[ad_1]

05/05/2019

HOUSTON – Occidental Petroleum Corporation announced that, as part of its bid to acquire Anadarko Petroleum Corporation, it has entered into a binding agreement to sell Anadarko's assets in Algeria, Ghana, Mozambique and South Africa. South for $ 8.8 billion. The sale is subject to Western's conclusion of its proposal to acquire Anadarko and should be entered into simultaneously or as soon as reasonably possible thereafter.

This type of sale is exactly what Oil of the world, in his recent analysis of the Anadarko situation, could occur. Click on right here to read the analysis, pre-Warren Buffett.

Assets for sale to Total represent approximately 6% of expected net production and approximately 7% of cash flow after Occidental's 2020 pro forma capital expenditures on the acquisition of Anadarko.

Proceeds from the sale of these high-quality, non-strategic assets cover a portion of the cash consideration intended to finance the proposed Anadarko acquisition. The sale accelerates the divestment plan previously described by Occidental, making most of the $ 10 billion to $ 15 billion in planned asset sales. This also reduces the overall requirements of integration of the acquisition. After taking into account the sale of this asset, Occidental continues to expect annual cost synergies of $ 2.0 billion and annual capital reductions of $ 1.5 billion from the proposed acquisition. Anadarko.

"We are delighted to have reached this agreement with Total. The value of $ 8.8 billion to be received for Africa represents an attractive value based on our in-depth evaluation of the last 18 months. Given our long history of productive collaboration, we are confident that we can achieve this sale quickly and efficiently, "said Vicki Hollub, President and CEO of Occidental. "Total has extensive experience working in Africa and is well positioned to maximize the value of these assets."

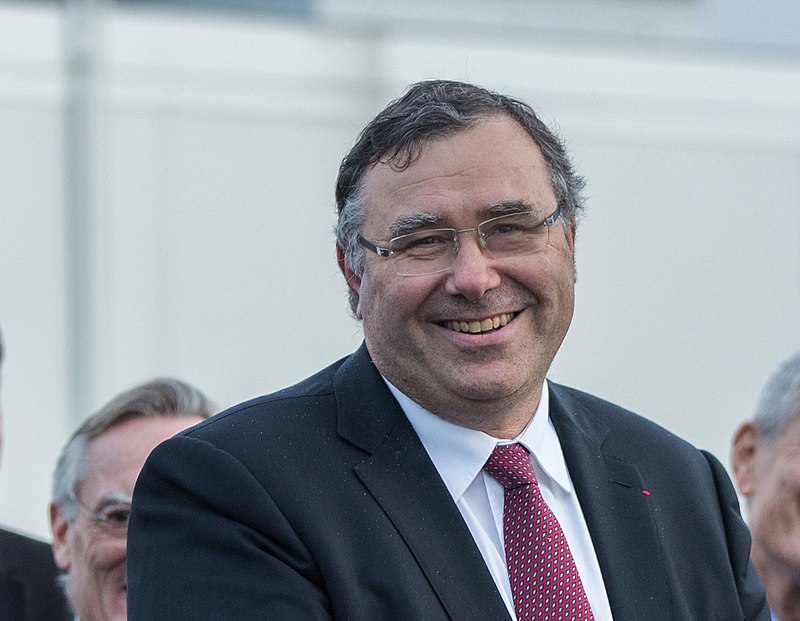

"These are world-class assets with significant development potential. We welcome this opportunity to leverage our expertise in LNG and deepwater developments as well as our long-standing experience in Africa, "said Patrick Pouyanné, chairman of Total's board of directors. "We have been working successfully with Occidental for many years and are committed to completing this transaction smoothly."

[ad_2]

Source link