[ad_1]

Ripple (XRP) is on a winning streak at the moment.

Yesterday, the third largest cryptocurrency in the world jumped 12% after Coinbase confirmed XRP list on its Coinbase Pro platform.

An XRP index is now in motion and there is a good chance that it will be listed on the Nasdaq, the world's second largest stock exchange.

Bitcoin and Ethereum indexes are now online on Nasdaq

On February 25, Nasdaq launched on its platform the long-awaited Bitcoin and Ethereum indexes.

The indices, generated by Brave New Coin, aim to provide a stable and accurate spot price for cryptocurrencies. The listing on the Nasdaq represents a huge step forward for the crypto industry and a Wall Street endorsement.

Hidden in yesterday's announcement, Brave New Coin confirmed he was in the "final phase" of launching a Ripple Liquid Index. Nasdaq is already partnering as a partner, so it seems inevitable that the XRP index list will follow.

The Nasdaq list of Bitcoin and Ethereum liquidity indices of the BNC is available https://t.co/d3qei1tqTL

– Brave New Coin (@bravenewcoin) February 26, 2019

A stepping stone for a Bitcoin ETF?

Traders have largely delayed the launch of encryption indexes on the Nasdaq, but this is a huge development.

As CCN had previously pointed out, the approval of encryption indexes could speed up the approval of bitcoin investment products, such as a bitcoin ETF. The Bitcoin and Ethereum liquidity indices (BLX and ELX, respectively) will provide the market with transparency and price stability. As the CEO of Brave New Coin explains:

"There is still a great price disparity between stock exchanges and countries, with differences of up to $ 1,000 at any one time."

Nasdaq indexes will solve this problem by creating a composite price from multiple exchanges. The list will also incorporate Nasdaq's surveillance technology to help identify and eliminate price manipulation.

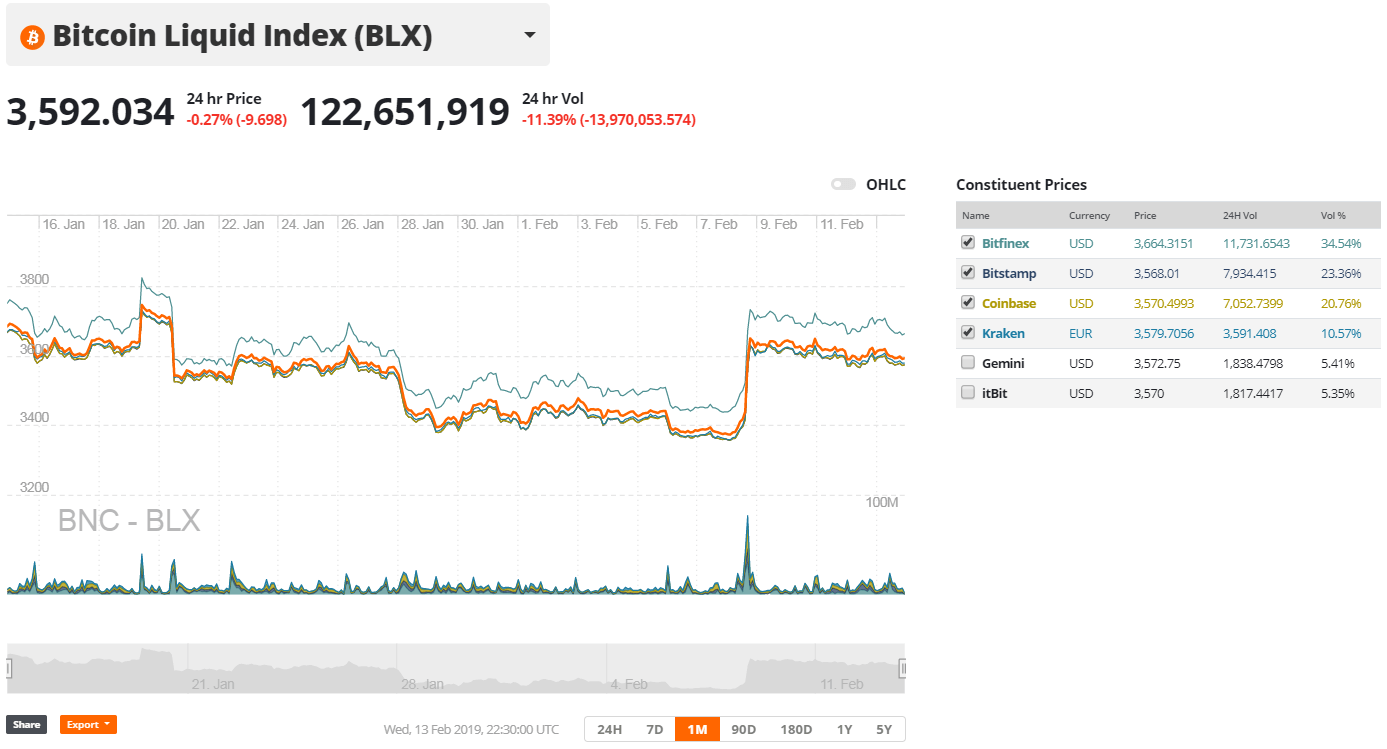

The Bitcoin BLX index offers a stable price compared to the high Bitfinex premium. | Source: Brave New Coin

This will help address the SEC's main concerns with respect to price manipulation and price disparity in crypto. The upcoming ripple index will only increase transparency and confidence in cryptoassets.

A reference price of ripple (XRP)

The Brave New Coin wave index will be launched under the symbol RLX and will take into account multiple exchange rates. At the time of writing, Coinbase Pro was not part of the participating cryptocurrency exchanges, but this could change if liquidity increases.

Like bitcoin and ethereum indexes, RLX will fully comply with the regulations set by the International Organization of Securities Commissions (IOSC). This will further ensure institutional confidence in the indices.

BNC's Liquid Index (LX) indices are both qualitative and quantitative. They take into account the stability and the quality of the constituencies, as well as the volume, the accounting depth, the size of the ticks and other factors coming from the qualified actors of the market, in order to value for the price of Bitcoin and Ethereum , expressed in USD, every 30 seconds. "

A huge week for XRP

Newsflash: Coinbase unveils plans to finally list Ripple (XRP) https://t.co/6MRC9Qq3CU

– CCN.com (@CryptoCoinsNews) February 25, 2019

After years of rumors, Coinbase finally confirmed that the XRP would be made available to traders.

On Monday, Coinbase Pro accepts XRP repositories. When liquidity is sufficient, trading is activated in the United States (excluding New York), Canada, Singapore, the United Kingdom, Australia and other European countries.

The traders reacted positively, raising the price by 12%. After a brief retirement, the XRP is currently trading at $ 0.32, according to the NCC price index.

Featured image of Shutterstock

[ad_2]

Source link