[ad_1]

When this big change takes place at the White House this Wednesday, inauguration day, what will it mean for other American homes – and the mortgage rates used to fund them?

As the country entered 2020, 30-year fixed rate home loans averaged 3.72%. Since then, mortgage rates have hit historic lows more than a dozen times and ended last year at an insanely low average of 2.67%, according to mortgage giant Freddie Mac.

A drop this big can mean big savings on a loan as huge as a mortgage.

30-year mortgage rates fell again in early January, reaching a record 2.65% on average, although they recently climbed higher.

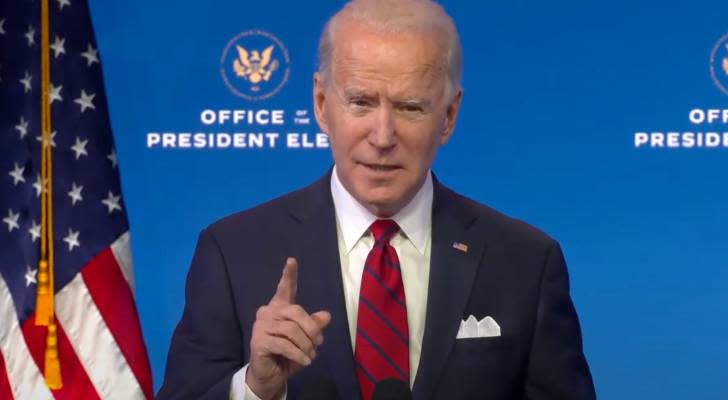

Prospective buyers and homeowners who still need to refinance to lower rates are looking for clues to the direction of mortgage rates once Joe Biden takes over as president.

Here’s what forecasters are forecasting.

Why rates could rise under Biden

Don’t expect mortgage rates to move when Biden is sworn in, but his administration could potentially affect their direction.

“Expect tax rates to rise, the Fed to offset rising inflation with higher rates, and the economy to slow,” Guy Baker, founder of Wealth Teams Alliance, told The Mortgage Reports.

And there is this, from Rick Sharga, executive vice president of RealtyTrac: “Biden called for more government investment in affordable housing, which could be funded in part by the proceeds of the supported house sale fees. by government agencies like Fannie Mae, Freddie Mac and the FHA. “

Baker, Sharga and other experts interviewed by The Mortgage Reports in October predicted that 30-year rates would climb to 3.51% on average in 2021 under Biden.

Why tariffs may not do much this year

Other forecasts predict only modest increases this year. Just last week, Freddie Mac predicted that 30-year fixed mortgage rates would average only 2.9% in 2021, and Fannie Mae – another government-sponsored mortgage company like Freddie Mac – a said rates would average just 2.8% by the end of this year.

Yet the past few weeks have brought more warnings of the potential for rate hikes, after two U.S. Senate runoff elections in Georgia gave Biden Democratic majorities in both houses of Congress. It could mean more public spending – and loan, which would put pressure on interest rates.

But presidents have only limited influence over mortgage rates. Keep in mind that the Federal Reserve still plans to maintain a key interest rate close to zero until at least 2024, and the pandemic will continue to have an impact.

If the COVID crisis continues to look dire, investors could withdraw money from stocks and put it into Treasuries as a safe haven. This would lower the yields (interest) on Treasury bills and mortgage rates generally follow the same path.

How to get low rates in 2021

Even so, if rates rise under the new president, borrowers will have to use some not-so-secret methods to sniff out the cheapest mortgages possible.

First of all, you will want to make sure that your credit score is in tip top shape, otherwise you will never be offered a very low rate.

Then you need to shop around for the best mortgage rates as they can vary from lender to lender. A study by Freddie Mac found that borrowers can save thousands of dollars by comparing five or more quotes, instead of saying yes to the very first offer.

If rates start to take off, a home buyer or refinancer could offset the rising costs of borrowing by saving money on home insurance. With a little comparison, you could potentially reduce the annual price of your blanket by hundreds of dollars.

[ad_2]

Source link