[ad_1]

An unprecedented pandemic did not prevent the US stock market from ending 2020 on a high note. The S&P 500 ended a very volatile year at an all time high and overall rose 16.3%. At the same time, several stocks in the health sector generated attractive returns for investors. However, this list did not include Gilead Sciences and Biogen.

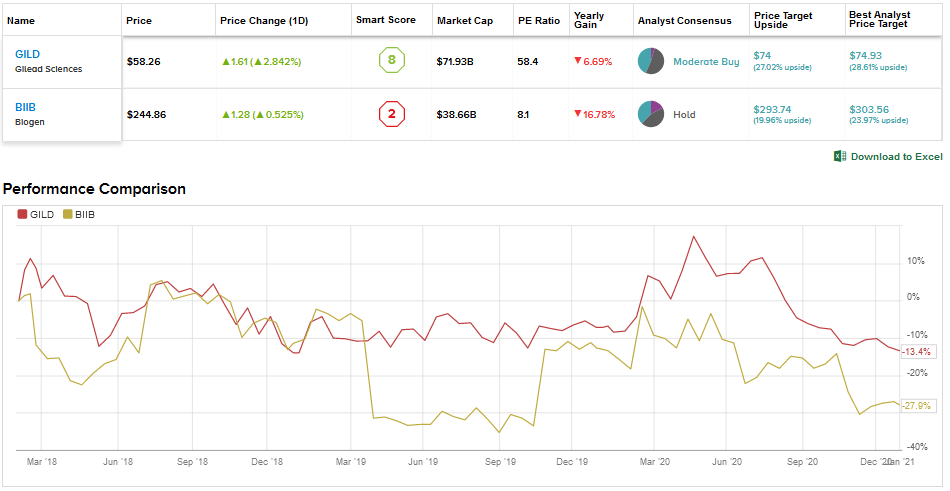

Does Wall Street expect these stocks to recover this year? We used TipRanks’ stock comparison tool to find out if analysts see upside potential in Gilead and Biogen and pick the stock with a better investment opportunity.

Gilead Sciences (BROWN)

Gilead Sciences grabbed the headlines last year when its antiviral drug remdesivir (sold under the brand name Veklury) received emergency use clearance from the U.S. Food and Drug Administration (FDA) in May for the drug. treatment of COVID-19. In October 2020, remdesivir became the first treatment approved by the FDA in the United States for patients with COVID-19.

The company performed better than expected in 3Q mainly due to remdesivir, which generated revenue of $ 873 million and resulted in an increase of over 17% in overall revenue from 3Q to 6 , 6 billion dollars. Gilead’s third-quarter adjusted EPS was up 29% year-over-year to $ 2.11. (See the analysis of the GILD share on TipRanks)

However, the company reduced its revenue forecast for 2020 to a range of $ 23 billion to $ 23.5 billion, from the previous forecast of $ 23 billion to $ 25 billion, and warned that remdesivir’s revenue is subject to a significant volatility and uncertainty. Additionally, its hepatitis C virus (HCV) -related activities continue to be under pressure amid the pandemic.

Gilead has a strong HIV portfolio, including its lead drug, Biktarvy. Sales of anti-HIV products increased 8% to $ 4.5 billion in the third quarter and accounted for 70% of the company’s overall product sales. That said, there are concerns about sales of the anti-HIV drug Truvada due to the loss of exclusivity.

At the same time, the company is strengthening its business through strategic acquisitions in key growth areas such as oncology. Last year, Gilead acquired Immunomedics for $ 21 billion. This acquisition added Trodelvy, an FDA-approved metastatic triple-negative breast cancer treatment, to Gilead’s portfolio. The company also acquired clinical stage immuno-oncology company Forty Seven for $ 4.9 billion in 2020.

More recently, Gilead announced an agreement to acquire German biotech MYR GmbH, which focuses on the development of therapeutics for the treatment of chronic hepatitis delta virus.

Investors were disappointed when Gilead announced in December that it would not pursue FDA approval for filgotinib as a treatment for rheumatoid arthritis in the United States, following a meeting with the regulator. The company has entered into a new agreement with its partner Galapagos, whereby the latter will assume sole responsibility in Europe for filgotinib, where doses of 200 mg and 100 mg are approved for the treatment of moderate to severe rheumatoid arthritis, and in all future indications.

In response to this development, Oppenheimer analyst Hartaj Singh lowered his price target to $ 100 from $ 105. However, the analyst reiterated a buying note on Gilead as he continues to believe in his thesis of “(1) a reliable remdesivir / other drugs against SARS-CoV flare-ups, (2) business base (HIV / Oncology / HCV) growing at low digits over the next two years, (3) operating leverage for greater earnings growth and (4) 3-4% dividend yield . “

Currently, the rest of the street is cautiously bullish, with a moderate buy analyst consensus based on 10 buy, 12 take and 1 sell. The average price target of $ 74 suggests a potential upside of 27% from current levels. Shares fell 10.4% in 2020.

Biogen (BIIB)

2020 has been a difficult year for Biogen, which specializes in the treatment of neurological disorders. The company faced a setback in November when the FDA’s central and peripheral nervous system drug advisory committee voted against the efficacy of aducanumab, an investigational antibody for the treatment of Alzheimer’s disease.

The news led to a massive sell-off of Biogen shares, with investors viewing aducanumab as a potential successful drug for the company. The advisory committee’s recommendations are not binding for FDA review and the company has revealed that the FDA will continue the review process, with a decision on aducanumab approval due by March 7, 2021 ( see BIIB stock market analysis on TipRanks).

To add to investor concerns, Biogen lost a patent litigation with Mylan in June 2020 over its best-selling multiple sclerosis drug, Tecfidera, which exposes it to competition from the generic version of Mylan. Tecfidera revenue fell 15% in the third quarter to $ 953 million, reflecting the impact of several generic entrants in the United States.

Additionally, Biogen’s spinal muscular atrophy drug Spinraza is feeling the impact of Roche’s Evrysdi, with sales of the drug down 10% to $ 495 million in the third quarter. Overall, the company’s third-quarter revenue fell 6.2% to $ 3.4 billion, and adjusted EPS fell 3.6% to $ 8.84. Biogen lowered its full-year revenue outlook to $ 13.2 billion – $ 13.4 billion, from $ 13.8 billion to $ 14.2 billion, assuming “a significant erosion of TECFIDERA ”in the 4th quarter.

Biogen has entered into strategic collaborations to gain access to drugs with promising potential. Recently it announced a $ 1.5 billion agreement (plus potential milestone payments) with Sage Therapeutics to co-develop and sell zuranolone (SAGE-217) for major depressive disorder (MDD), depression postpartum (PPD) and other psychiatric disorders and SAGE-324 for essential tremors and other neurological disorders.

Following the SAGE deal, Oppenheimer analyst Jay Olson reiterated a buy note on Biogen with a price target of $ 300. Olson explained, “Zuranolone is a potential first-class oral therapy for the treatment of MDD and PPD currently in several Ph3 studies. Given our view that zuranolone is an active drug and the considerable market opportunity in private label / PPD, we believe the deal provides BIIB with much needed medium term revenue growth and better positions for BIIB regardless of the result of aducanumab. “

Meanwhile, the streets are sidelined on Biogen with an analyst hold-up consensus based on 11 buys, 13 takes and 5 sells. The average price target is $ 293.74, which implies a possible 20% hike in the coming months. Biogen shares fell 17.5% last year.

Conclusion

After a difficult 2020, street sentiment looks better for Gilead than for Biogen, supported by factors such as the company’s HIV portfolio and the outlook in oncology. Also, unlike Biogen, Gilead pays dividends and has a dividend yield of 4.67%.

To find great ideas for trading stocks at attractive valuations, visit TipRanks Best Stocks to Buy, a newly launched tool that brings together all the information about TipRanks stocks.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment

[ad_2]

Source link