[ad_1]

Financial markets have seen a dramatic turnaround in the past 18 months or so since the world’s central banks sent in the cavalry, with US stocks reaching sky-high and companies posting record profits.

The big question as this fall approaches is whether the markets can stand on their own feet once the Federal Reserve begins to scale back its pandemic firepower.

For its part, the European Central Bank this week announced its intention to recall some of its pandemic monetary support to financial markets, raising expectations that the Fed will soon follow in its footsteps.

While ECB President Christine Lagarde said the pullout did not amount to a “smack” but rather a simple recalibration of stimulus efforts, the move was still seen as an important step.

Read: “The lady is not decreasing,” says Lagarde as the ECB slows down asset purchases

When the pandemic hit the global economy in 2020, central banks embarked on large-scale asset purchases and pledged to keep interest rates at historically low levels to help heal their economies and to keep credit in circulation during the COVID crisis.

“The ECB threw in the gauntlet,” Phil Orlando, chief stock market strategist at Federated Hermes, said in a telephone interview. “We expect a Fed cut announcement this year.”

“To reduce it, we suggest it will take place on November 3, which is the conclusion of the two-day Fed meeting in November.”

He also expects a rapid reduction process that ends by June 2022, followed by a 75 basis point hike in the Fed’s benchmark interest rate by the end of 2023, from the current range of 0% to 0.25%.

Vaccines, jobs, free markets

Fed Chairman Powell has often linked the pace of the U.S. economic recovery and levels of central bank support to coronavirus, vaccinations and labor market conditions.

As a result, Federated Hermes’ Orlando does not expect any decision on reducing the Fed’s $ 120 billion in monthly asset purchases at the central bank policy meeting on September 21-22. “The reason is that the August jobs report was terrible. He missed half a million jobs compared to consensus, ”he said.

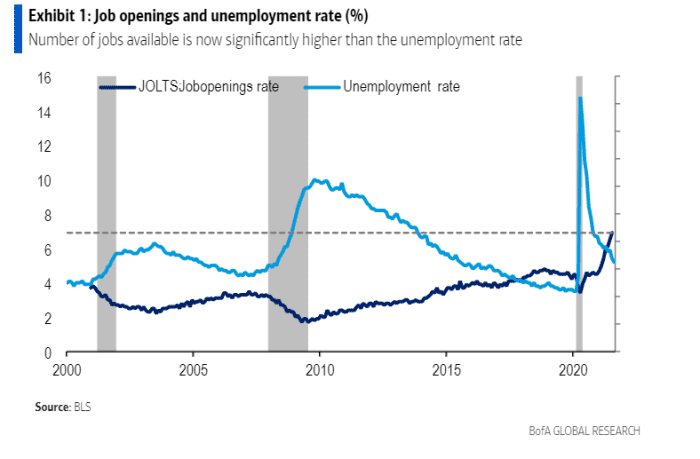

Labor market conditions are expected to improve over the next few months, given the expiration of the extra $ 300 per week in unemployment benefits and record job openings.

BofA Global summed up “perhaps the most underrated labor market statistic” in this graph from Friday, showing how job postings are now overtaking people who see work.

Job offers overtake applicants

BofA Global, BLS

“The Fed cites labor market statistics as a reason to delay the cut,” wrote Ethan Harris and BofA’s global rates and currencies research team. “We do not agree.”

“If demand is hot, their job is to lean against it, whether it manifests itself in an increase in the wage bill or in excess demand for labor.”

The recent rise in the US stock market came as the United States faces its highest number of daily deaths from COVID in six months, with nearly a quarter of the US population still refusing to be vaccinated despite a widespread availability in America.

In a renewed effort to stop the COVID toll, President Joe Biden in a speech at the White House on Thursday unveiled a 6-part plan to defeat “the unvaccinated pandemic,” which has filled emergency rooms with hospitals and left others without access to medical care.

Hard time

While the navigation has gone well for investors this year, with the S&P 500 Index up nearly 19%, a bad patch is likely ahead.

The Dow Jones Industrial Average DJIA,

lost 2.2% for the week, while the S&P 500 SPX index ended the week down 1.7%, recording the ugliest weekly declines since June 18. The Nasdaq COMP composite index fell 1.6%.

With stock valuations at “historically extreme” levels, a Deutsche Bank analyst on Friday said the risk of a “hard” correction was increasing.

Additionally, there could be multiple waves of the delta variant of the coronavirus and the threat of other strains to follow, but also the potential for a significant leadership change when President Powell’s term expires in January.

Since August, Orlando has been bracing for a 5-10% pullback in stocks through October, which hasn’t happened since November 2020 and could push the S&P 500 below its 200-day moving average. ‘around 4,000. However, after that, he expects the index to surpass 4,800 by the end of the year, with a forecast of 5,300 for 2022.

Debt test

Another test of U.S. financial conditions unfolded in real time for borrowers in the nearly $ 11 trillion corporate bond market, where the first part of a funding blitz in September unfolded without hitch.

Labor Day week in the United States broke daily records for the number of top-notch LQD companies,

borrowings on the bond market, mainly in order to obtain cheap financing before any volatility before the end of the year.

“This is really a testament to the resilience of the market in terms of being able to digest this volume of business credit transactions, despite the deluge,” said James Whang, co-head of the fixed income and municipal products group at US Bank.

Spreads in the US market for quality, high yield bonds, or “junk bonds”, have hovered near their all-time lows, even as the Fed sells the rest of its pandemic holdings of corporate bonds.

“I think the concerns about the reduction are a bit over the top,” Whang told MarketWatch. “I don’t think the Fed would do anything to restrain economic growth, while there is still a fair amount of uncertainty around the delta.”

Over the coming week, US economic data will focus on Tuesday’s cost of living reading via the Consumer Price Index and core CPI for August. Then it’s more jobs data on Thursday, while Friday brings the University of Michigan’s preliminary consumer confidence index for September.

[ad_2]

Source link