[ad_1]

Apple (AAPL) – Get the report had a busy few weeks and her inventory struggled.

The latest version of its flagship device, the iPhone, was unveiled in October.

Then the company released results on October 29, which led to a mixed reaction, with stocks slipping about 6% within two days of the event.

On Tuesday, the company unveiled a new line of Mac computers. It introduced a new Macbook Air, Macbook Pro, and Mac Mini with its own chip – the M1 – as it swivels away from Intel (INTC) – Get the report.

Even with the announcements of new products and a recent earnings report, that doesn’t even include the volatility we’re seeing in the overall market.

That includes post-election ups and downs, a pop-and-flop backlash in indexes due to vaccine news, and a sharp drop in growth stocks.

With all the noise, the Bulls are wondering one thing when it comes to Apple: is it still a buy?

Apple is a stake in Jim Cramer Action Alerts PLUS Members Club. Want to be alerted before Jim Cramer buys or sells AAPL? Find out more now.

Apple Trading

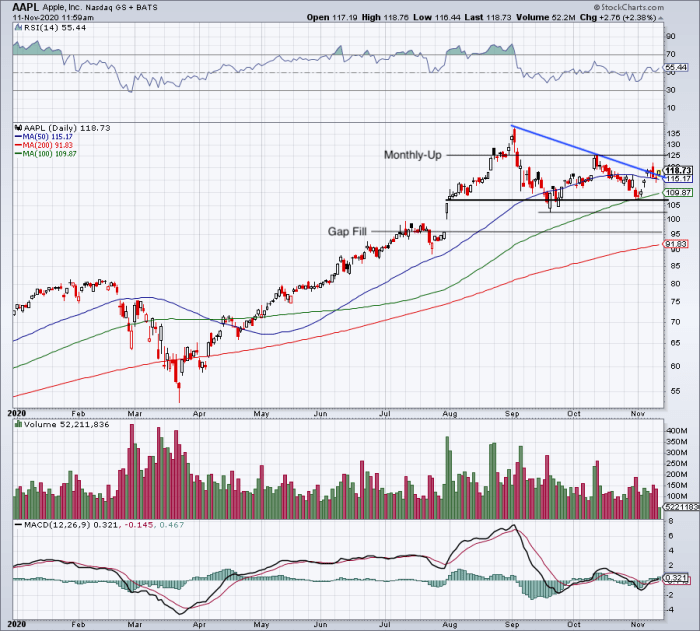

When Apple stock sold in earnings in late October, stocks found support in the $ 107 area from the 100-day moving average.

This makes both of these critical levels to watch out for if stocks should tip again. However, at least for now, that is not the case.

Apple stock recovered the 50-day moving average last week, but struggled against downside resistance (blue line). The fight against downside resistance – from its high in September to its low in October – is similar to what investors were seeing in both the Nasdaq and the S&P 500.

However, Apple and its market cap of $ 2.02 trillion is a monumental name to watch. His failure to break through would likely have had a ripple effect in the market. This may also be true on the upside.

Currently breaking down resistance on Wednesday, the bulls are hoping that now now is the time to buy Apple.

Let’s see if stocks can recover this week’s high at $ 121.99. Above opens the door to the October high, at $ 125.17, which would be an upward monthly rotation. Above that, the all-time high is technically at stake near $ 137.74.

On the downside, a close below Tuesday’s low could be a priority for investors. Not only does this push stocks below this week’s low, but it pulls Apple back below the 50-day moving average and downside resistance.

At a minimum, a close below that mark at $ 114.13 puts the 100-day move back into play, followed by the post-profit low of $ 107.14.

Below that, Apple could continue testing September’s low near $ 102 and par at $ 100. At the moment, a bigger correction doesn’t seem to be on the table, but it is possible if the stock starts to turn lower. In this case, a move below $ 100 could trigger a closing of the gap towards $ 96 and a 200-day moving average test, which would all be healthy in my opinion.

For now, however, the bulls are watching today’s breakout for further upside potential.

[ad_2]

Source link