[ad_1]

The economic calendar is very light with reports on three days only. Reports on existing and new home sales could be interesting and many advocate advanced economic indicators. The combination of empty airtime and some Fed news is like an aphrodisiac for experts, all of whom are Fed experts. The week includes the minutes of the recent FOMC meeting and the annual Jackson Hole Symposium. The theme, Challenges for Monetary Policy, could include almost anything. The full agenda is announced Thursday and we know that President Powell will speak Friday morning. Since market commentators believe that the Fed should focus on the most recent market concerns, I expect the following question:

Will reversing the yield curve be part of the Jackson Hole program?

Recap of last week

In last week's episode of WTWA, I focused on the investor response to recent volatility, asking if you should go out, hide or enjoy. It was a good idea for the subject of the week, with the market action continuing to make daily headlines and red alert notices on financial television. Commercial information was largely responsible for Monday and Tuesday's actions, proving that the market continues to process a tweet and a planned phone call as news. Wednesday's trading was caused by the temporary reversal of another part of the yield curve, segment 2-10.

Those who discussed the issue with us last weekend were better prepared to face another week of roller coasters. It is useful to have a plan and it comes to think of the week ahead.

The story in a graph

I always start my personal assessment of the week by consulting a good graph. This week, I present the version of Jill Mislinski, which gathers a lot of information in a single photo. The full article also includes several other interesting takes on price developments.

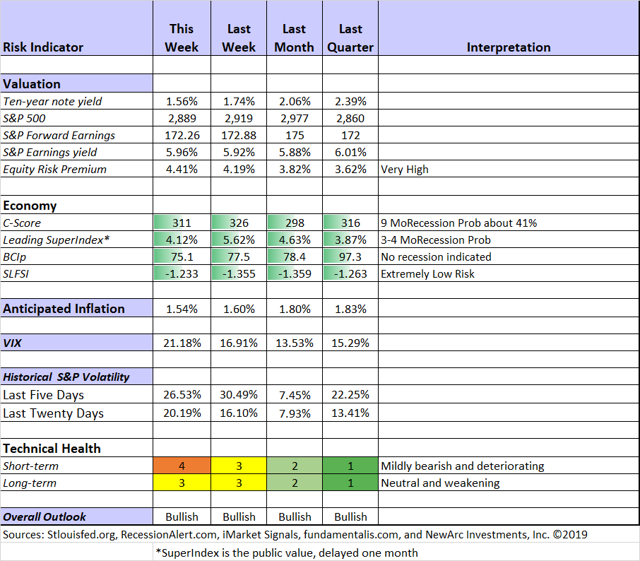

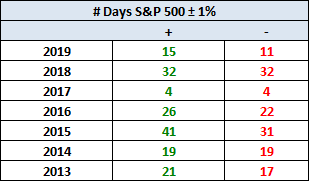

The market lost 1.0% for the week and the trip was wild. The trading range was 4.1%, of which 3.0% in one day. My Quant Corner weekly translates this into a volatility calculation that you can compare to both VIX and previous readings. Among the many other useful graphs in this article, let's mention the record of +/- 1% of trading days in recent years.

Personal note

Mrs. OldProf and I are doing a new test on holidays that we canceled a few weeks ago. There may not be a WTWA edition for the next two weekends, but I will keep an eye on the events. I will try to publish an update on the indicators, especially if something important seems to be happening. And thank you, again, to those who sent us ideas and recommendations on next steps.

Remarkable

The visual capitalist asks, Which countries have the most wealth per capita? You might be surprised by the list, and even more so by the difference between the average and median results. Here is an image of the static diagram, but I can not do justice to the beautiful animated diagram of this article. The intelligent animation contains a lot of information.

The news

Every week, I break down the events into good and bad. For our purposes, "good" has two components. The news must be market-friendly and better than expected. I avoid using my personal preferences to evaluate the news – and you should too!

The high frequency indicators of the New Deal Democrat are an important part of our regular research. The results are now positive within the three deadlines. Long-term indicators are particularly positive. the more volatile short-term indicators became positive. NDD remains cautious on the remainder of 2019, noting revisions in some quarterly data.

Good

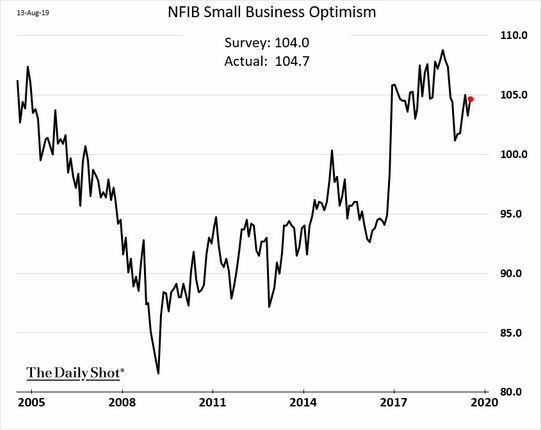

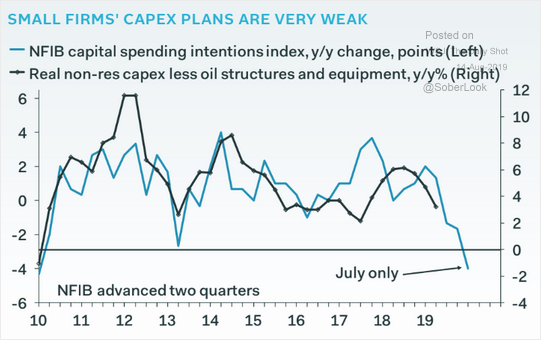

- NFIB Small Business Optimism Index increased from 103.3 in June to 104.7 in July. The table below is from The Daily Shot. Gene Epstein (Barron's) comments on the reasons for this remarkable improvement in the Trump period. Beyond the figure indicated, there is a weakness in planned investments.

- Mortgage applications increased by 21.7% for the week ending 8/10. The change from the previous week was 5.3%.

- Mortgage arrears remain at the lowest level for more than 20 years. (CoreLogic)

- Rail traffic is still shrinking for Steven Hansen's economically intuitive sectors (GEI), but signs of improvement are appearing.

- The NAHB housing market index rose from 65 in July to 66 in August.

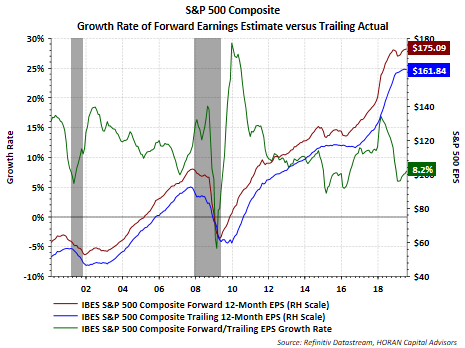

- Estimates of future earnings remain strong. David Templeton (HORAN) explains the effect of past exceptional peaks and more favorable comparisons.

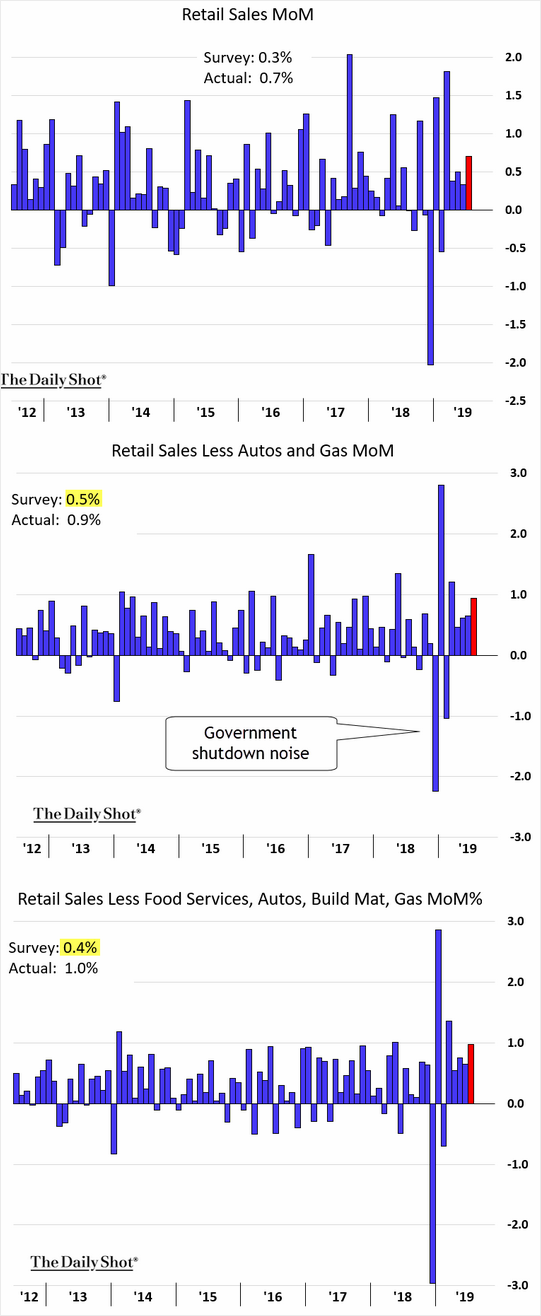

- Retail sales rose 0.7% in July, much better than expected by 0.3% and 0.3% in June.

- The building permits for July had a SAAR of 1336K, better than the expected 1260K and the one of June (revised upwards) of 1232K.

The bad

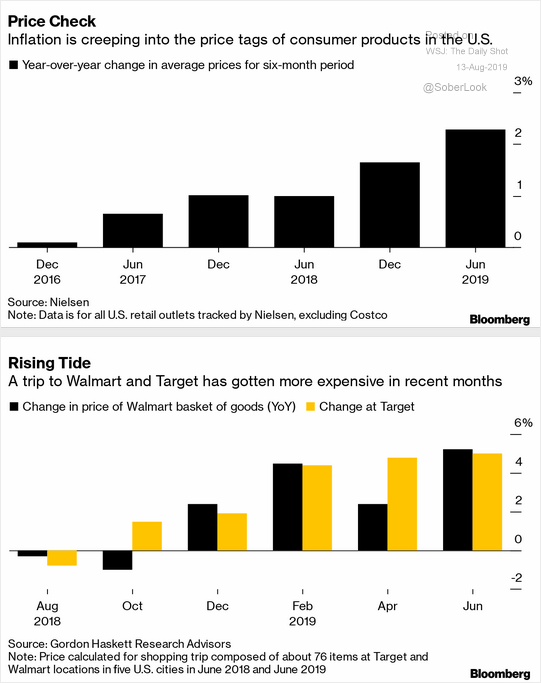

- CPI rose 0.3% in July, above the 0.1% in June and expectations of 0.2%. The core CPI also rose 0.3%, which is higher than the expected 0.2%.

- Increase in initial claims for unemployment insurance 220K, up from 211K last week and worse than expected at 215K.

- Industrial production for July decreased. The change of -0.2% was worse than the expected gain of 0.1%. The June report, however, was revised upward from 0.0% to 0.2%.

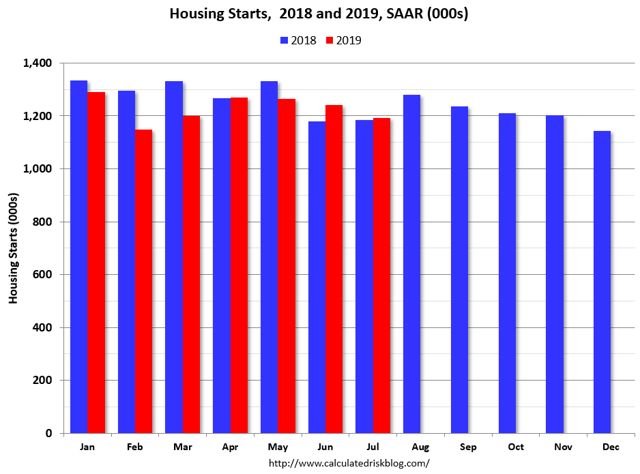

- July housing starts recorded a SAAR of 1191K, it misses the expectations of 1245K and that of June (revised downward) of 1241K. One of the many reasons we follow the calculation of risk is to get an idea of housing trends, avoiding focusing on a single report of an unstable series. Here is Bill's take on the chart below.

I imagined that housing starts would be slightly down in 2019 in 2019 compared to 2018, but nothing comparable to the annual declines registered in February and March. It is now possible that starts will increase slightly in 2019 compared to 2018.

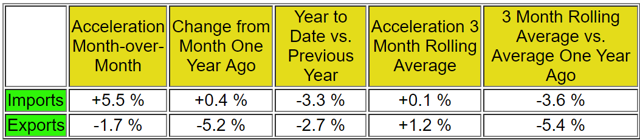

- The number of shipping containers in July still shows economic weakness. (Steven Hansen, GEI)

- Michigan Consumer Relaxation decreased to 92.1 during the preliminary reading of August. The final reading in July was 98.4 and expectations of a lower decline, at 97.7.

- The demonstrations in Hong Kong and the response have both increased in intensity.

- The trade war is further aggravated

Trump links a trade deal to China's action in Hong Kong, suggests meeting Xi

China promises to take "necessary countermeasures" against US tariffs

The ugly one

GE's allegations. Investors need accurate information. Giving the whistle is a career hazard and often not rewarding. The result is the combination of whistleblowers such as Harry Markopolos (Bernie Madoff Ponzi) and hedge funds that can make headlines. In this case, Markopolos sent the report to "an unidentified hedge fund before its publication and will share the profits, if any" (WSJ and Barron's). The allegations have consequences for other companies that deal with long-term care insurance.

As often with things that seem "ugly", I do not have a clear solution in mind. Or maybe no "solution" is needed. Like other veterans of the market, my reaction is that it does not seem fair to me.

The week ahead

We would all like to know the direction of the market in advance. Good luck with that! Second, plan what to look for and how to respond.

The calendar

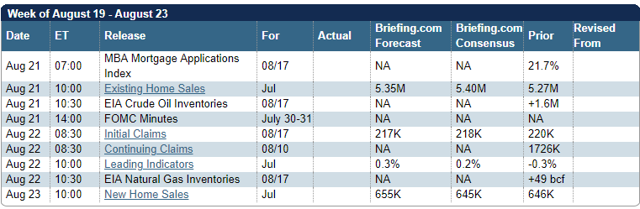

The economic calendar is light and many market players are on vacation. The main economic reports will focus on housing, but the focus will be on the Fed. We have the two minutes of the July FOMC meeting and the start of the Jackson Hole Symposium.

And of course, we can expect tweets and retweets and hope that no major international incident will occur.

Briefing.com has a good US economic calendar for the week. Here are the main American versions.

Theme of the next week

With a small economic calendar and Fed news on the calendar, the expert has an easy method to fill the space reserved for information. Since they are already issuing recession warnings based on the strong "message" of the bond market, they know what is important. The question for them is whether the Fed will recognize the danger. Although the Jackson Hole meeting is not intended for current political announcements, experts will ask:

Is the inversion of the yield curve on the agenda of Jackson Hole?

Context

The reversal of the yield curve of 2/10 and the decline in the market on Wednesday have pushed the prospects of recession to one of the major media.

Markets are prepared for a global slowdown proclaims the economist. And it's one of the most moderate sources.

A recession is coming. How is he going to be? asks the Washington Post.

Bloomberg is more nuanced, noting expert comments on other factors influencing market expectations.

The message of the bond market

James Picerno writes that the bond market is in a phase of economic contraction in the short term. He notes that this does not take into account the recent strength of economic data such as retail sales. More analysis here.

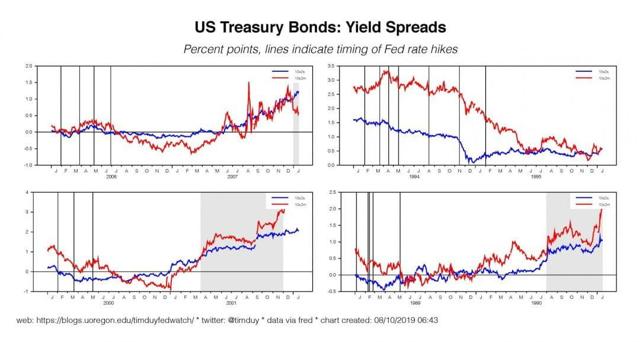

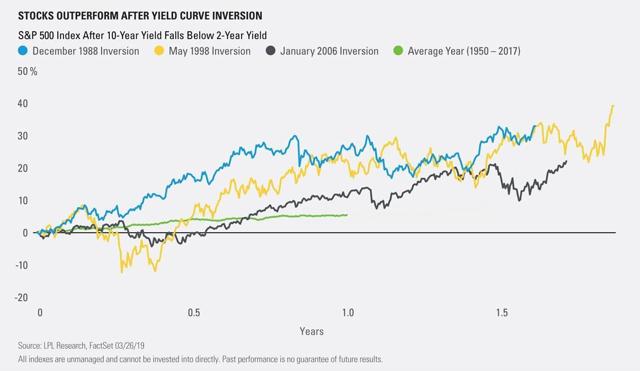

The analysis of Tim Duy, Do not panic. Again., takes a deeper look. He notes that the risks have risen, but the Fed should be more aggressive in its response. That said, "… they will not be willing to be as responsive to the yield curve as market players may wish. Do not forget that a reverse yield curve is a long leading indicator:

And some of Wall Street see it as a red herring. (Kate Rooney, CNBC)

The study of the subject by Dr. Ed Yardeni showed that "an inverse yield curve has predicted 10 of the last seven recessions". He suggests that the causal link is that a reverse yield curve implies a credit crunch, which is nowhere.

When will a recession come?

Eddy Elfenbein has a simple but precise description:

With 2/10, we have a rare example of a leading indicator with a good history, but this is done at the expense of timing. In simple terms, the world does not explode automatically once the 2/10 is reversed. It's more a dimmer than a rocker.

The key is that 2/10 is not bad news in itself. The world of finance likes to fetish the numbers. Instead, we should focus on what these numbers represent. An inverted gap of 2/10 pretty much corresponds to the way all the fire trucks go down to Arby having lunch. When the problem comes – and it will – the answer will be more difficult.

Bloomberg analyzes the past reversals and shows the great variation of the delays.

Professor Duy remarked that "we can practically guarantee that we are not yet at the top of this cycle …. The result is that a reversed yield curve does not mean that a recession is right above us. recent economic data in support of this point.

How is he going to be?

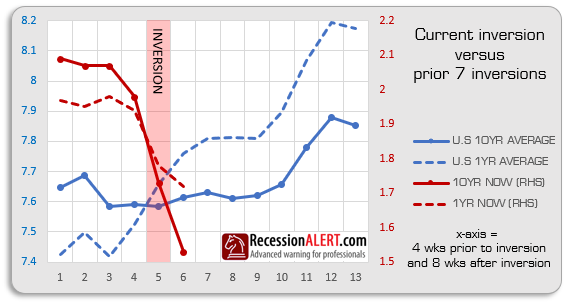

Some experts believe the data suggests a slight recession. RecessionAlert, one of our usual sources, notes that "the current reversal process is very different from the past". The bottom line is that both long and short rates have fallen rapidly. In general, past reversals included both rising. The full article is well worth a read.

In his reports to clients, Dr. Robert Dieli, expert in the business cycle, made the same remark.

The reaction of the stock can be counter-intuitive.

Can policy changes improve the chances of a recession?

The Federal Reserve can conquer the yield curve because this time, he reacts immediately by reducing rates. In the past, it has increased rates after inversion.

Or ending the trade war, which most regard as a source of concern in the face of sluggish global growth.

Business Insider quotes a study done in August by the New York Fed. This supplement to the regular version of Empire State includes additional questions. Among other conclusions, they report:

According to the survey, 79% of manufacturers and 60% of service companies reported that recent rate increases have resulted in a slight increase in input costs. 14% of manufacturers and 12% of service companies reported that increases were substantial. All figures represent a marked increase from the August 2018 survey.

What are the biggest risks of recession?

- Decline in business confidence due to policy uncertainty.

- A fight between President Powell and the President.

Implications

For all these reasons, we should not expect a spectacular announcement from the Fed at Jackson Hole, nor the panic caused by this indicator. As I have been doing for months, carefully observe other indicators is the order of the day.

I will have my own observations in the last thought of today.

Corner and risk analysis

I have a rule for my investment clients. Think first about your risks. Only then, should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update, which presents the instant indicators indicator.

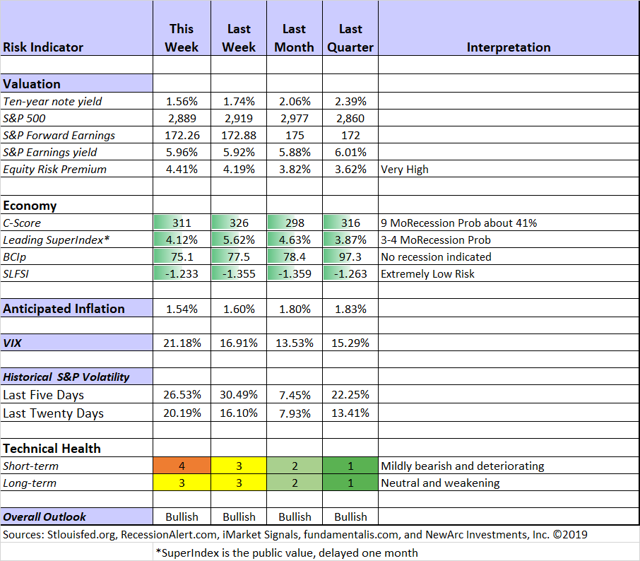

Short term technical data has become bearish and the trend is worsening. Long-term techniques have become neutral. The risk of recession is still in the "watchful" zone with chances of a notch. We see little confirmation of the risk signals, which we have been monitoring since May. Temporary reversal 2/10 is not the best measure, so it does not affect our estimate. It is also important to look for confirmation rather than blindly follow a single indicator.

Given all the factors, my overall outlook for investors remains optimistic.

The sources presented:

Bob Dieli: Analysis of the business cycle via the "C score".

Brian Gilmartin: All in all benefits, for the market in general as well as for many companies.

RecessionAlert: Solid Quantitative Indicators for Economic and Market Analysis

Doug Short and Jill Mislinski: Regular update of a range of indicators. Great graphics and analysis.

Georg Vrba: Business cycle indicator and market timing tools. The latest update to Georg's business cycle index does not point to a recession.

Guest sources

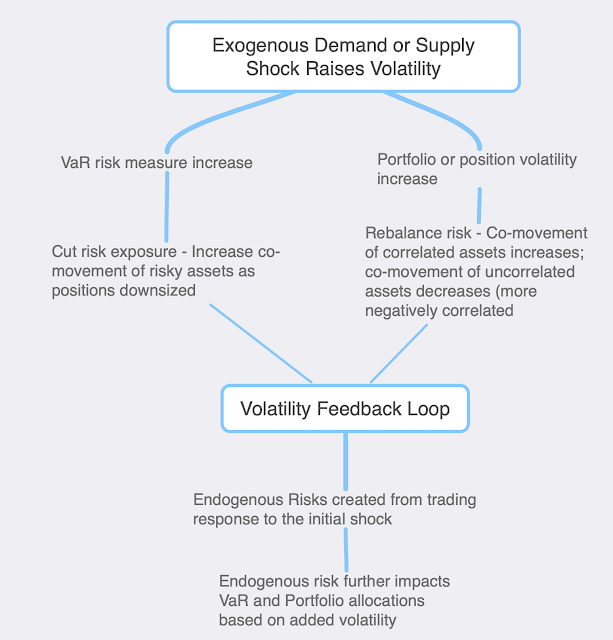

Mark Rzepczynski explains why the exogenous shocks on supply and demand are at the origin of the recent rise in volatility. This chart shows why normal rebalancing procedures for many companies provide feedback on volatility.

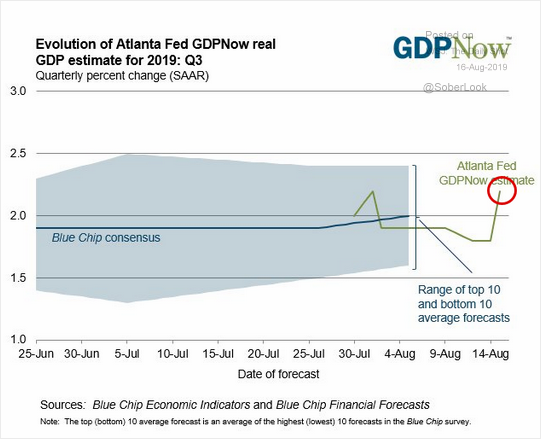

The estimate of the Fed's GDP in Atlanta is well outside the recession range.

Overview for traders

Our weekly Stock Exchange series is for traders. I'm trying to separate this from the usual investor advice in WTWA. There is often something interesting for investors, but keep in mind that the transactions described are certainly not suitable for everyone.

This week's edition explains how traders react to high sales. As always, we include the advice of top experts and share some of our trading models. Blue Harbinger, our usual series editor, brings together and provides a counterpoint from fundamental analysis.

Insight for investors

Investors need to understand and accept volatility. They should join my joy in a well-documented list of problems. As concerns are solved or even resolved, the investor who looks beyond the evidence can collect great money.

Best of the week

If I had to recommend a single article to read absolutely for this week, it would be Nick Maggiulli's. Seduction above the average. It starts with familiar data showing that 80% of active managers do not exceed their benchmarks for periods of three years or more. Then he writes:

However, I want to take the other side of this argument. If 80% of the stock pickers do not exceed their benchmark index net of fees, this implies that 20% of them will exceed their benchmarks.

Now think about it from the point of view of a stock breeder. They are probably intelligent, well educated and have been at the top of the academic hierarchy throughout their lives.

He then explains how easy it is to think that you are above average in a given group. "Being smart does not mean you'll be a good stock picker …" Many smart people convince themselves of the opposite.

His conclusion is excellent.

The only way to be above average as an investor is to invest differently from the masses. That's all. Whether it's a matter of giving up a market capitalization weighted index for individual stocks or diversifying one's assets, you can not invest like the rest of the population and expect yourself to perform better than the mass. To re-imagine a famous quote from Jerry Rice:

Today I am going invest as others not, so tomorrow I can to win what others can not.

For those of us who are looking for above-market returns – certainly me and maybe you – we need to take a smart and disciplined approach. Then, as it is different, we must remain confident when the market is lagging behind the average. (See the examples of small capitalization below for an example).

Stock Ideas

Chuck Carnevale has another great article describing why your stock analysis should focus on strength and not on rate of return. It illustrates the key principles of valuation and earnings growth using four disparate but well-known examples. Take the time to listen to the video lessons.

Blue Harbinger uses sales (down 21%) from Monroe Capital (NASDAQ: MRCC) as a risk and profit discussion platform for business development companies (BDCS). The post does not make an immediate "buy" recommendation – just an expression of interest. This is a great lesson on the BDC investment space. Those who are tempted by this type of investment should look at what just happened as well as what might happen next. Those who own BDCs that are not marketed are simply blind to what could happen.

Cover story of Barron, Wall Street has abandoned oil and gas stocks. You should not, is a complete look at the possibility of a rebound. There are many ideas in various sub-sectors. Those interested in this sector should take a look. Key quote:

Moreover, even in the event of a slowdown in global growth, the demand for oil in the short term is not expected to drop much, if at all. Demand has risen steadily in recent decades, showing resilience even during deep recessions such as the one that accompanied the financial crisis.

Kirk Spano explains the factors that could drive up oil prices.

Double Dividend Stocks suggests that two REITs have held up during recent market declines.

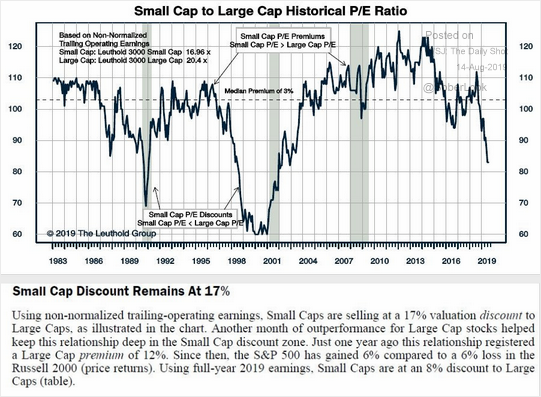

Another argument for small caps: a 17% discount. Please note that these stocks are "out of order" for about four years. Is this a trend or is the long-term median a better indicator?

What about Cisco (CSCO)? Mr. Martins argues that the recent decline is an opportunity.

William Stamm explains why ADP meets its criteria: a dividend aristocrat offering good total return and a reasonable outlook.

Personal finance

Anormal Returns is the essential source for all those who are seriously interested in investing. The Wednesday edition focuses on personal finances and offers many ideas to the individual investor. As always, there are many good links. My favorite this week is White Coat Investor's The property has its privileges. Beginning with the difference between paying interest and collecting interest, he suggests six ways to become an owner. Some points (control of expenses) apply to everyone while others (control of your work) are ideas that many people have not taken into account.

The sixth point focuses on entrepreneurship, which can be rewarding but certainly not for everyone. Make sure you have a life partner that helps you through the inevitable hard times. (Yes, Mrs. OldProf was very good at that.)

Pay attention to…

Bank shares, where the return is not as safe as for utilities. (Barron)

Bonds are expensive, writes Cliff Asness. It uses a clever combination of yield and slope of the curve, analyzes the correlations and produces an analysis that I have never seen before.

REITs as an alternative to shares. Daniel Sotiroff (Morningstar) explains that some are "only slightly different actions".

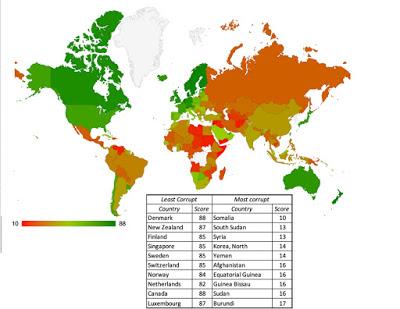

Country risk. The evaluation guru, Aswath Damodoran, takes stock of the main sources of risk: life cycle, political structure (including corruption and violence), legal and economic structure. This information is valuable for anyone considering global investments, including ETFs.

Final thought

Investors should not expect much news from Jackson Hole. If early week hype suggests otherwise, it would be a warning sign.

CNBC announced what investors hoped to get: an indication that "the Fed is at the beginning of a severe rate reduction cycle – or simply intends to cut back several times, which is insurance against a possible slowdown. No other alternative is mentioned.

MarketWatch tells us what they should expect. It is unlikely that the Fed will clearly indicate the way forward for future policy, leaving options open for the next meeting.

As you join me in monitoring the likelihood of recession, here are some themes to keep in mind.

A "false positive" in times of recession, the signal can be expensive. Those who followed a widely circulated signal in 2011 missed years of inventory gains. My plan is to reduce exposure to equities if there are signals confirming early indications. I studied the subject carefully in 2010, finding the best sources and methods. This was crucial to avoid false positives and would help reduce the risks if needed.

Economists are often criticized for a inability to predict recessions. Non-economists with a quantitative bias use the limited data available to create indicators claiming confusing precision. Consider these statements:

- An inverted yield curve preceded each of the last six recessions.

- A low unemployment rate preceded each recession

… Almost all the major lows of the unemployment rate preceded a recession. Just look at recent history; the unemployment rate reached its lowest point and a recession began in 1970, a recession began in the late 1980s, the unemployment rate was again reached in 1999 and the dot.com bubble exploded in 2007 / 2008 and the recession has begun. (Example here)

The first statement may be true, but avoid all timing and false-positive problems. This is often accompanied by a false claim that stocks are declining "generally" well before a recession.

The second statement may also be true, but it has no predictive value. By definition, recessions begin at the peak of the economic cycle. In an improving economy, you never know if a new peak will be a peak and you certainly can not jump to the first dive of a series. This effort to make good news bad is dangerously misleading

How can you say that difference between beginners and experts?

- A logical and theoretically valid reason for the forecasting method.

- A track record in real time.

- Understand that you can not use hundreds of indicators to explain a few events.

There are many articles filled with compelling charts and convincing survey arguments. This is not a good test.

Economic data almost always give a contrasting picture. Choose sources that see and balance the evidence. Avoid those who make unilateral laundry lists and change the indicators whenever you want.

[SivousêtestroubléparlavolatilitérécentedesmarchéscelapourraitêtreunsignedecontrôleIlpourraitêtrecoûteuxd'agirrapidementVotreportefeuilleatteint-ildessommetssansprécédentC'?EstaussiunavertissementEcrirepourmonpapiergratuit[IfyouaretroubledbyrecentmarketvolatilityitmightbeasignalforacheckupItcouldbeexpensivetoactinhasteIsyourportfoliomakingall-timehighs?ThatisalsoawarningWriteformyfreepaper[SivousêtestroubléparlavolatilitérécentedesmarchéscelapourraitêtreunsignedecontrôleIlpourraitêtrecoûteuxd'agirrapidementVotreportefeuilleatteint-ildessommetssansprécédent?C'estaussiunavertissementEcrirepourmonpapiergratuit[IfyouaretroubledbyrecentmarketvolatilityitmightbeasignalforacheckupItcouldbeexpensivetoactinhasteIsyourportfoliomakingall-timehighs?ThatisalsoawarningWriteformyfreepaperHighs of the market. You will get ideas on replacing overvalued stocks with those with great potential. We also have some places for portfolio consultations – free and no obligation. Just send an inquiry by e-mail to info at inclineia dot com].

Some other elements on my radar

I am more worried about:

- Iranian confrontations. Drones and seizures of tankers today, and tomorrow? Direct engagement increases the chances of an incident generating conflict. (BBC)

- A new arms race. Evidence of new delivery systems and Russian tests evokes memories of bad weather (expensive). (NYT)

I'm less worried about

- The Treasury "floods the debt market" (MarketWatch). Demand is plentiful and a judicious adjustment of the debt would increase the slope of the yield curve at a time when long-term rates are attractive.

Disclosure: Je / nous n’avons / nous n’avons aucune position dans les actions mentionnées, et nous n’envisageons pas d’initier de position dans les prochaines 72 heures. I have written this article myself and it expresses my own opinions. Je ne reçois pas de compensation pour cela. I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link