[ad_1]

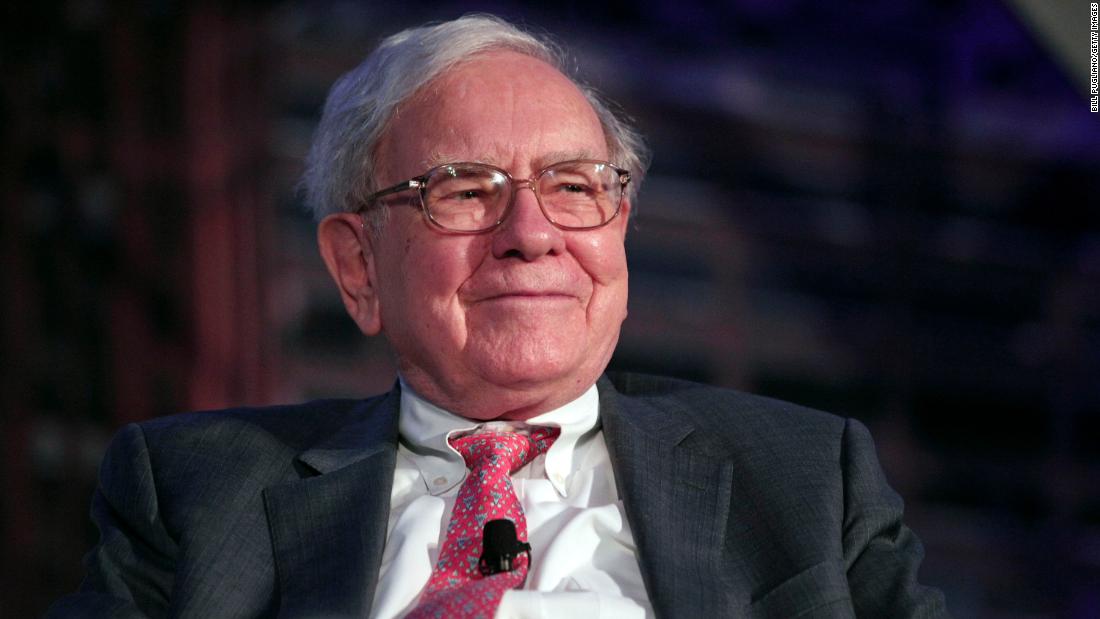

Operating profits, a measure Buffett and many analysts and investors prefer to view as a true measure of Berkshire’s health, also rebounded strongly. The company posted operating income of $ 6.7 billion in the second quarter, an increase of 21% from last year.

Berkshire has a huge pile of money which is growing further as Berkshire seeks more investment opportunities. The company had $ 144.1 billion on its balance sheet at the end of June, up from $ 138.3 billion in December.

The company revealed on Saturday that it bought back $ 6 billion of its shares in the second quarter. It has now repurchased $ 12.6 billion of Berkshire shares so far this year.

Still, Buffett has long talked about wanting to make another “elephant-sized” acquisition to expand the company’s portfolio of assets. But make no mistake: Berkshire does very well with what it already has.

Berkshire’s rail, utilities and energy companies were the big winners in the second quarter, posting a 28% jump in operating profits. Berkshire owns the Burlington Northern Santa Fe Railway and the utility companies PacifiCorp and MidAmerican Energy.

The company’s “other” business unit, which includes a variety of consumer businesses ranging from Dairy Queen and See’s Candies to Duracell batteries, Benjamin Moore paints and Fruit of the Loom underwear.

Ajit Jain, another vice president of Berkshire, heads the company’s massive insurance unit, which includes home and auto insurance giant Geico.

[ad_2]

Source link