[ad_1]

From January to March, Tesla is expected to generate revenue of $ 5.19 billion but did not reach $ 4.54 billion, likely due to lower shipments in Europe and China.

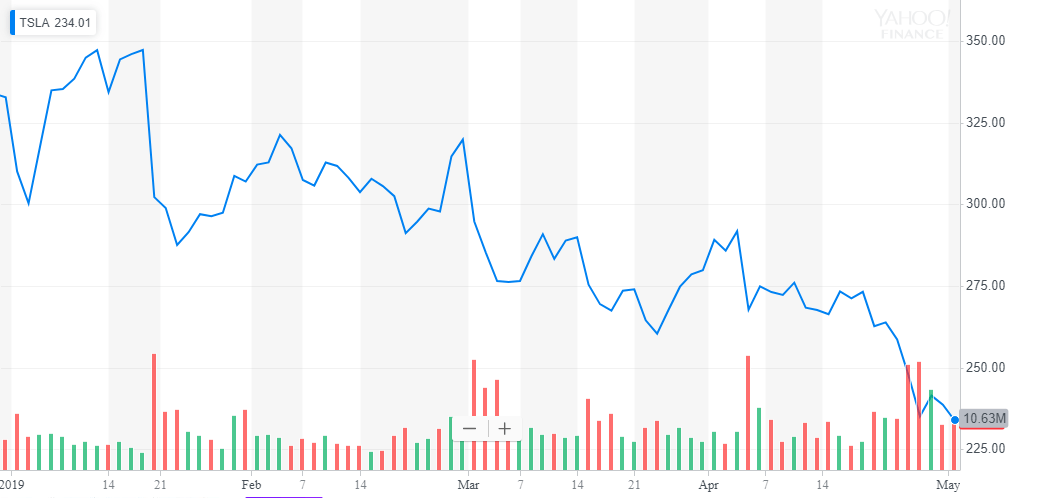

The Tesla stock has fallen sharply since the beginning of the year (source: Yahoo Finance)

According to a Reuters report, about 10,600 vehicles were stuck in transit at the end of the first quarter, which resulted in an overall decline in the company's revenue.

Is Tesla's fear an overreaction?

Although Tesla performed poorly on paper, as Wedbush analyst Daniel Ives said, Wall Street was expecting a much worse quarter for the automaker and Model 3 shipments were better than expected.

"Overall, the street was expecting an apocalyptic quarter and Model 3 deliveries were better than many feared," said Ives.

First-quarter figures also neglected some of the key milestones achieved by Tesla, such as the Tesla Model 3, which far surpassed the peak of electric car sales in Europe.

Tesla reportedly sold 19,482 models in the first quarter, while Nissan Leaf sold about 10,315 models.

Automotive analyst Matthias Schmidt said Tesla's Model 3 is expected to be completed in 2019 as Europe's best-selling electric car model, reinforcing its strong presence in a key market.

He said:

"I expect Model 3 to finish the year as the most sold electric car model in Europe has been helped by the fact that other manufacturers are reducing the supply of their electric models until 2020, with many creative excuses, to reduce their fleet. Average CO2 emissions – when necessary – to reach the next cycle of EU objectives introduced in 2020, covering 95% of their total fleet and 100% the following year. "

Ark Invest CIO expects Tesla to reach $ 4,000

Cathie Wood, founder of Ark Invest and Director of Investments (CIO), defended her call for Tesla to reach $ 4,000.

"Our belief in Tesla is so strong that she has never left our leading position," Wood said.

She highlighted the progress made by the company in the field of artificial intelligence (AI), a sector in which Ark Invest believes that Tesla is three or four years ahead of its competitors.

"We heard about Tesla's artificial intelligence chip. We saw the specifications. Our analyst, James Wang, is from Nvidia. He said, "Oh, my God." This exceeds the competition. They are at least three or four years ahead of their competitors, "she explained.

Regarding the concerns of strategists and investors about Tesla's possible capital increase, Mr. Wood added that the company could raise additional capital and would probably have no problem doing so.

Wood said:

"Oh, it can bring money. I do not think Elon wants to do that in this evaluation. I think that he thought that their day of autonomy last week would give them a great opportunity. Once analysts understand how far they are ahead of their competitors in terms of autonomy and how long it will evolve, they will be able to meet them. "

In recent months, Tesla has been showing signs of maturation as the company has moved from in-store physical sales to online sales, and has secured important markets like Europe with significant margins separating it from its competitors.

Investors such as Wood, who remain optimistic about Tesla's long-term future, anticipate an increase in demand for Tesla models in 2019 and a rebound of the company while the main markets are performing well.

[ad_2]

Source link