[ad_1]

Next, French Finance Minister Valéry Giscard d’Estaing, who died this week, spoke with President John Fitzgerald Kennedy in 1962. The stock market looks like the 1960s, says a strategist.

– / Agence France-Presse / Getty Images

The big question hanging over the markets is whether the deployment of coronavirus vaccines will trigger a sufficient response to propel the economy and trigger inflation, and thus give a boost to underprivileged industries such as finance and finance. energy.

Recent market flows suggest that many traders think so – according to Bank of America, a record $ 115 billion was invested in stocks in the past four weeks, including $ 25 billion in emerging market stocks. There has been a record $ 9 billion outflow in the past three weeks from safe haven gold, adds Bank of America.

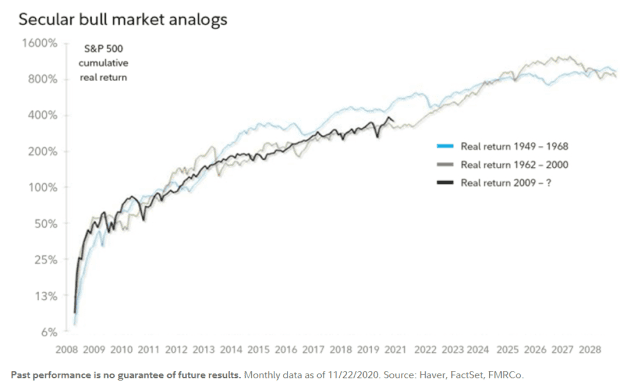

Jurrien Timmer, director of global macroeconomics for the global asset allocation division of Fidelity Investments, recently examined this dilemma. He looked at the inflation-adjusted total return for the S&P 500 SPX,

since 1871.

What is striking is that the stock market after the 2008 global financial crisis closely follows the bull markets between 1949 and 1968, and that between 1982 and 2000. “That’s a sample size of only two, but the analogue suggests that we may have a way to continue, ”he says.

So which of the two eras is most similar to the current phase? Timmer says the parabolic outperformance of large-cap growth stocks brings it closer to the 1949-1968 era.

“An important distinction between the 1960s and the 1990s is that the 1960s produced a secular upturn in inflation, while the 1990s did not see an inflection point. Growth / value trade is likely to depend on a pick-up in inflation from here, ”he adds.

It is not certain that this will happen. If the output gap – that is, economic performance relative to normal – continues to close, Timmer argues that value and small-cap and non-US stocks could outperform growth, large caps and U.S. equities through 2021.

The buzz

Every payroll report is important, but Friday’s release of November’s jobs report is particularly important, as that number has the ability to affect two potential sources of stimulus, Congress and the US Federal Reserve.

This employment relationship itself is fraught with uncertainty. Nationwide economists say 748,000 new jobs were created last month; those at Oxford Economics say 60,000 jobs have been lost. The consensus established by MarketWatch is that the Department of Labor reports 432,000 jobs added and the unemployment rate at 6.8% versus 6.9%.

Talks continue on a US fiscal stimulus and a trade pact between the UK and the EU, so developments on either front could upset markets. An EU official said a trade deal could be reached by the end of the weekend if there were no last-minute problems, according to Reuters.

Pfizer PFE,

will be in the spotlight after The Wall Street Journal, towards the end of Thursday’s session, reported that the vaccine that the U.S. drug maker is making with its German partner BioNTech BNTX,

encountered obstacles in the supply chain. The report was then updated to show that Pfizer lowered its production forecast for 2020 last month.

OLLI, Ollie’s point of sale,

may slip, as the discount retailer said same-store sales grew to single-digit single-digits in its fiscal fourth quarter, compared to 15% growth in the third quarter ending Oct. 31. Its third-quarter profits are well above estimates.

The market

ES00 futures contracts,

NQ00,

were moving higher after a poor finish until Thursday when the Pfizer story was released.

Futures on crude oil CL.1,

also advanced. The 10-year Treasury yield TMUBMUSD10Y,

was 0.93%.

Table

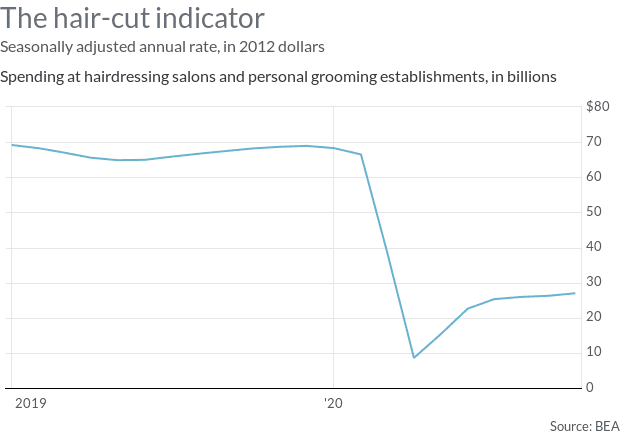

There are few businesses as hard hit as hair salons, as this graph shows. Using data from the Department of Commerce, it shows spending on haircuts is at 41% of pre-pandemic levels. It is as good a barometer as any other as to how normal the economy is or not.

Random readings

Globalization is everywhere – Mexican drug lords have outsourced their money laundering activities to China, where they are cheaper.

Patrons at a Toronto bar appear to have saved a local waterhole by purchasing all of its beer stock.

Time magazine named a teenage inventor their first “Child of the Year.”

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent out at approximately 7:30 a.m. Eastern Time.

[ad_2]

Source link