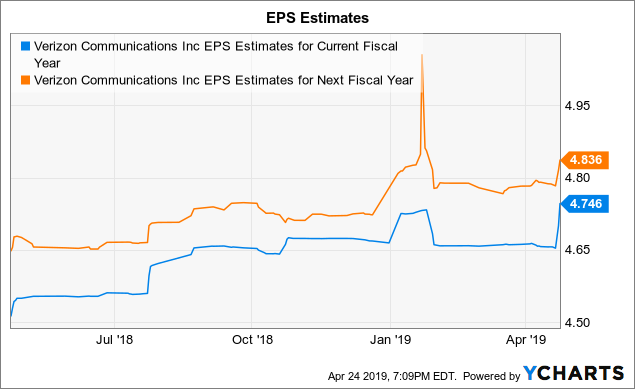

Verizon strengthened EPS estimates from 2019, from zero growth to single-digit percentage growth. Of course, this excludes the new lease accounting standard, which affects earnings per share estimates.

Analysts have already reached their target per share of $ 4.75 for 2019, so investors should not reap the benefits of higher earnings per share. The stock reacted accordingly with weak trading following the first quarter results.

Data by YCharts

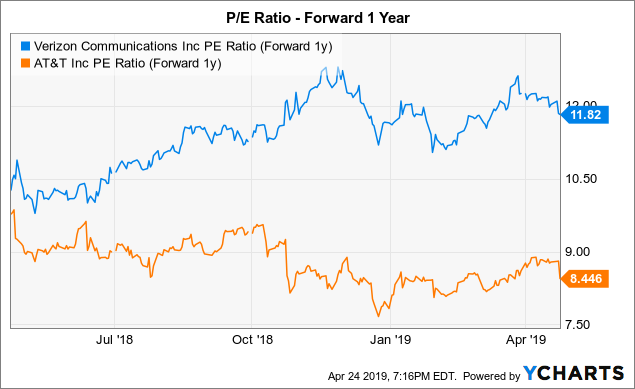

The biggest problem for the title is that Verizon is trading at very advantageous prices. AT & T (T). The gap between the end-of-career P / E ratios has reached the highest levels of the last 5 years. Verizon is now trading at 1.37 times the AT & T pricing multiple.

Data by YCharts

Given the fact that the remaining P / E ratio may generate misleading numbers, a better confirmation of the Verizon pricing issue takes into account multiple P / E futures. At $ 60, Verizon simply becomes too expensive compared to what investors can get for AT & T, even if it has difficulties with the subscribers of the DirecTV division.

Data by YCharts

To take away

The main benefit to investors is that Verizon has no real catalyst until the 5G mobile becomes an important business in 2021. The title is simply too expensive compared to AT & T to be able to overtake the double top of $ 60 in the short term.

Verizon is probably a good buy when the stock reaches in the above chart around $ 53 and the dividend yield reaches an attractive level around 4.5%. Investors will simply not intervene when AT & T returns exceed 6.0%.

Disclosure: I am / we are long T. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: The information contained in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

[ad_2]

Source link