[ad_1]

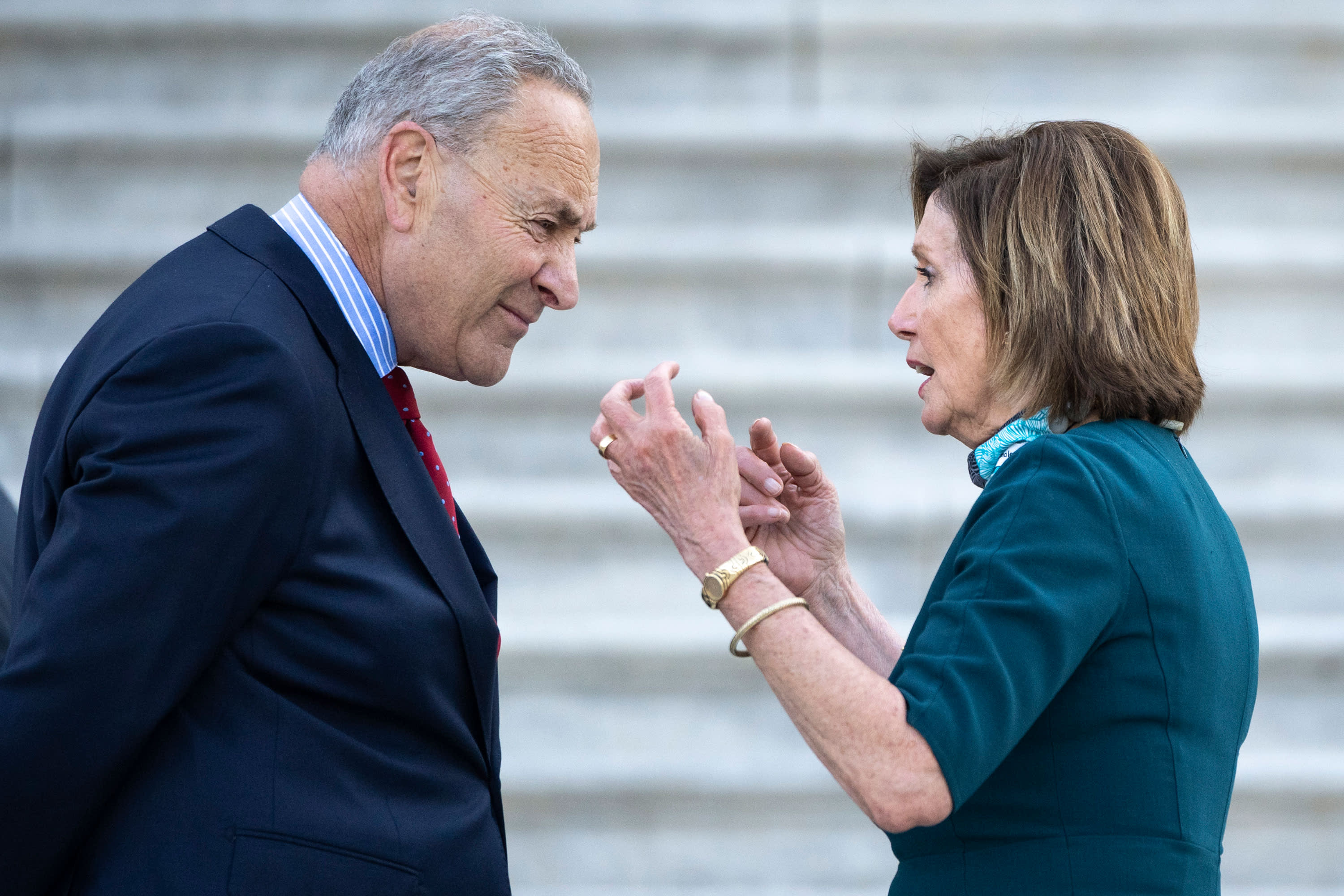

US Senate Majority Leader Chuck Schumer (D-NY) chats with House Speaker Nancy Pelosi (D-CA) on the steps of the US Capitol.

drew anger | Getty Images

The US stock market is on its way to posting its worst day in months. And American policy is partly to blame.

With the Dow Jones Industrial Average down 870 points in afternoon trading – on pace from its worst day since October – and the S&P 500 losing more than 2%, strategists say the standoff on Capitol Hill begins to shut down the market.

The S&P 500 is down 2.5% and is on track for its worst session since January.

Dan Clinton, head of policy research at Strategas Research Partners, wrote on Monday that Wall Street is increasingly convinced that lawmakers will not tackle the debt ceiling anytime soon.

“Much of this is short-term risk and global risk, but Washington’s policy framework is moving towards more risk after 18 months of unlimited fiscal and monetary policy,” he wrote. “The consensus now thinks the debt ceiling will be raised in the second half of October, which means a last-minute move, and another month of discussions on debt ceiling overruns and prioritization of public spending. if the debt ceiling is not lifted. “

If Congress does not suspend or increase the borrowing limit before the so-called “drop dead” date, the US government will default for the first time. The Treasury Department does not have a specific date at this time, but believes it will likely be at a certain point in October.

House Democrats plan to vote this week on a bill that would suspend the limit and fund the government for a few months beyond the end of the fiscal year when it ends on September 30.

Republicans have said they will not help Democrats lift the borrowing limit as a sort of protest against the billions of dollars in new spending proposed by the Biden administration.

“This week, the House of Representatives will pass legislation to fund the government until December of this year to avoid an unnecessary government shutdown that would hurt American families and our economic recovery before the September 30 deadline,” said House Speaker Nancy Pelosi, D-Calif. ., said Monday in a statement.

“Legislation to avoid a government shutdown will also include a suspension of the debt limit until December 2022 to meet our obligations again and protect the full confidence and credit of the United States,” he said. she adds. “The American people expect our fellow Republicans to take responsibility and pay off the debts they proudly helped incur in the December 2020 COVID ‘908’ package that helped American families and small businesses to recover from the COVID crisis. “

Probably the biggest hurdle is the Senate, where lawmakers will need to muster 60 votes to pass such a bill that is unrelated to separate reconciliation legislation.

Raising or suspending the debt ceiling does not authorize additional budgetary expenditure. Instead, raising the cap is more like increasing the country’s credit card balance.

It’s important to note that even though the Biden administration had not authorized any spending – even though Congress had not passed any bills in 2021 – lawmakers would still have to raise the cap to pay for legislation passed in previous years.

“The United States has never defaulted. Not once. It would likely precipitate a historic financial crisis that worsens the damage from the lingering public health emergency,” Treasury Secretary Janet Yellen wrote in an editorial this weekend.

“A default could trigger a spike in interest rates, a sharp drop in stock prices and other financial turmoil,” she added. “Our current economic recovery would turn into a recession, with billions of dollars in growth and millions of jobs lost.”

Even if lawmakers ultimately avoid a technical default, a long, last-minute debt limit battle could lead to a further downgrade of the US debt rating, similar to what happened in 2011. The Simple Specter of a default led Standard & Poor to lower the rating. US sovereign credit, which in turn shook demand for Treasuries and pushed yields higher.

But investor fears are not limited to the borrowing limit.

Instead, the additional angst over the debt ceiling adds to growing fears over the delta variant of Covid-19, pesky inflation and the end of easy Federal Reserve policies, according to Art Hogan, strategist. Chief Markets Officer at National Securities.

Hogan explained that the markets are closely watching the bipartisan effort to exceed $ 1,000 billion in infrastructure spending and Democrats’ efforts to add an additional $ 3.5 trillion to revolutionize the country’s social safety net.

But, he said, it’s not necessarily surprising to see the $ 3.5 trillion bill shrunk as it progresses through Congress.

“It seems the consensus is that we will get some but not all of the spending proposals passed,” Hogan wrote in an email. We are likely to see “increased taxes but certainly not in the order of magnitude that is currently under discussion”.

September is often a hectic month for markets, Hogan added, and 2021 is no exception.

“When we think about the things that drive the markets, we certainly feel like we’ve gone from complacency to worry in the face of a plethora of potential headwinds,” he wrote. “None of the concerns of market participants here and now are necessarily new, but are viewed through the prism of what has historically been a difficult month for markets in general, as such they appear to be reaching a crescendo. “

The Dow Jones and S&P 500 each lost more than 4% in September.

[ad_2]

Source link