[ad_1]

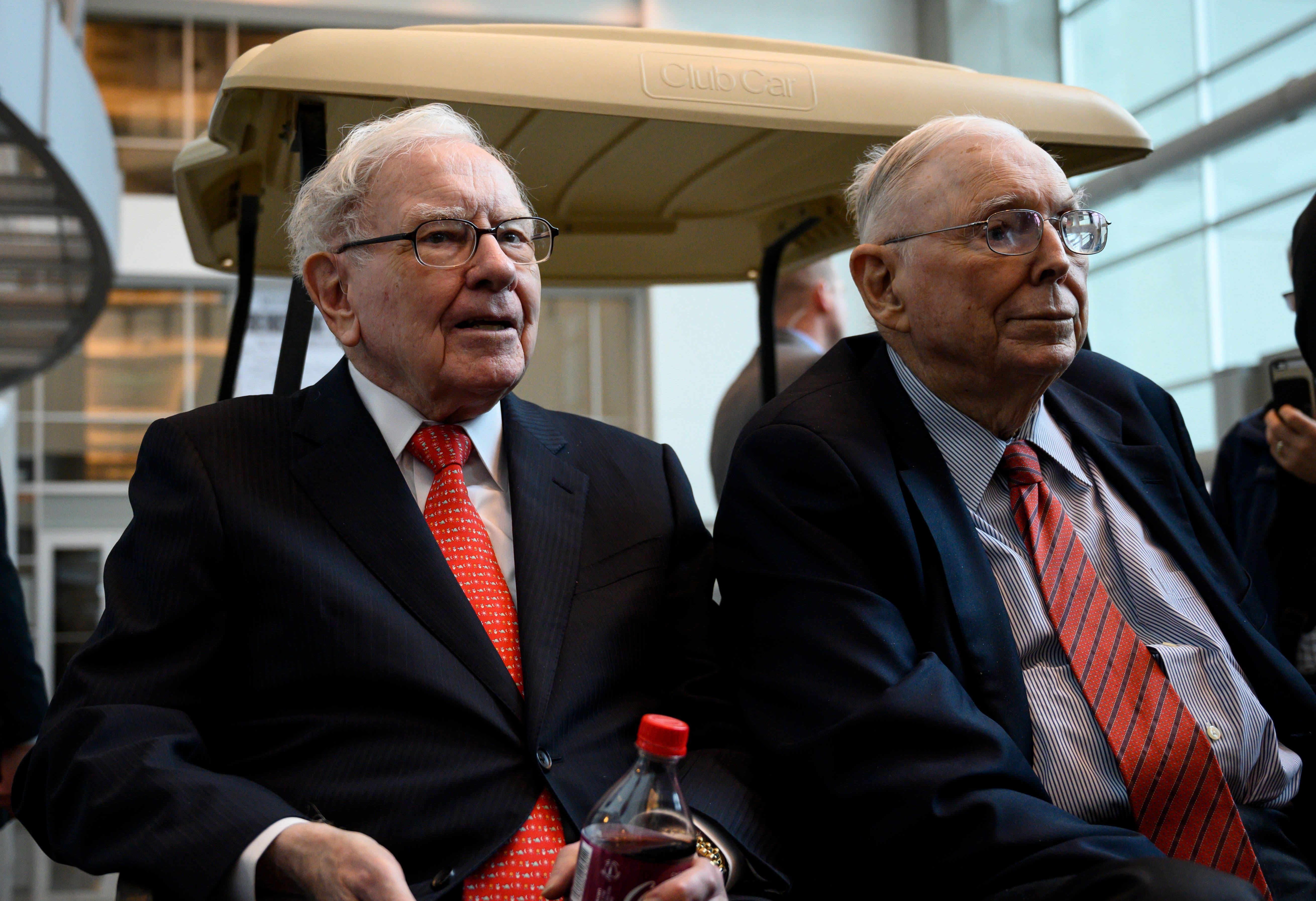

Warren Buffett (left), CEO of Berkshire Hathaway, and Vice President Charlie Munger, attend the 2019 annual meeting of shareholders in Omaha, Nebraska, May 3, 2019.

Johannes Eisele | AFP | Getty Images

Warren Buffett has shown greater interest in the oil industry with the recent $ 10 billion investment from Berkshire Hathaway to support Anadarko Petroleum 's purchase offer by Occidental Petroleum. He said it was a bet on the Permian Basin.

"I mean the Permian Basin has four million barrels a day – it's amazing," Buffett told CNBC's Becky Quick in an interview before the start of the annual Berkshire meeting in 2019. CHI Health Center in Omaha, Nebraska.

"Remember that it was the last great discovery in the United States 40 or more years ago … The United States produces 12 million barrels and four million" come from the Permian, does it added.

Western revealed this week that Berkshire had committed to investing $ 10 billion in the company to fund the Anadarko acquisition project. Berkshire would make the investment by purchasing 100,000 preferred shares, which pay an annual dividend of 8%.

Backed by Berkshire, the Western bid was superior to that of Chevron. However, "the Oracle of Omaha" does not consider this a hostile deal because Anadarko wants to sell its properties.

"I mean it's not a hostile deal in the sense that Anadarko had talked to Occidental about selling their properties … It's different from Coca-Cola or something like that. buy material goods … Anadarko wanted to sell … It was not like a private company sold or a company controlled by management, "Buffett told Quick.

When asked why he had not bought Anadarko, Buffett said he was not an expert in the oil industry.

"Charlie is very impressed with the Permian Basin, he knows more about oil than me, which is not really commendable, but we both follow him," said Buffett, referring to the vice-president. Berkshire President Charlie Munger.

The Permian Basin, which is 250 km wide and 300 km long, stretches from New Mexico to Texas and contains over 20 of the country's 100 largest oilfields, according to Chevron.

"You can spoil the oil fields very easily, a lot has been done in the early days, so you can mine a huge field, and with stupid production techniques you can dramatically reduce recovery rates," he said. said Buffett.

[ad_2]

Source link