[ad_1]

The US Federal Reserve is stuck in a high-stakes showdown with the markets.

This week, President Jay Powell was praised for recognizing a rapidly improving economic outlook and the possibility of a surge in inflation, while underscoring his commitment to keeping interest rates at the lowest levels in the foreseeable future.

But this relaxed attitude to inflation is pushing the price of long-term US government bonds up, causing spillover effects in global markets. Despite Powell’s interventionist approach to rising yields, unlike his eurozone peers, investors continue to wonder how long the Fed can allow this to last.

“It’s not the level of return that matters, but how it interacts with risky assets,” said Gene Tannuzzo, global head of fixed income at Columbia Threadneedle Investments. “If yields are rising at a rate that causes the stock market to fall and credit spreads widen, then [Powell] will be much more concerned.

In the past week alone, the yield on the benchmark 10-year note climbed to 1.75%, after trading around 1.6% a few days earlier. Since the start of the year, long-term Treasuries, which mature in 10 years or more, have fallen nearly 15% on a total return basis, according to a Bloomberg Barclays Index. If those losses continue, the first quarter of this year will be the worst since at least the early 1970s.

The drop reflects a sharp update in inflation and growth forecasts among economists, and suspicion that the Fed will eventually be forced to advance its first interest rate hike.

The European Central Bank has pushed back higher yields in its territory, fearing a detrimental rise in borrowing costs for businesses and individuals in difficult economic times. In contrast, the Fed chairman brushed aside any malaise, despite the ferocity of the decision at times, unlike the March 2020 episode where policymakers were in constant contact with banks and other market participants about chaotic market movements.

The speed of the liquidation, which began to pervade the equity and credit markets, rattled investors. In February, yields exceeded even some of the highest expectations of the year, after an ill-received Treasury auction kicked off choppy trading.

Powell again dismissed the recent market swings of $ 21 billion in US government debt on Wednesday, recalling that financial conditions across a variety of parameters remained “very accommodating” and that the central bank would only be concerned about “disorderly” movements that threaten to undermine economic recovery. To put it mildly, he suggested no intention of adjusting the Fed’s monthly $ 120 billion bond purchase schedule.

“The market could push them to change their behavior, but for now [Fed policymakers] made it clear that they did not want to participate directly in impacting the yield curve, ”said Rish Bhandari, senior portfolio manager at hedge fund Capstone.

Mike Collins, senior portfolio manager at PGIM Fixed Income, warned that another sharp rise in yields on Treasuries, however, could test their position.

“Financial conditions remain fairly flexible, but if rates rise, [0.5 to 1 percentage point], that could really slow things down, ”he said. The backlash in equity and credit markets could also be severe enough to prompt verbal intervention from the Fed, or even a shift toward buying longer-term debt by the Fed.

The development of the economic situation as summer approaches could make the situation even more difficult for the Fed.

Economists have already looked at a resumption in consumer price hikes this year as the economy reopens – an increase according to Fed officials will be temporary. But the central bank’s approval of higher inflation, along with its recent pledge to let inflation heat up to offset past periods of under-exceeding its 2% target, coupled with the enormity of the stimulus package. recently signed budget, has put investors to the limit.

“Markets have become extremely concerned that the Fed will make a policy error in terms of rising inflation,” said Saira Malik, head of global equities at Nuveen. “The market can handle an increase in yields, but it has to be orderly and driven by stronger growth and not rise because the economy is overheating.”

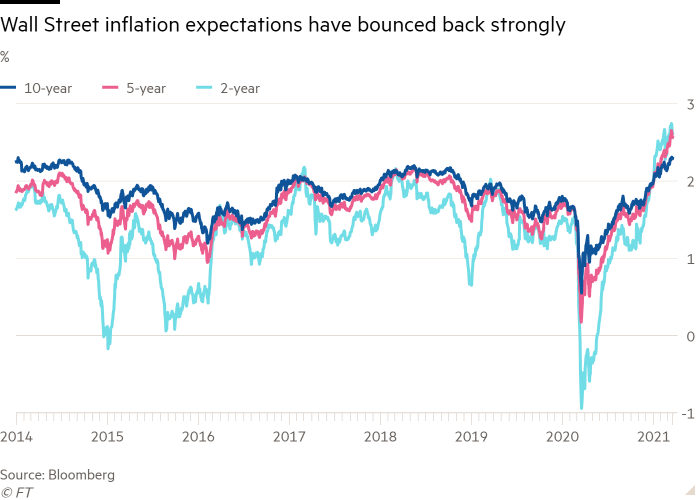

Brian Rose, chief economist at UBS Global Wealth Management, said he was watching long-term inflation expectations closely for any signs that inflation pressures could become destabilizing. The five-year break-even rates, which are derived from inflation-protected U.S. government securities, are now hovering around 2.6 percent, just below the highest level since 2008. The 10-year rate is slightly less than 2.3 percent.

“If they are doing too well and inflation expectations threaten to uncheck, then that becomes a problem and would make it much more difficult for the Fed to maintain very loose policy,” he said. The so-called dot plot of policymakers’ interest rate projections on Wednesday implied that the central bank would keep interest rates close to zero until at least 2024, despite the sharp improvement in its growth forecast.

“There is currently nothing to indicate that we are entering a new inflation regime that will. . . force the Fed to tighten, ”said Diana Amoa, bond portfolio manager at JPMorgan Asset Management. “Having said that, there is a lot more uncertainty about this.”

[ad_2]

Source link