[ad_1]

All financial figures are in Canadian dollars unless otherwise indicated.

Benefits of investing in REITs

In its simplest form, a real estate investment trust (REIT) is an investment vehicle that gathers investors' money to buy real estate. For my part, I could not go out and buy a mall today if I wanted it. This is just one of the reasons why REITs can be such an investment vehicle for the average retail investor.

REITs have established themselves as a means for the smallest investor to directly participate in the higher returns generated by real estate. High-quality, large-cap REITs offer many benefits to investors, starting with their demonstrated ability to generate long-term capital gains and reliable income through tax-optimized distributions that are superior to market, based on stable rents from long-term leases. Dividend growth rates for quality large-cap REITs have historically exceeded inflation.

REITs are a differentiated asset class, which historically had a lower correlation with the traditional asset classes of equities and fixed income securities. They can serve as a source of protection, portfolio diversification and liquidity. The addition of public real estate investments to a portfolio provides benefits in terms of income, diversification and hedging against inflation. In addition, they may offer less liquidity risk than private investments.

REITs generally generated better risk-adjusted returns than global equities and fixed income securities for almost all long-term holding periods. The addition of quality REITs to equity and fixed income portfolios increases the total return of investors and reduces risk.

In general, REITs must have at least three quarters of their assets invested in real estate and earn at least three quarters of their income from rents, interest, sales of real estate or property. other sources from real estate themselves. They also have to pay most of their income in the form of distributions – one of the reasons why investors are so attracted to REITs, particularly in registered retirement accounts where they are not required to pay taxes.

However, since they pay large sums in distributions, it can be difficult for them to finance growth; they can only fund growth in three ways. The first is to sell old properties and buy new ones. Although this does not necessarily translate into growth, it often happens. The second is indebtedness – REITs tend to be highly leveraged and therefore very sensitive to interest rates. The third is to issue shares, which dilutes the unitholders. Most REITs will do a combination of all three.

REITs provide stable distributions based on stable rents from long-term leases. REITs must distribute to unitholders at least 90% of their taxable income in the form of dividends, which is significantly higher than most other shares. And, the distribution growth rates for quality large-cap REITs have historically exceeded inflation. A portion of the distributions paid by the REITs may be a return of non-taxable capital, which not only reduces the Unitholder's base cost and taxable income in the year in which the dividend is received, but also defers the taxpayer's return. Tax on this part. until the immobilization is sold. (Theoretically, a unitholder may obtain a negative base price if the units are held for a sufficiently long period.)

These attributes of REITs have been sustained over time and in different economic environments, including the global financial crisis of 2008-2009. REITs are a valuable part of a diversified investment portfolio.

Commercial real estate is an integral part of a truly diversified portfolio. But not all real estate is created equal. Grocery store-based properties are needs-based and provide essentials for everyday living. Necessity-based retailing provides a conservative income component to your portfolio and is a pure inflation game in the form of higher food prices.

We invest in REITs for a stable and predictable income. We do not expect as much capital gains. But this year is an exception. Decisions by the Federal Reserve Board and the Bank of Canada to suspend interest rate increases have allowed all interest-rate-sensitive securities, including REITs, to prosper.

Although traditionally a conservative and income-seeking investor, REITs recorded one of the best market returns in Canada in 2018. The S & P / TSX Capped Index of S & P / TSX total return of 6%, including distributions, while the total return of the S & P / TSX Composite Index decreased by 10% over the same period.

Canadian REITs also had a strong performance up to 2019, the second best performance of all TSX sub-sectors this year, surpassed only by technology stocks. The capped S & P / TSX real estate index is up nearly 17% since the beginning of the year. This is an impressive advance in four months for a sector that is not subject to strong fluctuations except in extreme circumstances. Expectations of a possible reversal of interest rates by the Bank of Canada have placed income-generating actions such as utilities and REITs on investors' purchase lists and pushed these two sectors on the rise.

There is good reason to believe that this upward trend will continue even at a slower pace. The Canadian economy continues to be weak and the Bank of Canada has indicated that it is not planning to resume rate hikes anytime soon. In fact, the Bank of Canada could reduce by a quarter of a point or more if the situation does not improve.

US President Donald Trump lobbied the Fed to lower its rates. He thinks that the hikes last year were a mistake. The president wants a strong economy for the 2020 elections. The rate cuts would encourage more investment and hiring firms and give a boost to the stock markets. All this suggests that the REIT climate should remain favorable for at least the next two years.

Both the Federal Reserve and the Bank of Canada raised their respective rates several times in 2018 – four times for the Fed and three times for the Bank of Canada – and yet, REITs have consistently generated one of the best returns. sector. This positive performance over such a challenging year for Canadian stocks was particularly surprising due to rising interest rates. Rate increases were expected to result in a mass sale of publicly traded REITs.

However, I believe investors have come to see the industry from a different angle. Rather than focusing primarily on underlying interest rates, they put more emphasis on the economic fundamentals of REITs, with indicators of economic growth and supply and demand being more important factors in the performance of Canadian REITs. REITs as interest rate changes, provided the changes are managed, progressive and cost effective. not unexpected.

Choice Properties REIT: An aligned sponsor, a strong management team, stable performance

Choice Properties REIT (TSX: CHP.UN) (OTC: PPRQF) was created by Loblaw Companies Limited in 2013. It entered the market that same year with the signing of a strategic alliance agreement with Loblaw, giving to the REIT:

- The right of first offer on the retained properties of Loblaw;

- The right to participate in Loblaw's shopping center acquisitions; and

- The right to participate in all Loblaw developments.

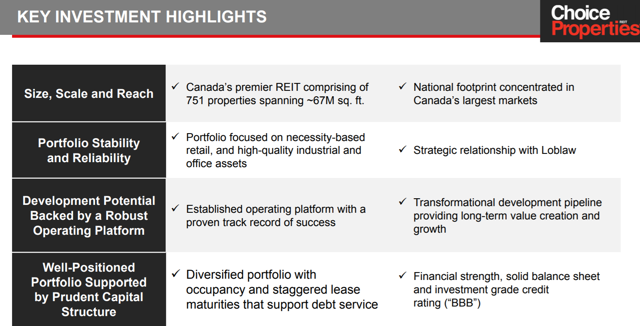

Choice Properties' strategy is to create value by improving and optimizing its portfolio through acquisitions, strategic development and active property management. The primary tenant of Choice Properties is Loblaw Companies Limited, Canada's largest retailer. The REIT's strong alliance with Loblaw positions it well for future growth. Loblaw's parent company, George Weston Limited (TSX: GWL), retains an approximate 65% interest in Choice Properties REIT.

Source: choicereit.ca

Choice Properties was a pure-play retail investment company until its acquisition in 2018 of the Canadian Real Estate Investment Trust, or "CREIT", as it had been called over the years. This $ 3.9 billion transaction created Canada's largest REIT, valued at approximately $ 16 billion, and more than 700 properties comprising retail, office, industrial and retail assets. residential. The Combined REIT is now in an enviable position, with more than 70 leading development sites designed to create attractive multi-purpose residential communities, many of which are close to public transit, where people want to live, work, have fun and shop. More than 90% of the development sites are located in the six largest VECTOM markets in Canada – Vancouver, Edmonton, Calgary, Toronto, Ottawa and Montreal.

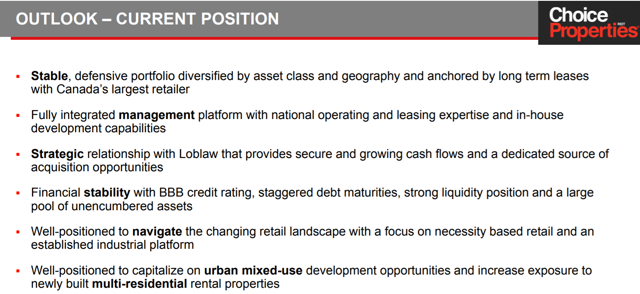

Choice Properties offers a beautiful combination of defense, from its needs-based grocery and pharmacy-based retail centers, and an attack by the form of vast opportunities for long-term development and intensification, including most now include a significant residential component.

By partnering with CREIT, Choice Properties REIT has the largest and most attractive Canadian real estate development pipeline, which, combined with its standard financial metrics and nature-based need of its retail tenants in fact an attractive long-term defensive investment. .

With CREIT, Choice Properties REIT has become Canada's largest diversified real estate investment trust. It owns, manages and develops a high-quality portfolio of approximately 760 properties, totaling nearly 70 million square feet of gross leasable area, as well as 23 other properties under development. The long-term development pipeline includes more than 70 properties in key urban markets – most of them in major hubs – for the creation of attractive mixed-use, residential-oriented projects, with 90% of the development sites located in the six VECTOM Canada (Vancouver, Edmonton). , Calgary, Toronto, Ottawa, Montreal).

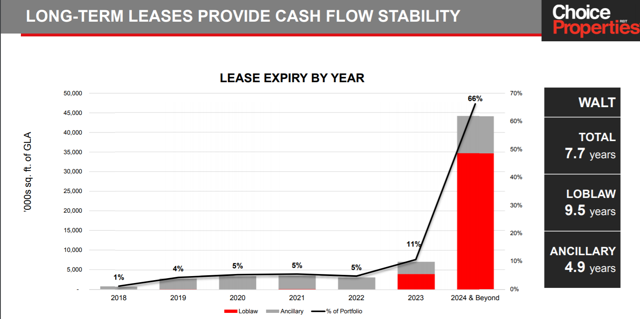

Choice Properties Real Estate Investment Trust is an open-ended, open-ended real estate investment trust. Loblaw Companies Limited, or Loblaw, [TSX:L] selected Choice Properties REIT in 2013 as part of its strategy to maximize the value of real estate holdings in its food retail operations. Backed by quality real estate, a strong key tenant in Loblaw and strong leadership, and with a stable portfolio focused primarily on non-discretionary and service-oriented retailers, Choice Properties continues to maintain the high occupancy rate of its total portfolio, with a weighted average remaining. ten year lease term.

The business model of Choice Properties has evolved over time to include more real estate development to create NAV and to generate superior returns over acquisitions, as well as to improve the quality of the portfolio over time. The active development pipeline of Choice Properties has an estimated total cost of $ 1.2 billion and almost 3 million square feet is currently under development.

Choice Properties properties have been exceptionally busy over the last 17 months, following its February 2018 acquisition of Canadian Real Estate Investment Trust – or CREIT – a diversified commercial REIT, for $ 3.9 billion. dollars, creating the largest real estate investment fund in Canada and significantly enhancing the future development and intensification of Choice Opportunities.

The merger marks the end of a fantastic era for CREIT as an autonomous entity, after it was released to the public 25 years ago. CREIT has performed very well over the last 25 years. It posted a compound annual growth rate of 8% of funds from operating activities; an annual growth rate of 5% of distributions per unit; plus a 20-year average internal rate of return of 14%. For the CREIT unitholders, the ride was good: $ 10,000 invested in September 1993 was worth $ 261,000 when the plan of arrangement was completed.

Most of CREIT's owners, including me, have chosen to receive a stake in Choice Properties. Approximately 43 million units were traded for Choice Properties units. I've learned four important lessons from my investment in CREIT:

- CREIT had an excellent management team, whose key members were responsible for managing Choice Properties. After long experience with CREIT as a unitholder, I realized that good governance could not be regulated or legislated. This must be part of the "DNA" of a company.

- The power of capitalization over time is the most important force in the accumulation of wealth. And, this composition is facilitated by leverage, which can occur when the issuer proposes a dividend reinvestment plan.

- It takes a lot of time, patience and operational execution to create a high quality REIT, capable of generating peak returns.

- An REIT is generally a good investment if it trades below the NAV.

Prior to its merger with Choice, CREIT was widely viewed as one of Canada's most prudently managed REITs (alongside RioCan REIT, which I mentioned earlier). The CEO of CREIT at the time, Stephen Johnson, was chosen to lead the merged company in its first year. On May 1 of this year, Mr. Johnson retired at the age of 67, handing over the reins to former CREIT chairman, Rael Diamond. CREIT's superior culture is therefore still very much alive at Choice.

With the integration of both activities now complete and the 2018 results in the background, it is encouraging to see that Choice's management is simplifying and improving its financial information. In the long term, I expect the business will continue to look more like CREIT, with management seeking to reduce debt to less than 40% of the LTV ratio and reduce the payout ratio of funds from the export to less than 70%. ramp-up of the value-added development program.

The prime properties started well in the year 2019 with strong financial and operational results for the first quarter of 2019, which were released on April 26 – with an impressive $ 169 million completion budget. Choice Properties' management remains focused on growing its rental portfolio with a portfolio of development projects currently comprising approximately 1,200 apartments. From an operational point of view, net operating income to the same assets on a cash basis increased by 2.4% compared to the first quarter of 2018.

With strong real estate, a strong key tenant in Loblaw and exceptionally strong management, and a stable portfolio focused primarily on non-discretionary and service-oriented retailers, Choice Properties continued to maintain the best investment rate. high overall occupancy of its 97.4% first quarter portfolio, with a weighted average remaining lease term of 10 years. Retail trade – which accounts for the majority of the portfolio – accounts for 97.8%, while the industrial sector accounts for 97.2%. The office portfolio, at 92.2% occupancy, is the only weak spot, reflecting continuing weakness in Calgary and Halifax. However, office fundamentals remain solid in Choice Properties' other VECTOM markets in Toronto, Vancouver, Montreal and Ottawa, driven by strong employment growth.

Source: choicereit.ca

Choice's first quarter of 2019 was a significant quarter in terms of completion of development, with many more to come. Up until the first quarter of 2019, Choice Properties completed 13 projects under development, which allowed 808,000 square feet of new leasable area to become revenue. This compares to 517,000 square feet completed in 2018 for a total investment of $ 193 million. Altogether, Choice Properties is investing an additional $ 416 million in properties under development for a total projected cost of $ 948 million.

In the first quarter, Choice Properties also acquired two high-quality commercial properties anchored in grocery stores and a major residential development site in downtown Toronto for a total investment of $ 56.1 million.

Choice Properties has seven residential projects at various stages of planning and development, which include 1,184 apartments and an anticipated investment of $ 528 million. Many of Choice's residential development projects come from the CREIT transaction and four are still in their infancy. There is a long and significant additional residential density runway in many centers anchored in Loblaw in Canada over the next 10 years.

The business model of Choice Properties has evolved over the years to include more real estate developments. Smart development is a good way to create a NAV and earn higher returns than acquisitions. This is also a good way to improve the quality of the portfolio over time. The active development pipeline of Choice Properties has a total cost of approximately $ 1.2 billion, representing nearly 3.0 million square feet of development.

Until the end of April, Choice posted a cumulative total return of 21.2%, including distributions, of 21.2%, easily exceeding the total return of 17% for the year. S & P / TSX Composite Index.

Source: choicereit.ca

A reasonable return and a reasonable valuation

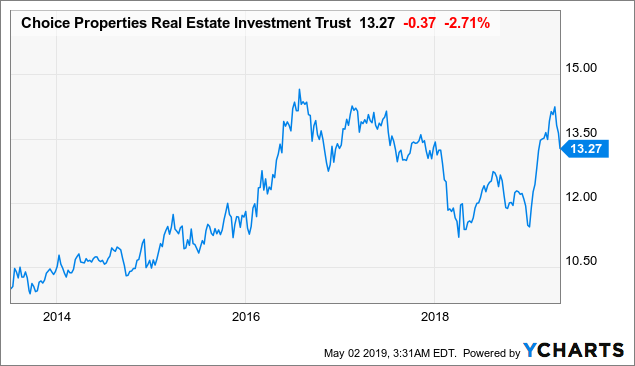

Choice Properties lost 2.71% on Wednesday to close at $ 13.27, following its announcement after the close of Tuesday markets, a purchase of $ 300 million purchase at a price of 13.15 $ per unit to a syndicate of underwriters co-sponsored by TD Securities Inc., RBC Capital Markets, BMO Capital Markets and CIBC Capital Markets acting as bookrunners, for gross proceeds of approximately $ 300 million, account for the greenshoe excess allocation option to purchase an additional 3,422,250 units which, if exercised in full, would increase the gross size of the offering to approximately $ 345 million.

My 12-month price target for Choice Properties is $ 16.75, which represents a 26% increase over Wednesday's closing price of $ 13.27 and a 23% premium to net asset value of 13, $ 60 from the REIT per unit one year in advance, or a multiple of 17x to Choice AFFO 2019 from Properties per unit of estimate. I believe that my target price for cogeneration is a reflection of its conservative financial leverage, portfolio attributes, large cap liquidity, public market track record and a controlled unitholder discount.

Data by YCharts

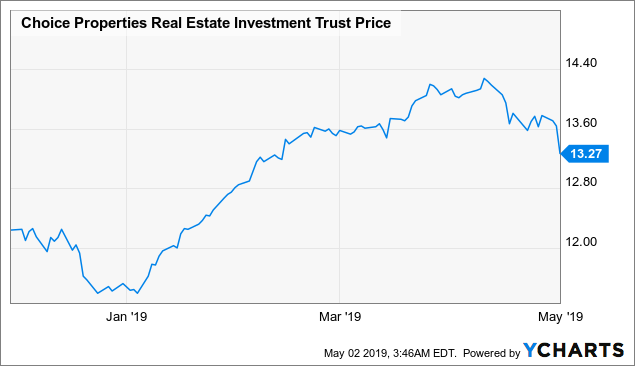

Many of Choice Properties' most ambitious projects will take years. In the meantime, investors are paid to wait. I have a predilection for equities with returns above the market average, both for cash flow and for the caution required of management in managing capital responsibly. Choice distributes a monthly distribution of approximately $ 0.0617 per month, or $ 0.74 per annum, for a current yield of 5.43%. The distribution is well hedged by Choice's cash flow, the REIT's distribution ratio setting at approximately 85% of the adjusted operating funds for 2019, falling to approximately 83% by 2020, as Choice's cash flow will continue to grow.

Data by YCharts

After the ramp-up of Choice in 2019, after the December swoon, the units are trading at approximately 12.6 times the funds from operations estimated for 2019 – which is more or less the long-term average of 12.5x. For long-term investor investors, Choice will almost certainly generate significant long-term growth, while paying an attractive distribution to unitholders in anticipation of Choice's unutilized value.

Risks of investment

While Choice continues to diversify, its primary tenant remains Loblaws, which operates in the competitive environment of food retailing. The REIT's special focus on Loblaws allows it to face competitive forces in the food retail sector and Loblaws' ability to compete. More generally, Choice's concentration on the retail sector exposes it to risks related to the health of the economy. To the extent that negative economic factors affect consumer spending, tenants may suffer. However, given the nature of Choice's primary tenant-based needs, the impact will likely be less severe.

Thank you for doing it here in the article. I like to research and write quality business articles for Seeking Alpha. Investment is one of my hobbies, just like writing, and it is rewarding to be able to combine both hobbies productively. I have had a long career in finance and investor relations, which has forced me to maintain close relationships with both sides of the street – analysts and portfolio managers sellers and sellers – daily . I have read thousands of research reports from stock analysts side sellers. Professional fund managers and analysts on the sellers' side are focused on the short term. They have been conditioned to be, as they are measured and graded on a quarterly basis.

My investment horizon is considerably longer. In fact, my ideal period of detention is forever. I strive to provide a more detailed and long-term analysis of the companies I am looking for.

The true value of my articles stems from insightful comments from members of Seeking Alpha, and I continue to learn from readers' comments about my articles. Collectively, your comments give me a valuable opportunity to tap into "the wisdom of the crowd". The comments of the members of Alpha Research continually reinforce for me the way in which investment decisions should articulate around our personal investment and financial goals, which are as unique as we.

Please share your thoughts in the "Comments" section under this article. With so many authors and savvy readers, I find that I learn as much insightful and value-added commentary from readers as research for the article itself.

I acknowledge that Choice Properties REIT may not be suitable for all investors because each investor has their own investment and cash flow objectives. To understand why I recommend and continue to own Choice Properties REIT and why I believe the units are long-term holdings, it is helpful to be aware of my investment approach, which can be summarized as follows. four compound words: quality-value, large-cap, dividend growth and long-term. For more details, please refer to an interview conducted by Canada's leading business newspaper, the Globe and Mail Report on Business section, "A Long-Term Perspective Contributes to the Volatility of the Weather Market for Investors".

I focus on companies that fit this description in four sentences. Choice Properties REIT fits this model and I will continue to occupy all my position, ideally "forever".

In Seeking Alpha, my articles focus on high-growth, large-capitalization, and growing dividend stocks, with strong business models, strong management teams, and vast economic gaps – "Forever Stocks", such as J & # He likes to call them. I strive to provide a thorough analysis of the companies I am looking for. I have written this article from the perspective of a long-term investor who follows a simple four-part strategy:

1. Identify a company with strong competitive advantages.

2. Satisfy me, its competitive advantages are durable.

3. Invest in this company when it is trading at a fair price.

4. Keep the shares "forever" unless there is a material change in the fundamental investment thesis associated with the company.

If you found this article helpful, please follow me on Seeking Alpha to receive a notification when I publish a new article.

Disclosure: I am / we have long been CHP.UN. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link