[ad_1]

Fourteen analysts raised their price targets on Friday morning. Two others reiterated their overweight ratings. And I guess I missed a few others.

I understood. Everyone loves Salesforce.com (CRM). And what does not love?

The company has exceeded the $ 0.47 earnings per share estimate that Wall Street was expecting as it posted gains of $ 0.66. Base gains of $ 0.52 still exceeded expectations if we want to go, especially after the company benefited from $ 0.11 in market-to-market investments. Revenues of $ 4 billion exceeded $ 3.95 billion on Wall Street.

I find it ironic that Wall Street celebrates CRM pulling a rope. Do not believe me? Let's go back to Q1. After crushing the estimates last quarter, managing customer relationship management lowered his estimates of second quarter net earnings of $ 0.66 to $ 0.47.

Do these figures seem familiar to you?

Go back and check the second quarter results: CRM reported EPS of $ 0.66 against an estimate of $ 0.47. Thus, the company has beaten its own estimates downwards by indicating a number consistent with the initial estimate. This number also came with a little help, but I keep it away from the subject. Do not worry about the man behind the curtain.

The irony does not stop there. Forecasts for the full year at the end of the first quarter ranged from $ 2.88 to $ 2.90, but the updated EPS estimates range from $ 2.82 to $ 2.84 for the first quarter. year. I bet you think I'll complain too. Well, you would be wrong. What is not discussed with this figure is the quick settlement of Tableau's acquisition and the dilution of $ 15.7 billion. Forecasts for the year are solid. This is the real reason for optimism. The same can be said about Q3. The number of shares for the third quarter will be 15% higher and 8% higher for the full year when calculating diluted net income.

So, if you want to celebrate something, celebrate the advice given all year long. That actually is more between $ 3.045 and $ 3.067, which is about the best quarterly beat that Salesforce has just reported.

In terms of revenues, the company has guided its entire year from $ 16.1 billion – $ 16.25 billion to a new range of $ 16.75 billion to $ 16.9 billion. of dollars. Of the $ 650 million increase, between $ 550 and $ 600 million comes from the acquisition of Tableau. The remaining 50 million we saw were delivered in the second quarter.

My point of view of numbers and tips like this is to get investors to look beyond the headlines. Numbers, title numbers, are easy to manipulate. They cause an instant reaction, create momentum, and can pull an impulse (either bullish or bearish) on price action before we have time to rationalize if strength or weakness really exists.

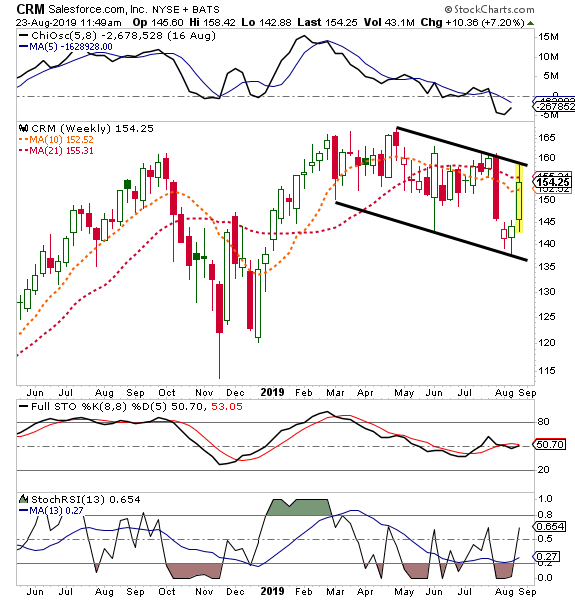

On the technical side, until the CRM releases $ 160, we are stuck in a broad trading range with a target inflow of $ 135 to $ 140 and a profit take of $ 155 to $ 160. I would not look short as long as we would not have less than $ 135, but I would consider a breakout purchase above $ 160. Traders can absolutely play on the range of commercial channels, but at the moment this does not favor the purchase.

Overall, I like buying Tableau as an add-on to CRM. Business is consistent and not going anywhere, but it was not the quarter to make one of the headlines that would make you believe. I will wait until I see 140 dollars or exceed 160 dollars before changing my name.

(Salesforce is a participation in Jim Cramer's Action Alerts PLUS member club.) Do you want to be alerted before Jim Cramer buys or sells CRM? Learn more now.)

Receive an email alert whenever I write an article about Real Money. Click the "+ Follow" button next to my signature for this article.

[ad_2]

Source link