[ad_1]

Despite the expectations of Wall Street analysts for the first quarter, the shares of UnitedHealth (UNH) collapsed after the report. What is the value of the story that is missing to investors? With attractive valuations, opposed to the general desire to avoid health care plans and the actions of pharmacies, investors should again look at UNH's actions.

<img src = "https://static.seekingalpha.com/uploads/2019/4/16/71188-1555438440356372.jpg" alt = "UnitedHealth (NYSE:A H"width =" 635 "height =" 353 "data-width =" 635 "data-height =" 353 "data-og-image-twitter_small_card =" true "data-og-image-twitter_large_card =" true "data- og-image-twitter_image_post = "true" data-og-image-msn = "true" data-og-image-facebook = "true" data-og-image-google_news = "true" data-og-image-google_plus = "true" data-og-image-linkdin = "true" />

First quarter results and 2019 outlook

UNH reported GAAP GAAP of 3.56 USD, with the business turnover up 9.3% to 60.31 billion USD. The $ 500-million turnover clearly shows that the company's prospects are overshadowed by the risks that the government is adopting health insurance for all citizens. Optum and UnitedHealthcare have once again posted solid profits. Net margin improved to 5.7% on operating income of $ 4.8 billion.

UNH has even increased its adjusted EPS for 2019 between US $ 14.50 and US $ 14.75. Net income was $ 13.80 to $ 14.05 per share. Cash flow of $ 3.2 billion is consistent with last year. Management has achieved a return on equity of 26.8% and a dividend payout up 19.1% over the previous year to reach $ 860 million.

Stock drops drastically

The 7.5% week-on-week decline in UnitedHealth and nearly 25% from the 52-week highs set in December 2018 seems irrational. Shares are now trading below sales once, while the forward price / earnings ratio is less than 15 times. However, with the high shareholder returns, UnitedHealthcare's 23% operating profit and strong customer base, markets are unaware of the company's growth potential.

UnitedHealthcare Employer & Individual added 705,000 customers, while UnitedHealthcare Medicare & Retirement added an additional 405,000 in the first quarter compared to the previous year. Even UnitedHealthcare Global has added 30,000 more people a year.

OptumHealth Force

OptumHealth's strong growth in revenue from $ 6.6 billion to $ 6.7 billion is a significant strength. The market effectively uses leading-edge information, data analysis, technologies and clinical information. Its technological implementations will contribute more to the growth of the company's profits for the years to come.

Operating margin of 7.1% is above last year's levels, but below the 9.8% mark at December 31, 2018. Nonetheless, health care, behavioral health and health-related services unit progressed during the quarter. OptumHealth's customer base has grown from 2 million to 93 million people.

Opportunity

OptumInsight's order book grew 14.5% to $ 17.4 billion and positively contributed to the Company's results for the coming quarters. Last year, he acquired the advisory board, which gives the UNH the technological tools needed to progress. This includes artificial intelligence and value-based care. Building a common language against disparate data is the first step. After that, he will apply measures and measures to find models. The artificial intelligence will help the company analyze the information so that the unit can develop predictive information.

Evaluation

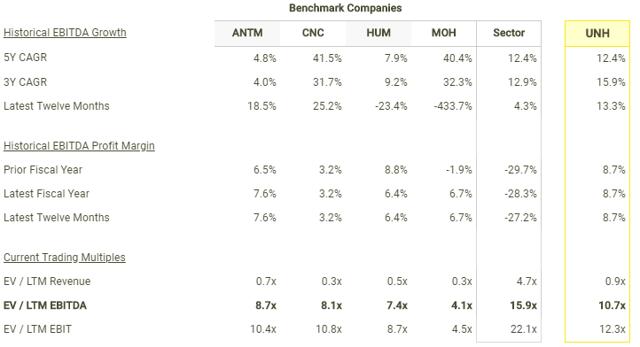

Wall Street analysts are very optimistic about the shares of UNH, with the average price target setting at $ 301.80. If the stock is 40% lower than this value, what is missing for value investors in the calculation of the number of fair values? Investors could use a multiple valuation model of EBITDA. This compares the operating measures and valuation multiples of similar public companies to determine a value for the company in question. Comparing UnitedHealth to Humana Inc. (HUM), Molina Healthcare Inc. (MS) Centene Corporation (CNC) and Anthem, Inc. (ANTM), allocating a modest EV / LTM EBITDA of less than 11 times would result in a fair value between $ 246 and $ 287.

Source: finbox.io

Take away

The political hurdles that threaten the health care plan sector can be temporary. If the government ends up giving up the current plan, UNH and others bounce back. Timing this reversal is impossible. The most effective approach to recognizing value is to create a small position in the UNH stock and establish a long-term average. Despite the risks, UNH has a solid foundation that will reward the value investor.

Thank you for your time reading this article. For a limited time, I invite you to sign up for a no-risk trial access to Do-it-yourself (DIY). This invitation will close once capacity is reached.

Please [+]To follow me for coverage on deeply reduced health care stocks. Click on the "follow" button next to my name.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link