[ad_1]

Wells fargo (WFC) – Get the report was one of three big banks to kick off the earnings season on Friday, joining JPMorgan Chase (JPM) – Get the report and Citigroup (VS) – Get the report.

Down 6% on the day so far, Wells Fargo is the worst performing of the bunch.

Considering the rally we saw as the event approached, it is no surprise to see these bank stocks sell off. Even with the decline, they are still rising over the past few weeks and months.

Wells Fargo’s earnings of 64 cents a share beat analysts’ estimates by 58 cents. However, revenues fell short of consensus expectations.

So far, stocks are bouncing off midday trading lows. Can Wells Fargo Recover More Losses or Should Investors Expect More Fall?

JPMorgan and Wells Fargo are interests in Jim Cramer Action Alerts PLUS Members Club. Want to be alerted before Jim Cramer buys or sells JPM or WFC? Find out more now.

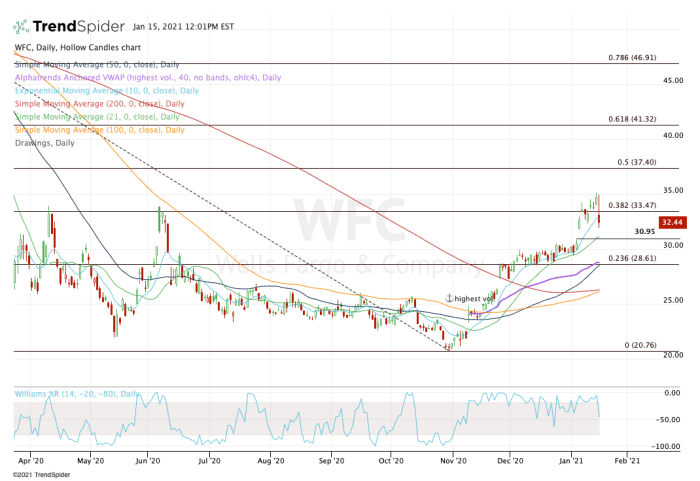

Wells Fargo Trading

At one point, stocks fell more than 8%, before the bulls began to step in and push Wells Fargo stock higher.

This action could push stocks above the 10-day moving average, which would be relatively healthy price action and show investor commitment to the bank.

We will use this observation to assess the Wells Fargo inventory.

If it recovers the 10-day moving average, let’s see if stocks can climb back above the $ 33.50 resistance bar and 38.2% retracement. If possible, the recent high near $ 35 is on the table, followed by a possible move to the 50% retracement near $ 37.50.

The downside has a few areas of interest. Like the 10-day moving average, we’ll use these areas to gauge investor interest in the stock.

In other words, if Wells Fargo stock cannot retrieve the 10-day moving average, traders should be open to the possibility of stocks closing the gap starting Jan. 6 near $ 31 and testing the 21-day moving average.

If that doesn’t hold up as support, then the $ 28 to $ 29 area is on the table.

In this area, Wells Fargo stock finds a plethora of potential support, including the 50-day moving average, a VWAP measure, the 23.6% retracement and a retest of the December breakout level.

Finally, if Wells Fargo is really feeling the selling pressure, 100 and 200 day moving averages could be a possible landing point. Currently, those measures are just under $ 26.50.

[ad_2]

Source link