[ad_1]

Monday’s market rout could serve as a good reminder that, yes, stocks can stumble when trading near record territory.

While the downward pressure on equities this time has been fleeting, that doesn’t necessarily mean the end of market volatility this summer, Ryan Detrick, chief market strategist at LPL Financial, said in a note. Wednesday.

“From less participating stocks, to low seasonality, to a lack of bear, to typical fluctuations in the second year of a bull market, the summer months could be ripe for a possible pullback (down from 5-9%) or even a 10% correction, ”Detrick wrote.

These are among the “many reasons” why, after rallying over 90%, he believes the S&P 500 SPX Index,

“Could finally be ready for a break,” especially when it comes to the often difficult months of August and September.

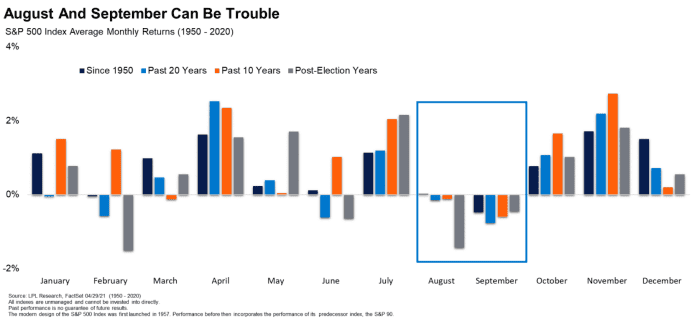

This chart shows that the average monthly returns of the S&P 500 in August and September, since 1950, have been largely negative, over different time periods.

August and September are often problems for stocks

LPL Financial

The study includes the modern S&P 500 index, launched in 1957, but also the performance of the S&P 90, its predecessor.

Historically, the chart also shows that April, July, and November tend to be the best months for S&P 500 returns.

But despite a bruise on Monday, the S&P 500 was up 0.7% for the week through Wednesday, while the Dow Jones Industrial Average DJIA,

was 0.3% higher for the same stretch, as investors grabbed the battered XLE energy stocks,

and financial XLF,

sectors.

Lily: What junk bonds are reporting for this summer after Monday’s strong rout

“Incredibly, we haven’t seen that much 5% decline since October,” said Detrick, noting that the average year since 1950 has seen three separate S&P 500 pullbacks of 5% or more, “without any ‘not one will happen. again in 2021.

“This doesn’t mean that a 5% correction is imminent, but note that most stocks are already down 10% from their recent highs, which suggests that market internals are a bit weak and that the risk is higher than Ordinary. “

[ad_2]

Source link