[ad_1]

Welcome to our weekly report on cannabis, a reliable source of information on the latest developments and analyzes in the cannabis sector for investors.

Trading Summary

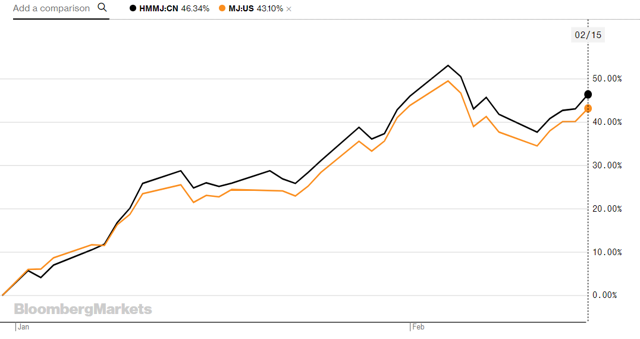

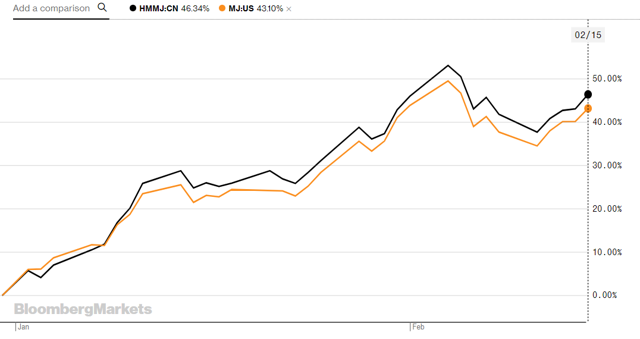

Cannabis stocks stabilized last week after two tumultuous weeks. The Horizons Marijuana Life Sciences Index ETF (OTC: HMLSF) gained 3.2% and the ETFMG Alternative Harvest ETF (MJ) gained 4.0%.

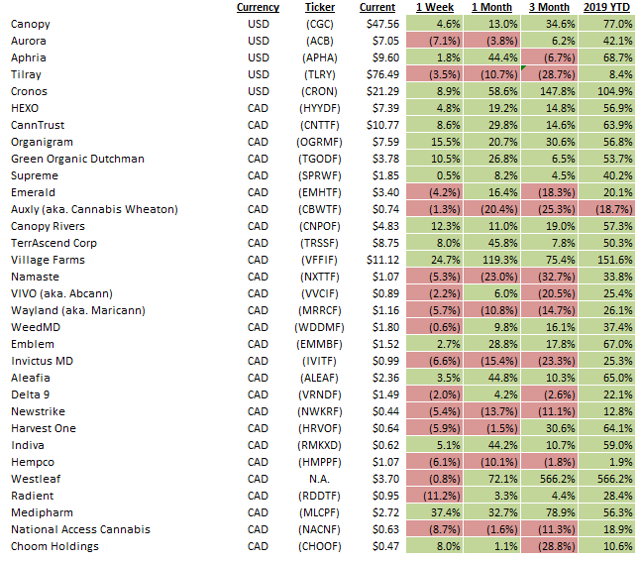

Canadian large cap stocks: Canopy (CGC) grew 4.6% after posting C $ 83 million in sales last quarter, the highest of any Canadian sponsor. Tilray (TLRY) has still lost 3.5% and the title is by far the worst performer in 2019 among the big discs. Aphria (APHA) and Cronos (CRON) have both gained ground and Cronos has gained 5% in 2019 so far. Aurora (ACB) lost 7.1% after reporting C $ 54 million in revenue compared to last quarter

Canadian Mid Cap: CannTrust (OTC: CNTTF) gained 8.6% on its profits and appointed a new CFO. HEXO (HEXO) canceled the 5% loss from the previous week. OrganiGram (OTCQX: OGRMF) rebounded 15.5% after losing 16.5% last week with its last quarter. Green Organic Dutchman Holdings (OTCQX: TGODF) also grew by 11%.

Small Canadian capitalizationSmall cap stocks had mixed returns driven by company-specific information. MediPharm (OTCPK: MLCPF) jumped 37% after announcing another $ 35 million Canadian extraction contract. Village Farms (OTCQX: VFFIF) jumped 25% after announcing that its application for listing on the NYSE had been approved. Radient (OTC: RDDTF) lost 11% after climbing 32% the previous week after receiving a treatment license from Health Canada. Supreme (OTCQX: SPRWF) was essentially stable after the release of its F2019 second quarter results.

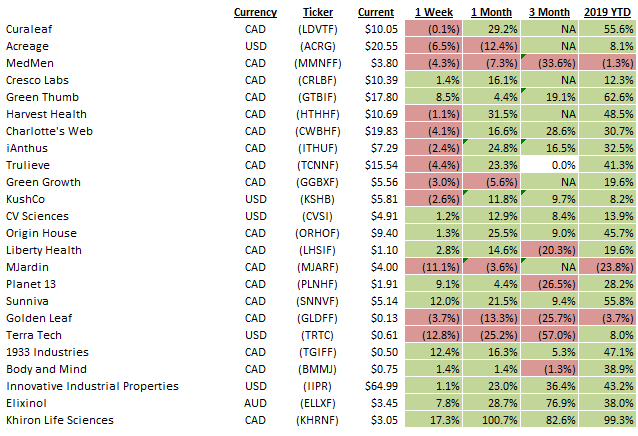

American multi-state operators: Cannabis stocks in the United States had a quiet week, with Canadian revenue dominating the news. Most stocks had a week without incident, but several stocks had important news. Harvest Health (OTCPK: HTHHF) has acquired Falcon International Corp., a California-based company, for an undisclosed amount. MedMen (OTCQB: MMNFF) has lost another 4.3%, with investors equating its lawsuits with former CFOs. Sunniva (OTCQB: SNNVF) gained 12% after announcing an additional $ 4 million in purchase orders and is now forecasting sales of between $ 56 and $ 60 million in 2019.

Auxiliary and international: CBD shares of Charlotte & # 39; s Web (OTCQX: CWBHF) lost 4%, CV Sciences (OTCQB: CVSI) gained 1% and Elixinol (OTCQX: ELLXF) gained 7.8%. Cannabis supplies maker KushCo (OTCQB: KSHB) lost 2.6% and Innovative Industrial Properties REIT (IIPR) gained 1%. Khiron (OTCQB: KHRNF) has again jumped 17% as the momentum continues.

News from the industry

Look to the front

Canopy and Aurora hit the headlines last week after announcing their respective quarters ending December 31st last year. Canopy recorded a record $ 83 million in business, while Aurora recorded a $ 54 million decline. Clearly, Canopy was better prepared for legalization and took advantage of opportunities to capture a larger share of the market than any other competitor. Aurora also experienced impressive growth, but investors clearly had higher expectations as its shares lost 7.1% last week after the quarter. Canopy jumped 4.6% last week as investors digested strong revenue growth despite a lower gross margin. The weakness in Canopy's gross profit margin is explained by the non-recurring start-up costs of its facilities and the higher costs resulting from its activities in beverages and food products, which do not yet generate products. However, we note that most players face similar unique expenses related to the commissioning of facilities and the preparation of the forthcoming legalization of food and beverages. As a result, we would caution against comparisons that adjust the margin of one company but not the others for these non-recurring costs. After finding that the initial sales figures had been legalized, the two largest players in Canada felt that investors should feel that initial legalization was very slow and that the legal market remained nascent. We expect Canopy and Aurora to control 40% to 50% of the total market, but the only two combined revenues were less than CAN $ 100 million, a total legal market of $ 200 to $ 250 million in the fourth quarter . We also believe that investors will begin to focus on gross margin and other cost items as companies are expected to achieve profitability in the coming quarters. Overall, we believe that last quarter was decent for most of the limited partnerships in terms of revenue growth, but we should see continued growth over the next few quarters as shortages occur. will expand and that limited partnerships will continue to increase their capabilities.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link