[ad_1]

"Emotion control is the most important factor to play in the market, never lose control of your emotions when the market moves against you, do not be too confident about your winnings, or over-shot at your losses. " – Jesse Livermore

Take a deep breath. As equities struggle to find their direction in a context of increased volatility related to rising rates and threats of new strategies, following the commercial battles between the White House and China, many investors are hyperventilating. They would be better served if they recalibrated their expectations regarding the results and timing of any future China / US agreement. tariff question. The negotiations are not over. they are simply part of an ongoing process to create common ground on issues that have been around for decades.

For the second week in a row, the trading week started on a negative note, with all major indices all down. The Dow 30 lost more than 600 points while the S & P was down 69. Fears that trade negotiations are about to slip were the catalyst for panic selling. Tuesday's turnaround changed the tone and the positive sentiment continued until Friday's sales return. As investors leave the "The worst week of the year for actions"there has been little or no follow-up in panic selling. Dow 30 and S & P 500 were stable over the week.

The cycle continues. Investors witness a period during which positive elements are highlighted, then see a few headlines changing the context in which the negative aspects occupy a central place. As quickly as this change occurred, a return to positive points stabilized the ship and the S & P was 2.5% of the historical record. It makes me wonder why many have been in panic mode.

An investor should ask himself if the whole question of the trade rate has been solved on the stock market. This is not really the demon that it is being made. Of course, this comment will be the subject of lively debate. Investors are now being said to be overly optimistic about some of the positive aspects recently mentioned. The best view was to never become too negative about the situation as a whole.

Trade is not the only negative point. Opponents repeat that all is not well. The yield curve has flattened, global growth will now be stifled, expansion in the United States is old and on the verge of receding, the stock market is overvalued as profits flatten, etc.

Experts will now decide whether this is an opportunity or the beginning of what could disrupt the stock market. Not many would agree, but this vision of common sense presented by Josh Brown explains how, when these moments of "fear" come up, they are the best thing for this bull market.

I have worked directly and indirectly with investors from all walks of life and all regions of the country. I have also had the opportunity and the pleasure of associations with a pinch of foreign investors. I can promise you from an emotional point of view that few people can withstand the volatility and losses that a portfolio of stocks brings to the table. You have to understand how the market works with a lot of discipline to stay focused.

One of the problems that anchors investors' minds is the absolute "fear" of losing money. Of course, there should always be a concern, it is a normal reaction. However, I see a difference these days.

This state of mind is more prevalent now than I have ever known. This feeds the figures on feelings reported week after week. There are peaks of bullish activity, but overall, we are still below historical norms after years of newer highs in the stock market. Many were ejected from the market en route, while headlines kept reminding us that a crash was imminent. It is incumbent upon it to keep investors sidelined, in cash, for an excessive length of time.

These days, not only do market players fear "problems", but they also fear new highs in the stock market. I recently read reviews when the S & P recorded a new record, at 2,945.

"But in the end, bulls accept a ton of risk with an extremely thin margin of error.When the spill occurs, it will be breathtaking."

It is not surprising then that market players can not escape this distressing state of mind thanks to the constant reminders that have been part of this market for so long. So I'm not surprised that most investors are afraid to take a long-term view. Now, this is not supposed to be 20 years old. It is not necessary to set a prescribed time for this view. There is probably no good or bad period to use. Instead, it can eliminate very short-term views that destroy the average investor.

Before the turmoil in prices, the latest rise in share prices showed how a slow merger could occur in bull markets, while there was not much good news to force stocks up . However, bad news is not enough to bring down prices significantly. A neutral "title" where the market is treated without emotion. In my opinion, when the market movement is "up" in this environment, it makes a statement that should not be dismissed as easily.

Then comes what is considered a huge negative and this message falls away as the next episode of anxiety arrives. I found this state of mind at EVERY new stock market summit, and this was repeated last week. The long-term trend is immediately rejected. Technical gurus all start with these warnings:

"This level of short-term support could be compromised, if the S & P can not reach another high quickly, it looks like the market is overturning."

The concentration on the very short term is accepted and followed by far too many investors these days. This is now the last title and what just happened. Everyone wants all situations to be resolved "today". Any other choice is unacceptable and represents a huge disadvantage for the markets.

So, let me try again. At the highs, the S & P 500 was up 17 +% for the year and about 25% from the December lows. Up to now, the depth of this decline is measured at 4.5%. When I add a price action to the combination of other data points to form a strategy, I'm sorry, but I just do not see any problem.

The most skeptical ideas and hasty conclusions were the way skeptics approached the stock market, but also their downfall. Investors should realize that stock prices follow a series of short-term trends as part of the long-term dominant trend. Making reckless decisions with every change of trend in the short term because of a title is the recipe for failure. It undermines the ability to step back and realize what is really happening.

A single point of view for making successful investment decisions, starting at 30,000 feet.

Economy

Scott Grannis explains how bad the economic situation is not as bad as many claim.

A Wells Fargo / Gallup poll found that small business confidence rebounded sharply in the second quarter, a record high, as the current situation reached a new high and concerns about the recession eased. The main concerns were with clients and new businesses, followed by recruitment and retention of staff.

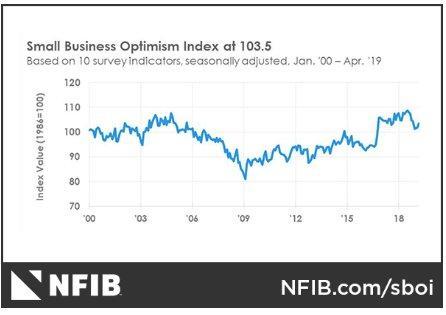

The index of optimism for small businesses (NFIB) rose 1.7 points to 103.5. NFIB President and CEO Juanita D. Duggan:

"Small independent US businesses rebound after the first quarter" closing, slowing down "and not seeming to look back in. The April index is further evidence that as certainty and stability increase , optimism and action also increase. The explosion is due in large part to the strong growth of half of the small businesses in the economy. "

In May, Michigan's confidence allowed the index to reach its highest level in 15 years, from 97.2 in April, to 102.4 vs. 101.4 in March 2018. The sentiment in Michigan now strongly rebounded after 91.2 in January, its lowest level in two years. All of the various "soft" data measures have rebounded since the December-January downturn, although analysts believe we could face potential hurdles due to rising concerns related to the trade war.

The leading economic index rose 0.2% to 112.1 in April, a new historical record (data back to 1959), after rising 0.3% in March to 111.9 in March . Seven of the 10 components made positive contributions, particularly stock prices and the main credit index.

April retail sales fell 0.2% overall, as the 0.1% increase in the non-auto component was lower than expected. And they follow the March gains of 1.7%.

The Empire State's manufacturing index reached its highest level in six months, at 17.8 vs. 10.1 in April and its lowest level in two years, 3.7 in March, compared with 27.1 in October 2017, its highest level in three years.

The Philadelphia Fed manufacturing index rose 8.1 points to 16.6 in May, exceeding estimates after falling 5.2 points to 8.5 in April. The index was at 32.3 last year and is the best since 17.0 in January. It went from a low of 33.1 months to 33 months from February.

The homebuilder survey for the month of May rose more than expected, going from 63 in April to 66. That was 56 last December.

The April Housing Report revealed real gains of 5.7% for housing starts and 0.6% for permits. March data were revised upwards to indicate that home construction would reach 1.168 million units, instead of falling to 1.139 million units, as previously reported.

Mondial economy

China's industrial output saw its growth rate from one year to the next decline by more than 3 percentage points compared to the strong growth of 8.5% recorded in March to 5 , 4% in April. The forecast was for growth of 6.5% from one year to the next.

Retail sales growth was disappointing in April, down 7.2% in March from 8.7%.

The Brexit talks are broken as the Labor Party moves away. The soap opera continues without agreement for the moment.

Earnings observations

Weekly update of FactSet Research:

For the first quarter of 2019:

With 92% of the S & P 500 companies reporting actual results for the quarter), 76% of S & P 500 companies reported a positive BPA surprise and 59%, a surprise in the turnover.

The decline in cumulative earnings for the S & P 500 is -0.5%. If -0.5% is the real decrease of the quarter, it will be the first decline from one year to the other of the results of the index since the second quarter of 2016 (-3 , 2%).

The weighted revenue growth rate for the first quarter of 2019 is 5.3% today. If the final growth rate for the quarter is 5.3%, it will equal the lowest turnover growth rate of the index since the second quarter of 2017 (also 5.3%).

Assessment: The 12-month P / E ratio for the S & P 500 is 16.5. This P / E ratio is equal to the 5-year average (16.5) but above the 10-year average (14.7).

-

Financial sector revenues increased the most since March 31. The weighted growth rate (5.3%) of Q1 2019 for Q1 2019 is higher than the estimate of 4.9% at the end of the first quarter.

-

The health care sector has the highest (year-over-year) growth in earnings for all eleven sectors at 9.2%.

For Q2 2019analysts expect earnings to fall -1.9% and revenue growth of 4.2%.

For the third quarter of 2019analysts expect earnings growth of 0.5% and revenues of 4.3%.

For Q4 2019analysts expect earnings growth of 7.3% and earnings of 4.7%.

For 2019analysts expect earnings growth of 3.2% and earnings of 4.7%.

The political scene

The current price positioning has been stepped up to next level last week. President Trump said it would be wise for China to "act now" to conclude a trade deal with the United States, anticipating that "much worse" terms would be proposed after what he had predicted would be its certain reelection in 2020.

Chinese Vice Premier Liu He said the United States has agreed to hold more trade talks in Beijing, adding that "negotiations are not broken." As expected, China's response to the latest US increase was announced Monday morning. The proposal is to increase tariffs on 60 billion US goods on June 1st.

The last time investors were greeted with fare titles in January and March 2018, the market is selling heavily. Little has changed, with the next round of pricing being hailed by more panic-driven sales.

Investor sentiment is focused on the negative aspects and, when emotions come into play, it is likely that we will see a new period of volatility fueled by the perception of negative stocks. This has already begun with the next step, the threat that all Chinese products will be hit by a tariff, the potential tranche of 325 billion dollars. Investors have already shown how they intend to make this a short-term hurdle for equities.

If any of these rates were reversed or reduced, this could lead to upward pressure on the stock market. The timetable and the application of these tariffs will also play a role in the market reaction. Wanting to take the lead on this issue by positioning yourself for a result one way or the other could be a serious mistake.

At the same time, Minneapolis President Neel Kashkari noted that there is little or no evidence of the "reported" effect on the economic situation in the United States.

In addition, the Trump administration plans to delay car rates for up to six months as negotiations continue with the European Union and Japan.

US Treasury Secretary Steven Mnuchin told a Senate subcommittee on budget allocations that the Trump administration was making progress in resolving tariffs on steel and aluminum applied in Canada and Mexico. Mnuchin also said the negotiators would soon visit China to continue negotiations with Beijing and said trade disputes with Canada and Mexico were almost resolved. The resolution of these tariffs is "a very important part" of the adoption of the United States-Mexico-Canada agreement.

This appears to be an agreement now that the United States is on the verge of eliminating tariffs on steel and aluminum imposed in Canada and Mexico in favor of more enforcement measures. strict, which helps pave the way for the ratification of the USMCA.

A national emergency declaration under the International Economic Emergency Authorities Act (IEEPA) and a trade restriction with Huawei are the latest measures taken to intensify trade tensions between the United States and China. A decree signed Wednesday by President Trump will pave the way for a ban on equipment manufactured by "foreign opponents" on US networks and will require a risk assessment for national security.

Chinese exports to the United States now account for only 3.5% of China's GDP.

Fed

The commercial skirmish has already been extrapolated to worst-case scenarios and the talks on rate cuts are coming back into the picture.

Rather than conclude before all the facts are present, the situation becomes very simple. Everything will depend on the results of the American economy. In the first quarter, the GDP should be between 0.50 and 1%, the real impression being 3.2%. It may be wise to wait to see what happens before changing the portfolio based on commercial rhetoric.

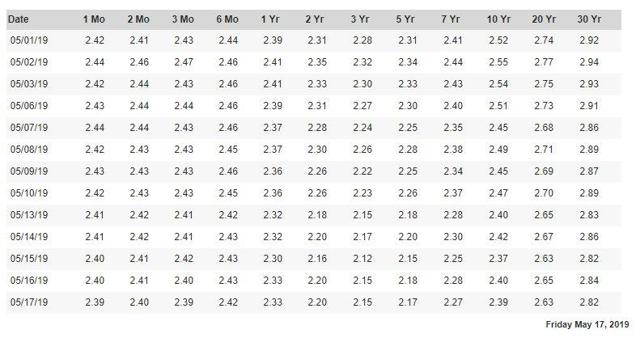

For those who are obsessed with the yield curve:

Source: United States Treasury Department

The 2-10 spread started the year at 16 basis points; it is 19 basis points today.

Another brief period last week where the 3-month / 10-year curve is reversed. This time, the market did not react.

Feeling

Price headlines took first place in the last two weeks, bringing equities to record their worst downturn of the year. The feeling began to reflect the price evolution. A week after reaching its highest level since October (around the time the S & P 500 reached its previous record), the bullish sentiment collapsed this week to 29.8% from 43.1%. % last week. From a historical perspective, this is not extreme, but it has brought optimism to its lowest level of 2019 by far. In addition, it was the largest decline in bullish confidence since December 13 last year, after falling 17% in one week.

Crude oil

The weekly inventory report showed an increase of 5.4 million barrels. At 472 million barrels, crude oil inventories in the United States are about 2% higher than the five-year average for this time of year. Total motor gasoline inventories fell 1.1 million barrels last week and are about 2% lower than the five-year average for this time of year.

Despite all the worries about tariffs, which are disrupting global growth, the price of crude oil remains quite resilient. WTI closed the week at $ 62.71, up $ 1.17.

The technical picture

While the S & P was in full panic Monday, the experts were not able to publish their forecasts quickly enough. S & P 2650 seemed to be the consensual target downward. There was also talk of a full round trip, and the index would come back to 2,350 low points in December. As you know, anything is possible when emotions dominate, and these negative targets may come into play, thus giving the experts a genius. Again, they may join the list of people who have overreacted and are left behind. I also noticed during this week that no one was asking for a rise in share prices.

Coming back to the introductory ideas of the article, it's never wise to draw conclusions based on a fast-paced emotional incident.

Chart provided by FreeStockCharts.com

The DAILY chart of the S & P 500 index shows that the index fell below, then quickly took the short-term moving average to 50 days (blue line), and then went down below. This action shows the indecision of traders these days. On a positive note, there was no follow-up to Monday's panic sale.

What we found was a great consternation about tweets, headlines and analyst criticism of what is being presented on the world stage as a huge disadvantage for equities. Perhaps the investment community has already understood the consequences of what is happening on the global trading scene. Given headlines, a decline of 4.5% so far, after gains at the lowest, says a lot. Does someone listen?

No need to guess what can happen; instead, it will be important to focus on the significant pivots in the short term. However, the long-term view, the 30,000-foot view, is the only way to make successful decisions. These details are available in my daily updates for subscribers.

Short-term views are presented to give market participants an idea of the current situation. It should be noted that strategic investment decisions should NOT be based on a short-term vision. These views make a lot of noise and will cause an investor to take actions that tend to detract from overall performance.

Individual stocks and sectors

The winning quote of the week.

"The retail sector can not stand apart, which is a bad sign for the consumer and a bad omen for the economy."

Has anyone ever heard of Amazon (NASDAQ: AMZN) or Walmart (NYSE: WMT)? They seem to get by and do not send any signal.

The calendar is changing, but the assessment of the economic conditions and the reactions to these forecasts remain the same. Very questionable. Two months ago, many were frenzied about the lower-than-par growth forecast for the first quarter of 2019. Add to that what many saw as a troubling impression of fourth quarter GDP, which would translate into continued deceleration. real GDP. Go a step further, it meant that a recession could be hiding.

Oops! The US economy accelerated in the first quarter, with real GDP up 3.2% a year for the quarter and year-over-year. The first set of tariffs on trade had been in place for about a year. The Fed's premature comments on lowering rates have disappeared as quickly as they entered the picture.

So much for the theories of "high level of tax cuts". Now, the argument is "can this be maintained"? With the rise of the issue of commercial tariffs, this argument is not lacking. At least that is what we are told now.

It is a thing for the majority of economists to stumble and err. It's a whole different story when an investor stumbles. The real money is at stake. From my point of view, these same investor mistakes are repeated all the time. Every problem that arises seems to elicit the same reaction. Premature decisions are made before ALL evidence is examined and carefully considered. Economists do it all the time, investors do not have to follow their example.

Nobody is perfect, we are all human and mistakes will certainly be made. Make the same mistake again and again and there is virtually no chance of success. Doing it while you are managing money is a financial suicide. The winning investor never reacts impulsively and if they "fail", they realize it quickly and do their best to correct the situation.

Going back to the economy, we see that the "potential growth" of the American economy is accelerating. The corporate tax cuts remain in effect, the actual deregulation will not be about to be reversed and the probabilities of future regulation are lower. An opinion of course, which goes against the consensus that estimates of GDP for the second quarter are revised downward. The lowest estimates seemed based on the daily "feeling" of the situation.

As we have seen, it was better not to make quick decisions based on negative economic projections, but many did. The same goes for the view that not everything may be as bad as everyone suggests. Of course, this does not mean that you start buying shares on margin. It is here that those who have stayed on course have an advantage and are the only ones to occupy the pilot's seat.

Investors are therefore at another crossroads. In the ongoing trade negotiations with China, analysts will tell us many facts about the effects of tariffs. Believe me, none of this will be positive. Experts swept aside their remarks from the January 2018 period to highlight and warn Smoot-Hawley where consumers will be handcuffed to the point that the US economy will turn around.

I remind everyone that there were a lot of numbers circulating when the first set of tariffs were imposed and that they were all negative. The winning investor followed the price movements on the stock market when all this happened and concluded that the situation was not as bad as it was presented. In summary, they did not adhere to this rhetoric at the time and do not buy it now. This has proven to be the right way to approach the investment scene. The confirmation then came with the impression of the first quarter GDP of 3.2%.

At the moment, one can draw a conclusion on the negativity associated with the tariff issue, decide to lighten the equity holdings and become completely defensive now that the S & P is close to highs. I hear that from many investors now. This sounds convenient, but it was not a viable strategy in early 2018 when the rates were introduced for the first time. Of course, there was an initial dive, then new heights were made. One must wonder if the same mistake is about to be repeated. Ask yourself if this tariff question is now irrecoverable because no agreement was reached last week. Are there possible outcomes that does not result in a dire situation for the global economy?

It never ceases to amaze me. Investors like to believe that they can see what will happen next. Even worse, they are starting to position themselves for that! In one way or another, they will go out of the market, and then simply return to the stock when the sky is clearer. They can wait a long time. Announce that you will leave the stock market until the resolution of the trade war, it is live in an imaginary country. If there is really a resolution on pricing issues in the future, the market will already reach new heights. You will find yourself at the most inopportune moment.

As you know, it was decided to remain invested in December 2018 and April 2019 because of a strategy that worked over and over again. I repeat, I just can not see months and years, and I will never comment on a significant decline or new heights. Whoever does this "guess".

What I know for sure is our position on the primary market trend. The markets are a fluid situation and what may seem like a smooth sailing today will be a rough sea tomorrow. What I see today are reasons to avoid thinking too much about the situation and to maintain the plan that allowed savvy investors to reach that level. Rest assured when the situation changes significantly, the strategy will evolve.

It is not necessary to leave the stock market now, Stay on course.

I would also like to take a moment to remind all readers of a major problem. Dans ces types de forums, les lecteurs apportent une foule de situations et de variables lorsqu’ils consultent ces articles. Par conséquent, il est impossible de déterminer ce qui peut convenir à chaque situation. Veuillez en tenir compte lors de l’élaboration de votre stratégie de placement.

à tous les lecteurs qui contribuent à ce forum pour faire de ces articles une meilleure expérience pour tous.

Bonne chance à tous!

"Une correction plus profonde ou de nouveaux sommets de marché à venir? Si votre stratégie n'inclut pas la scène macro, vous êtes sur le point d'être laissée pour compte. La vue à partir de 30 000 pieds constitue le SEUL moyen de négocier ce marché haussier. Il est temps de passer du cap le commentaire qui dit "si cela se produit, que cela se produira", ne changera de cap que dans quelques jours. "

"Ignorer le commentaire de whipsaw. the Investisseur avisé est là pour vous aider, et les membres viennent de profiter d’une sélection qui a enregistré un gain de 14% depuis le 10 mai. C'est très simple, on ne leur a pas dit de fuir ce marché lundi lorsque la vente de panique a commencé. Laissez le commentaire "fantaisiste" à d'autres personnes, envisagez de participer à notre succès. "

Disclosure: Je suis / nous sommes longs CHAQUE STOCK / ETF DANS CHAQUE PORTEFEUILLE ÉCONOMIQUE. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Divulgation supplémentaire: Mes portefeuilles sont TOUS. positionné pour tirer parti du marché haussier sans couverture en place.

Cet article présente mon point de vue sur le marché des actions, il reflète la stratégie et le positionnement qui me conviennent. Bien sûr, il ne convient pas à tout le monde car il y a beaucoup trop de variables. J'espère que cela suscitera des idées, ajoutera du bon sens au processus d'investissement complexe et permettra aux investisseurs de se sentir plus calmes et de les contrôler.

Les opinions rendues ici ne sont que cela – des opinions – et, avec les positions, peuvent changer à tout moment.

Comme toujours, j'encourage les lecteurs à faire preuve de bon sens dans la gestion des idées que je décide de partager avec la communauté. Nulle part est-il impliqué que tout stock doit être acheté et mis de côté jusqu'à votre mort. Les examens périodiques sont obligatoires pour s’adapter aux modifications du fond macro qui se produiront au fil du temps.

[ad_2]

Source link