[ad_1]

Oil prices retreated to start the week following a new series of tariffs imposed by Trump on Chinese products, another contraction of the impact on the Chinese manufacturing PMI and the increase in production OPEC in August. Prices fell however Wednesday morning, WTI recording an increase of over 4% due to positive economic activity in the service sector in China

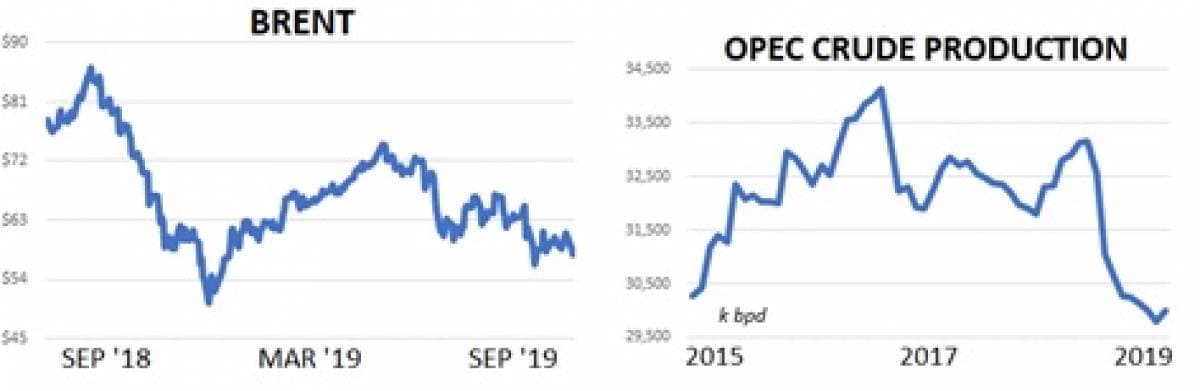

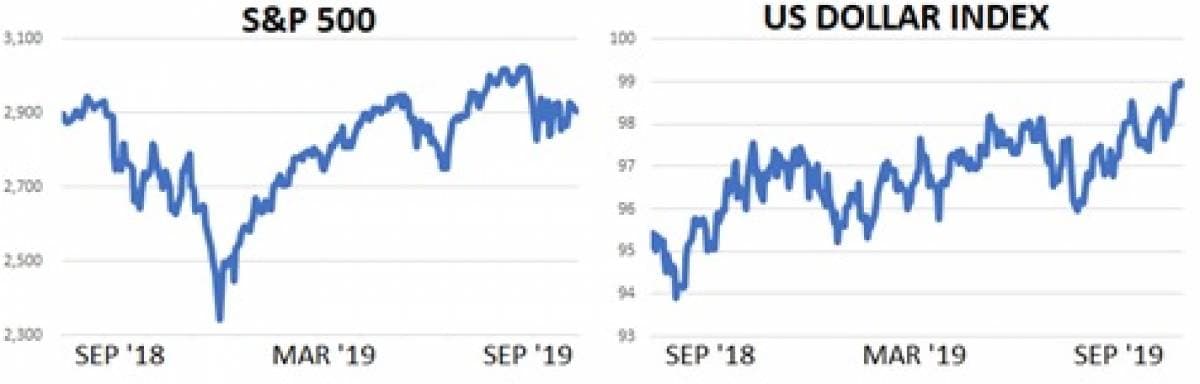

The bargaining week began with a thud when Asian markets opened Monday morning after President Trump announced a further 15% increase in his tariffs on Chinese goods of limited value. about 110 billion dollars. Brent fell below $ 59 while WTI was just south of $ 55. The S & P 500 index fell to 2,900, before flattening about 4% below its July record. Traders are still eagerly awaiting a new round of tariffs in mid-December, as trade officials in the United States and China do not seem to be able to agree at the table. negotiations. On the American side, it was revealed to the White House that the conversations with Beijing Trump on Twitter took place about last week. At the same time, Chinese state newspapers continued to ask Washington to change their stance without hinting that they were ready to meet Washington in the middle.

The Chinese manufacturing PMI recorded 49.5% for the month of August in its sixth contraction territory in the first eight months of the year. Asian stock markets were reassured by a better rating from Caixin's PMI and news from policymakers that new stimulus is under way, but crude oil and US stocks have been hit hard by another data point that breeds fear, amplified by a shrinking territory print in the US ISM manufacturing only two days later.

Bloomberg estimates that OPEC production increased by 200,000 bpd in August, while Reuters reported that more Iranian oil and refined products could hit the market than previously thought. Total cartel production for the month of August was estimated at 29 990 million barrels per day in August, an increase of 195 000 barrels per day. This is the first time since the cartel has reaffirmed its commitment to reduce supplies. Saudi Arabia and Nigeria were both responsible for the overall leap with respective increases of 50,000 bpd and 160,000 bpd. To make matters worse, Reuters quoted an FGE study suggesting that Iran still sells about $ 500 million worth of petroleum products a day and that their crude oil exports are only 80%, instead of > 95% commonly accepted.

The new bear this week did not worry us excessively. We have no doubt that the rest of 2019 will include ups and downs in trade negotiations, economic data and fundamentals. While China is replacing US agricultural products with European and South American competitors and US buyers are moving away from Chinese manufacturers, we are concerned about the potential market response to a trade agreement between China and the United States. United States. As the two sides fail to reach an agreement and their two economies weaken, would a trade deal magically ignite the economic fire? We are not so sure. It may be that if both parties take too long, companies will simply have to stop trading between themselves and this will hurt the health of the global economy. We have written at length on the idea that the stimulus measures adopted by central banks may actually cause a feeling of attractiveness, because they confirm that the economy is sick and in need of help. Could a trade agreement lead to the same kind of dilemma? The longer the United States and China raise tariffs instead of negotiating, the better the chances that a trade agreement will not give much weight in terms of economic growth.

Quick shots

– Brent crude has traded near the $ 58 mark this week against a loss of $ 20 over the last twelve months. We believe that the 26% drop in crude prices over this period gives us a good idea of the combination of macro-economic tensions and tensions between the United States and China currently perceived by operators.

– According to Bloomberg estimates, OPEC crude oil production for the month of August is the first increase in cartel production in 2019. Saudi Arabia (+ 50,000 b / d) and Nigeria ( + 160,000 b / d) contributed to an overall increase in production of 200,000 b / d.

– Regarding equities, the S & P 500 index is exactly stable over the last twelve months, while the Shanghai Composite index is up 7%. In Japan, the Nikkei is down 3% since last September and in Europe, the Euro Stoxx 50 is up about 1%.

– Crude oil options markets are warming as traders find that the downside risk continues. The CBOE / NYMEX WTI volatility index is trading at close to 35%, up 5% from last month. Equity markets send similar signals with the VIX nearly 20% after only 12.5% at the end of July.

– With macro-economic issues, the Fed Fund Futures imply almost completely the likelihood that the Fed will vote in favor of a 25-basis-point rate cut at its September 17-18 meeting. Meanwhile, the US dollar index is putting understated pressure on crude oil, reaching its highest level in 2.5 years.

– President Trump has been trying to convince China to reach an agreement this week by tweeting that his proposals would become much more demanding when he was re-elected in 2020. Officials on both sides still do not have the ## 147 ## Formal intention to meet again.

– Saudi Arabia has withdrawn its position of Saudi Aramco chairman of its energy minister, Khalid Al-Falih, to end conflicts of interest as the kingdom prepares for its next IPO.

– Iran's leaders said on Monday that they would take further steps to enrich uranium if the other JCPOA members were not able to obtain from the country an easing of the current sanctions imposed by the United States.

– Boris Johnson suffered heavy losses in Parliament this week after the rejection of his Brexit proposal. The House of Commons voted 328-301 in favor of an extra step forward of three months after the Brexit process after Johnson promised to reach an agreement in October.

DOE Wrap Up

– US crude oil inventories fell by about 10 million barrels last week to 428 million barrels, due to a sharp decline in imports and increased exports. US crude inventories averaged 436 million barrels in the last four weeks, an increase of 7% year-over-year.

– To be precise, traders shipped 5.9 million bpd of crude oil to the United States last week and exported 3.0 million bpd for net imports of only 2.9 bpd. By comparison, the United States has recorded net imports of 4.3 million bpd to date in 2019 and 5.9 million bpd in 2018.

– The United States currently has 24.4 days of crude oil supply. The number of days of supply is 8% higher in one year.

– Much has been written in recent months about the poor financial situation of the fracking industry in the United States and not without reason. Last week, however, producers made their biggest effort so far, with 12.5 million barrels a day. Oil production in the United States has averaged 12.0 million barrels per day in 2019 and has rebounded sharply since its last hurricane decline in July.

– On a more optimistic note, the new infrastructure has allowed the Cushing Business Hub to continue to weaken. Crude stocks in the center fell 2 million barrels last week to 40.4 million barrels, down 12 million barrels last month and its lowest overall rating since December.

– The activity of US refiners recorded a bearish decline from around 300,000 b / d to 17.4 M / d last week. Refinery demand averaged 17.55 million barrels a day over the past month, down $ 200 billion a year.

– Gasoline inventories in the United States have dropped from about 2 million barrels last week to 232 million and have averaged 233.75 million bpd in the last four weeks. , which represents an annual increase of about 0.7%.

– US stocks of distillates also fell by about 2 million barrels last week to 136 million barrels. Distillate inventories increased 6% year-over-year and we continue to view this as evidence of a possible slowdown in the US agricultural market.

[ad_2]

Source link