[ad_1]

We have an important schedule with news on employment and housing. Some important market issues have been avoided, at least for a while. What is behind the rebound of stocks. Trying to explain the reasons for new market perceptions is a wonderful subject for the experts! Everyone can play because no title or expertise is required. Everyone can have an opinion. There is no way to determine who is right. I'm waiting for many to ask:

What assumptions are embedded in current market prices?

Recap of last week

In my last edition of the WTWA (two weeks ago), I wondered if those who had deduced an economic disaster from the decline of the stock in December now had a different point of view. It was a good guess. The daily commentary, while containing tales of recession, took note of the new mood of the market. To the next concern!

The story in a graph

I always start my personal assessment of the week by consulting a good graph. This week, I'm presenting Jill Mislinski. It includes a lot of relevant information in a single photo, worth more than a thousand words. Read the full post for more great graphics and background analysis.

There was a lot of news last week, but the shares rose only 0.4% and the trading range was only 1.4%. You can see volatility comparisons in our Quant Corner (below).

Remarkable

Generation Z enters the labor market. The visual capitalist has his usual complete infographic, which you can appreciate only by seeing it in its entirety. Here is a very small part.

The news

Every week, I break down the events into good and bad. For our purposes, "good" has two components. The news must be market-friendly and better than expected. I avoid using my personal preferences to evaluate the news – and you should too!

Where relevant, I include expectations (E) and prior readings (P).

The high frequency indicators of the New Deal Democrat are an important part of our regular research. This week's update indicates that short-term indicators remain negative while long-term and coincident indicators remain neutral. It will take another week before all the effects on data from the closure of the government disappear.

Good

- Testimony of Powell does not bring much fresh news but seems to satisfy the markets. Tim Duy analyzes the data before the testimony and concludes that the patience of the Fed is justified.

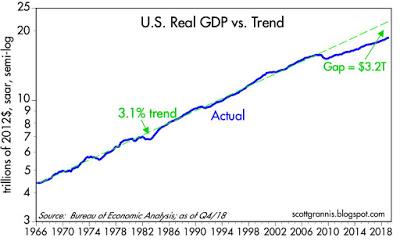

- Q419 GDP recorded 2.6% exceeding expectations by 2.3%. Eddy Elfenbein examines trends in growth in recent decades, with results that would surprise many. See Scott Grannis, who points out that the economy barely reaches the overall trend growth rate.

- Building permit 1326K (SAAR) exceeded the expectations of 1285K.

- Consumer confidence of the Conference Board reached 131.4 points against 125.0 and 121.7.

- Personal income rose 1.0% in December, exceeding estimates and the previous reading, both by 0.3%. Jill Mislinski examines real disposable income per capita, a measure that is arguably more significant.

- Basic ECP 0.2% was above the expected 0.1%, but remains within the range desired by the Fed.

The bad

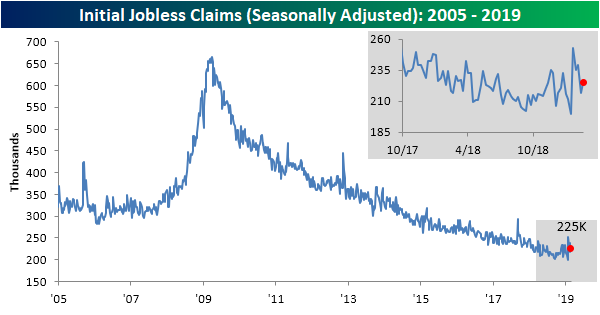

- Initial jobless claims increased at 225K, slightly worse than expected of 221K and the previous one of 217K. New Deal Democrat has alert levels for requests that have not yet been triggered.

- Personal expenses down 0.5%, worse than expected for a drop of 0.2% and much more unfavorable than the gain of 0.6% recorded in November.

- ISM Manufacturing It missed 54.2 expectations on 56.0 and 56.6 in January. Get details and colors on the ISM website. Their research concludes that this reading, if annualized, corresponds to real GDP growth of 3.3%. In other words, it is slightly above the long-term trend.

- University of Michigan feeling has decreased at 93.8 below expectations of 95.6.

- Rail traffic remains in contraction for economically intuitive sectors. (Steven Hansen, GEI)

The ugly one

Denuclearization denied by North Korea.

The week ahead

We would all like to know the direction of the market in advance. Good luck with that! Second, plan what to look for and how to respond.

The calendar

We have a big economic calendar focusing on data on employment and housing. The ISM non-manufacturing index is important and some will try to find meaning in the Fed Beige book.

News on trade negotiations between the United States and China will remain the most important.

Briefing.com has a good US economic calendar for the week. Here are the main American versions.

Theme of the next week

After the events of the past three months, many are wondering about two different issues:

- What is the most likely outcome for several key questions?

- What result is expected, and therefore already taken into account in current market prices.

Economists say that these results are "reduced" by what they mean already reflected. This is confusing because the ordinary definition implies that results are ignored. Experts prefer "cooked in", so they will ask:

What is already cooked in current market prices?

It's a wonderful subject because it's important, but it's just a question of opinion. There is no way to know in advance the overall decision of millions of market participants. Here are some key elements to challenge, including my conjectures about the prevailing market belief. My personal conclusions follow each point in italics.

- Aging economic cycle with a recession in the future (NEAR). Share prices reached near recession levels in December. The rebound has changed perceptions a bit, but most seem to consider this as temporary.[[[[The belief that the economy and the market are in "late cycle" seems almost universal. Oppenheimer has a paper suggesting that the cycle could last five more years. In fact, nobody really knows. The best we can do is conclude that a recession is unlikely in the next year. In a year, we could well conclude the same thing. We experienced a sharp decline in 2008 and the recovery was slow and gradual.].

- The Fed has reversed the trend and further rate hikes are pending. This could change quickly with signs of economic strength.[[[[The Fed's turnaround, particularly in the balance sheet, has not been as dramatic as it seems to many. The Fed sees a stronger economy, so higher rates will eventually come. This seems unlikely until the yield on the 10-year note has risen, reflecting higher rates in Europe and the anxiety about inflation.].

- The Fed has little ammunition to fight a new recession. [This depends upon when a recession might occur. Fed participants have been emphasizing an array of tools. More importantly, those who harp on this point are not really focused on stock and bond market results over the next year or so].

- The treaty to replace NAFTA will face a democratic opposition and an uncertain future.[[[[This is very important and attracts a lot less attention than it deserves. Negotiations will be underway, but I think they will soon be adopted in the United States.]

- "Medicare for all" is a major threat to any hope of a balanced budget.[[[[This would certainly be a costly program requiring a new source of funding. It has no chance of flying in the next two years and probably will not come to the House. Health insurance stocks have overreacted to this issue, which will be relevant in the 2020 election].

- A trade agreement between the United States and China is expected to be concluded soon.[[[[I'm waiting for an agreement soon, but I do not think that's reflected in current prices.]

I will add a little to my own conclusions in the last thought of today.

Quant Corner

We regularly follow some of the sources presented and the other best news of the week.

Risk analysis

I have a rule for my investment clients. Think first about your risks. Only then should you consider possible rewards. I monitor many quantitative reports and highlights the best methods in this weekly update.

The instant indicator

Short- and long-term technical conditions have returned to the most favorable level. Our fundamentals remained bullish throughout the December decline and rebound.

The sources presented:

Bob Dieli: Analysis of the business cycle via the "C Score.

Brian Gilmartin: All in all benefits, for the market in general as well as for many companies.

RecessionAlert: Solid quantitative indicators for economic and market analysis.

Georg Vrba: Business cycle indicator and market timing tools. BCI does not report a recession.

Doug Short and Jill Mislinski: Regular update of a range of indicators. Great graphics and analysis.

Guest comment

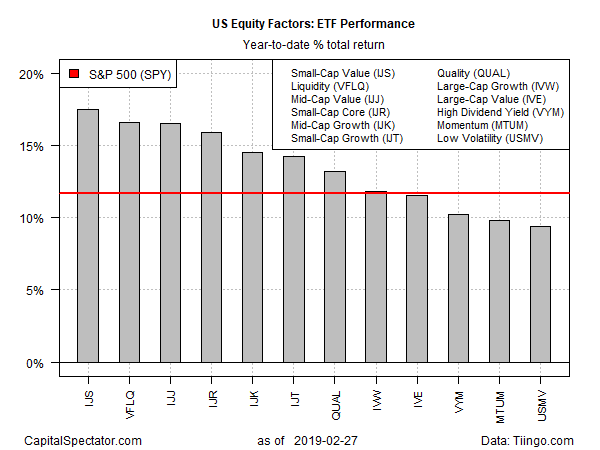

James Picerno has published an interesting article that highlights the strength of the value factor of small-cap companies in cumulative results. The complete analysis is quite interesting and does not attract enough attention.

Overview for traders

Check out our weekly "Stock Exchange". We combine links to important trading publications, news topics and ideas from our trading models. Last week, our business models returned to the market. The conditions have improved but are not yet clear. Please note that there is no bullish or bearish call in the short term. This reflects our research on the environment that offers the best potential for our own trading systems. Sharp "V" bottoms are a challenge for any system, and recent times have set records.

This week we explored the question of timing – momentum in relation to the fundamentals. To that end, we focused on a recent model choice, Realty Income (O). In addition to our discussion of new model ideas, we have published the Oscar and Felix rankings, featuring the Russell 1000. Our usual editor, Blue Harbinger, has taken advantage of it.

Overview for investors

Investors should accept volatility. They should join my joy in a well-documented list of worries. As worries (closure, Fed policy, Fed policy) are resolved or even resolved, the investor who looks beyond the evidence can raise big money.

Best of the week

If I had to recommend a single article to read absolutely for this week, it would be the analysis of Dividend Sensei Best dividend stocks to buy before a commercial deal. The article provides a complete description of the methods, with solid arguments for each. The reader can also see the key sources used by the author. There are many action ideas, including popular key categories:

- High yield (yield over 4%)

- Rapid growth of the dividend

- Dividend Aristocrats

- Kings Dividend

- My shopping list on the bear market

This is a timely and informative article, loaded with good ideas.

Stock Ideas

Interested in energy?

Chuck Carnevale discovers 16 dividend income opportunities in the energy minerals sector.

Kirk Spano points out "a dozen dirty oil stocks for 2019." Many will find the list of major Permian oil producers particularly interesting.

Andrew Hecht examines trends in natural gas and analyzes Encana's rebound (ECA).

How about Hawaiian Airlines (HA)? Two very different methods provide contrasting answers.

Perhaps, given the 30% drop recorded in the last six months (D.M. Martins).

Yes, says Peter F. Way.

Do you think about biotechnology?

Join me to follow the cover of these stocks by Bhavneesh Sharma. His article on Alector (ALEC), a company fighting neuroinflammation in neurogenerative diseases, is a good example of his work.

Andrew Bary (Barron's) loves Celgene (CELG) even in the face of opposition to the Bristol-Myers deal (NYSE: BMY). [Jeff – I do too.]

Big Pharma "goes into gene therapy," says Barron's. The story covers the main companies involved and includes this explanatory chart.

Marc Gerstein is looking for over-sold securities in a market that has already recovered.

Personal finance

Seeking Alpha The editor-in-chief of daily editor Gil Weinreich is always both interesting and informative. Each week, it highlights interesting stories for advisors and investors. This week, I particularly liked his post on the poor American ranking of the health in general, n ° 35 on 169. Spain and Italy came in second position. Read the full post for Gil's analysis, which focuses on the financial implications of poor health. Cuba is the No. 30?

Abnormal returns are an important daily source for all of us after news about investing. I read it every day, finding a lot of good ideas. His theme of Wednesday's personal finance is of particular interest to investors. Among the usual collection of excellent choices, I particularly enjoyed Castlebar's discussion of the simplicity of your finances. Do not confuse "complicated with better". Mia Taylor's discussion of money and marriage is also helpful.

Special retirement tips for single women. (Barron's).

Pay attention to…

Wendy's (WEN). Good performance but lack of catalysts concludes D.M. Research Martins.

IBM versus Microsoft (MSFT). Dividend Sensei sees a clear winner.

Final thought

I've put a special emphasis on investment ideas this week. My indicators identify it as a good time to increase its allocation to well-chosen actions. This is especially true in some key undervalued sectors such as non-FAANG technology, financial services, biotechnology and cyclical sectors. David Templeton (HORAN) describes the recent improvement of cyclical values over defensive names. If this is a sign of a stronger economy, it is a good trend to play.

The potential resolution of trade wars would also be a major positive element on major revenue fronts, extending the business cycle and mitigating global growth issues.

N.B. This makes do not require a result that resolves every point of contention – just one that stops the pain. Andrew Hecht notes that "a trade agreement will ignite the global economy". One of the candidates is American steel (X), which has been hit by tariff measures and retaliatory measures.

There are many other companies that are ready for a big rebound.

Trade problems remain the most important weight on current share prices.

[If you need help analyzing the economic effects of trade policy and the best stocks for a rebound, send us an email to main at newarc dot com. We can also discuss your personal risk-control needs, or our popular yield-enhancement program.]

I am more worried about:

- The India-Pakistan conflict.

- North Korea

I'm less worried about

Disclosure: I am / we have been CELG for a long time. I have written this article myself and it expresses my own opinions. I do not get compensation for that. I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link