[ad_1]

Bitcoin prices recently hit new highs, and the basic dynamics of tighter supply and increased demand have supported that rise, according to a report compiled by London-based cryptocurrency custodian Copper.co .

Copper argued that the recent price hike was a function of the growing demand for BTCUSD bitcoin,

and the increasing scarcity of the asset which has a maximum supply of 21 million, which is expected to be hit by 2140. The researcher also said that interest in new bitcoins is coming mainly from North America, and the states. -United in particular.

According to CoinMarketCap.com, roughly 18.625 million bitcoins were created or mined digitally in the language of cryptocurrency enthusiasts, but a good deal of it was lost, the folks at Copper wrote.

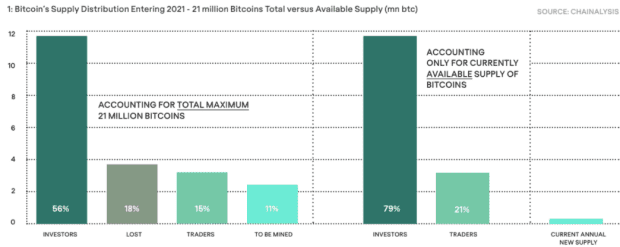

According to their estimates, 56% of bitcoins are held by investors, 18% are lost, 15% are held by so-called traders and the rest have yet to be mined (see attached graphic):

via Copper.co

Copper said that with the majority of investors being long-term owners, representing eight out of 10 cryptocurrency holders, the growing appetite for the world’s most popular digital asset can have a disproportionate effect on values.

The researchers said the rise in bitcoin above $ 40,000 was already in play even before Tesla Inc. TSLA,

made its surprise filing with regulators on Monday, declaring its investment of $ 1.5 billion in bitcoin and its decision to eventually allow customers to buy its products with bitcoin.

“Data shows new investors have pushed prices much higher

last six months of 2020, to acquire north of 2 [million] bitcoins, ”Copper researchers wrote in the study.

“In order to be able to buy bitcoins in such large quantities, the price has recovered

well above the $ 20,000 mark that helped convince early investors

to sell their cryptocurrency above its previous record, ”they said.

The crypto market is dependent on a new supply of some 3.2 million bitcoins on exchanges and held by traders, according to the report.

The study also found that investors who had owned at least 1,000 bitcoins for about three months increased their holdings in 2020 by 173%.

This growing demand, combined with this limited supply, helped push the value of bitcoin to a total market value of around $ 800 billion, and Copper said the main driver of demand was North American buyers who ‘sourced from Asian miners.

“The price increase is the result of a marriage of demand and liquidity-crisis which

occurred at the beginning of 2020 when the outflows of the stock exchanges, i.e.

bitcoins being placed on auto-safekeeping – have increased dramatically, ”the company’s research revealed.

Copper also made an interesting conclusion, noting that nearly a third of bitcoin trading volume occurs during the time when the New York Stock Exchange is open and investors should focus on trading in the DJIA Dow Jones Industrial Average. ,

and the S&P 500 SPX index,

The fact that a large portion of bitcoin trading takes place during trading hours, between 9:30 a.m. and 4:00 p.m. Eastern Time, may explain why movements in the S&P 500 are sometimes seen as correlated with the prices of the bitcoin, wrote Copper.

[ad_2]

Source link