[ad_1]

Photographer: Yan Cong / Bloomberg

Photographer: Yan Cong / Bloomberg

Sign up for Next China, a weekly email about the nation’s current situation and its future.

The daily fixing of the yuan in China is once again attracting attention. The currency is expected to experience its biggest monthly decline since last March, prompting traders to take a close look at the benchmark rate again for policy signals.

A drop in the currency on Thursday to levels last seen in December was followed by the People’s Bank of China, which set the benchmark dollar rate at the lowest level in nearly three months. On Monday, authorities pegged the yuan even lower.

After a relentless eight-month advance against the global reserve currency, the yuan weakened in February, then fell more than 1% so far in March. In one A statement released after Wednesday’s quarterly monetary policy committee meeting, the central bank said it would make China’s exchange rate more flexible.

“The renminbi may have reached an intermediate high against the dollar recently and the steepest part of its rise could be behind us,” said Fiona Lim, senior currency analyst at Malayan Banking Berhad in Singapore. “A correction in stocks at home, a sharp rise in Treasury yields and nervousness in the wider global markets could keep the dollar strong against the onshore yuan.”

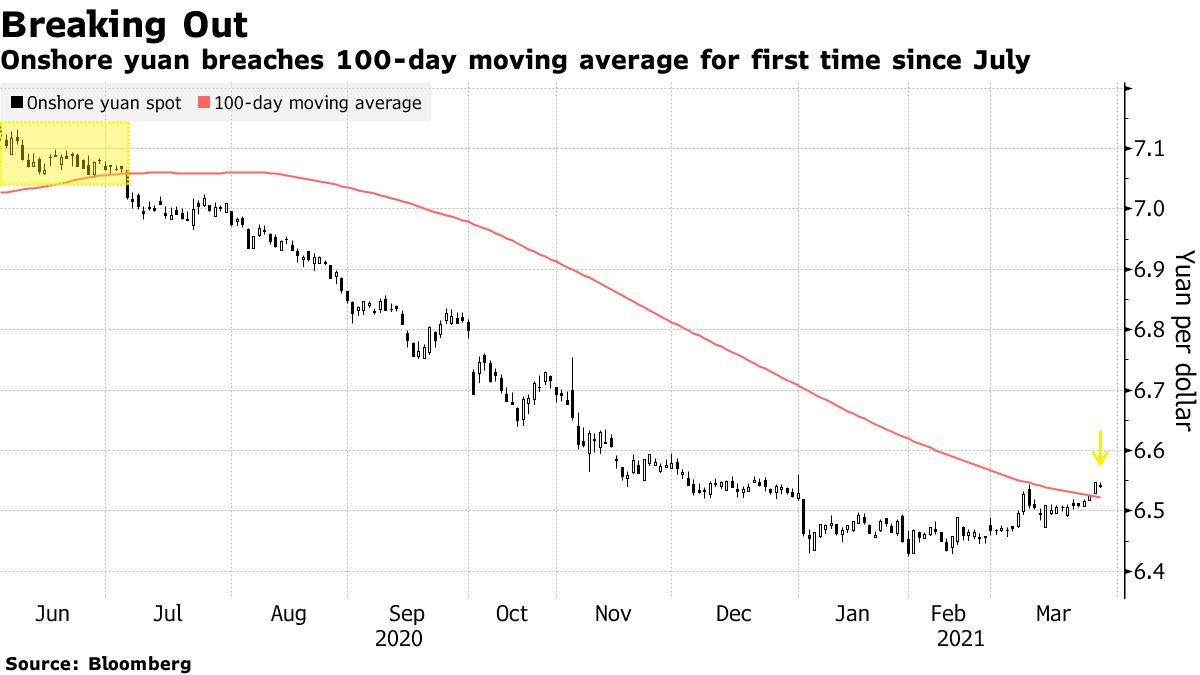

The dollar-yuan pair returned above its 100-day moving average – which it hasn’t done since July – a key technical signal that could pave the way for further weakness in the Chinese currency. It was at 6.5436 Monday.

More transparency

Attention returns to the Chinese currency at a time when the benchmark yuan rate is easier than ever to decipher. Analysts’ estimates of the daily rate have become more precise, reflecting policy makers allow market movements to determine it. Forecasts from the daily Bloomberg Survey of Traders and Strategists – compiled here – were on average only a pip lower than the official number for the month following the Lunar New Year holiday.

The fixing is the most obvious tool the PCB has to influence its currency, setting a benchmark rate each trading day at 9:15 a.m. Beijing time, then allowing the yuan to move 2% in either direction. A significantly higher or lower rate than expected is generally seen as a signal from Beijing.

From correction to signaling, how China handles the yuan: QuickTake

The change in transparency is part of Beijing’s efforts to reduce control over the currency market as it moves towards a long-term goal of encouraging global use of the yuan. He moved to loosened its grip again last October, with the yuan closing the year nearly 7% stronger against the dollar.

Narrow range

Prior to last week, the onshore yuan was trading in a narrow range of 1,200 pips against the dollar this year, a gap five times smaller than over all of 2020.

Although it has slipped about 0.2% against the dollar this year, the yuan has shown continued strength against most other major currencies – including a 5% higher rise against the yen and Swiss franc. , and a gain of more than 3% against the euro.

Partly because it was growing at the same rate as the US currency as the two largest economies in the world. pandemic rebound faster than global peers.

Any signal that authorities are willing to let the yuan trade more freely could now accelerate its decline against the dollar. Onshore options traders have already started betting on this scenario with one-month and two-month risk reversals – a measure of expectations for the dollar-yuan – hitting their highest since December.

“I think it will become more volatile from here on as Treasury yields rise and tensions with the West intensify,” Dariusz Kowalczyk, chief China economist at Crédit Agricole CIB, told Hong Kong. “The yuan peaked when it hit 6.40 earlier this year.”

– With the help of Livia Yap, Ran Li and Tian Chen

(Updates with the latest yuan fixation in the second paragraph)

[ad_2]

Source link