[ad_1]

Rooms at the Fairmont Royal Pavilion, perched on the platinum beaches of Barbados, can cost over $ 1,000 a night. Catch the morning catamaran diving cruise; be back ashore in time for the royal afternoon tea.

For some employees of Houlihan Lokey Inc., an offer is now on the table: a five-night stay at this Caribbean retreat, at the expense of the investment bank – a reward after a year of record profits. It also represents a silent appeal to the company’s junior employees: Please don’t quit.

This same prayer resonates all over Wall Street, where turnover and burnout rates among young workers are accelerating. Banks have tried to turn the tide with raises, bonuses, vacations, and even Free Platoons. All of this means that it has never been more lucrative to be a young banker in the United States.

The trouble is, it’s never been more lucrative for aspirants to work outside the golden world of finance. And the gap between banks and other employers like tech companies has narrowed.

“Is this the best time to be a banker to make money?” Of course, ”says executive recruiter Dan Miller of True Search. “Is this a horrible time in terms of lifestyle? Absolutely.”

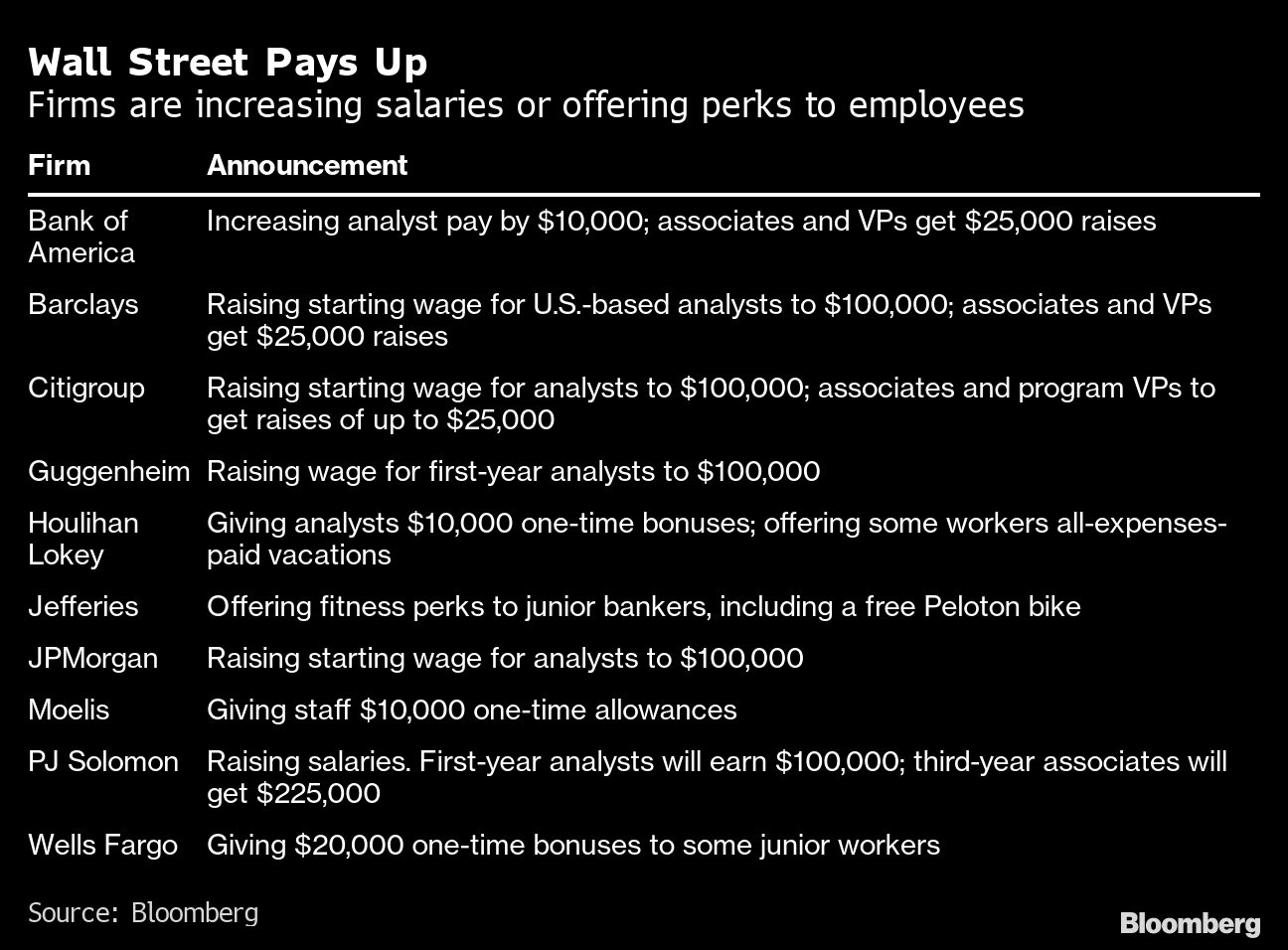

Wall Street pays

Companies raise wages or offer employee benefits

Source: Bloomberg

A presentation prepared by 13 first-year Goldman Sachs Group Inc. analysts earlier this year led to a calculation across Wall Street after shining the spotlight on the working conditions of junior bankers – some of them working 100 hours per week while their physical and mental health suffered. Goldman responded by easing weekend hours and pledging to increase staffing at its busiest companies.

Still, some industry veterans have harsh words for those who complain about the workload. Howard Lutnick of Cantor Fitzgerald has suggested that some of the young workers who are considering leaving finance just might not be made for it. “Young bankers who decide they’re working too hard – choose another life,” he told Bloomberg TV earlier this month.

And the grueling workloads of bank analysts remained, and in some cases, worsened. As Covid-19 gripped the nation last year, the mantra of ‘work hard, play hard’ morphed into ‘work hard, sit on your couch’ as the economy grows. was heating up and agreements proliferated.

Frustrated and overworked, many of them turned to the anonymous ex-banker behind the popular “Litquidity” finance account for help. In an interview, he said he was inundated with posts on Twitter and Instagram from young industry colleagues who were fed up and wondering if the work was worth it.

Lit, as he calls himself, was at the time a senior investment banking partner and knew only too well what they were going through. He too was feeling exhausted and stressed, and at one point he went to a doctor to check his heart palpitations.

“Do you know the feeling when your stomach sinks?” I felt it in my heart, ”he said by phone from Central Park in New York. It’s probably related to stress, his doctor concluded. Last winter, Lit quit her job to focus on growing the Litquidity brand and writing a daily newsletter. He says he’s also working on launching a venture capital fund.

It is not only in finance that workers are becoming more demanding – a similar scenario playing out nationwide. McDonald’s Corp. country clubs in Nashville, Tennessee, raised wages and offered hiring bonuses to attract new workers. From March to May, the rate of American workers voluntarily leaving their jobs peaked in at least two decades. In Washington, lawmakers are fighting to raise the minimum wage to $ 15 an hour.

Of course, the isolated world of finance and some other professional services operate on a much higher plan in terms of compensation. Last month, dozens of the nation’s top law firms increased first-year salaries to $ 202,500, just a few thousand. They also offer multiple annual bonuses and extra time off as they struggle to retain talent and their employees face burnout.

New six-figure salaries for first-year analysts at Citigroup Inc., JPMorgan Chase & Co. and others are close to double the estimated national average wage. BlackRock Inc., the world’s largest asset manager, has joined the war for workers by announcing a General increase of 8% for employees.

Miller, who co-leads the financial services practice of True Search, says young bankers today have many more options than previous cohorts of analysts. Banks and consulting firms have long been a source of hiring for private equity and, more recently, venture capital, technology and fintech. Today, while many of these industries are hiring at an all-time high, many young bankers no longer have to hang around for two years. They can leave early or ignore the finance stint altogether.

Some bank chiefs have promised to ease the pressure. After the junior analysts’ presentation, Goldman CEO David Solomon vowed to better enforce the rule that they should be off on Saturdays. But the sentiments etched in banking culture over decades don’t change easily. Lit pointed out that Goldman’s no-work Saturday policy has been in place since 2013.

“There has to be a way to make it hold,” he said. “What’s the point of earning half a million if you work 20 hours a day?”

Of course, almost every tech company is filled with stereotypical youngsters wearing hoodies and sneakers typing on laptops while curled up on bean bags, taking an occasional sip of Kombucha before taking a nap in sleep capsules. . But the broad outlines – a more relaxed office culture, more extensive remote working options, and a better work-life balance – hold true, recruiters say.

And in recent years, as stock markets have exploded, it’s clear that technology can be an even faster path to financial security and unfathomable wealth.

Kim Freehill, managing director of financial services research firm FSJ Partners, said in an interview that fintech hiring is so intense that some of her financial services clients are struggling to find available candidates for jobs in the financial sector. equity research focused on this sector.

Lazard Ltd. CEO Peter Orszag seems to grasp the reality that Wall Street faces: “It will always be the case that investment banking involves hard work,” he told Bloomberg on July 1. . But, he added, “it must be interesting hard work.”

– With the help of Mary Biekert

[ad_2]

Source link