[ad_1]

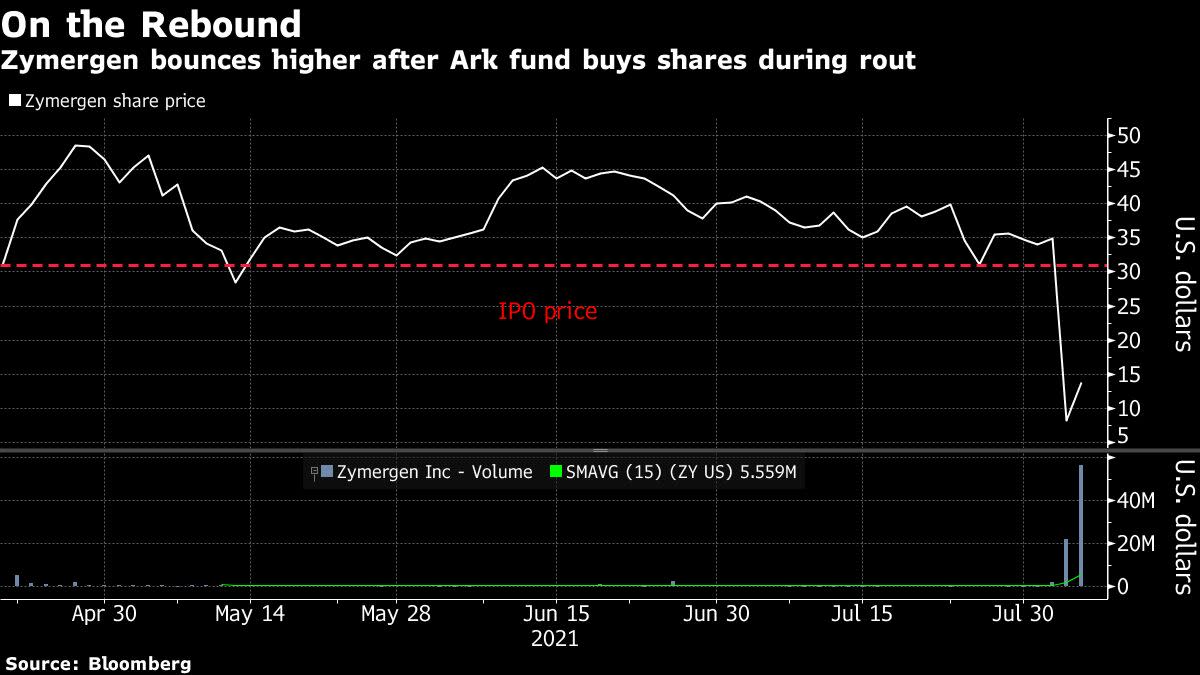

(Bloomberg) – Zymergen Inc. rose to 87% after one of Cathie Wood’s Ark Investment Management LLC funds recovered its shares.

The purchase came amid Wednesday’s 76% decline, a record drop that took the synthetic biology company to its lowest since it debuted in April, after the company withdrew its sales guidance for 2021 and announced the departure of its general manager. Despite the rebound, the stock has lost more than 50% since its IPO at $ 31 a share.

Zymergen said it is working to restore investor confidence after customers struggled to get its film biotreated for use in items such as foldable smartphones implemented in their manufacturing processes. But skepticism has grown among Wall Street analysts. William Blair’s Matt Larew, who downgraded the title to the neutral equivalent, said his credibility was “destroyed”.

The action triggered a halt to trading when the market opened after it learned that the retail guru’s ARK Genomic Revolution fund, which trades as ARKG, had bought 2.47 million actions. Thursday’s gains meant the Emeryville, Calif., Based company chained its worst day of losses in the market with its biggest single-day gain.

ETF ARKG has taken off around 5% so far this year, with some of the fund’s biggest bets like Teladoc Health Inc., Exact Sciences Corp. and Vertex Pharmaceuticals Inc. posting double-digit declines.

Other top Zymergen backers include SoftBank Vision Fund LP with an approximate 27% stake as of April 26, according to Bloomberg data, as well as Singapore sovereign wealth fund GIC Pte Ltd and UK fund giant. Baillie Gifford & Co.

Ark did not immediately respond to emails seeking comment.

Zymergen has four keep ratings and two sell recommendations, according to data compiled by Bloomberg. No one currently considers this a purchase, up from six such calls last week.

(Updates to include product details in the third paragraph, analyst coverage in the finale.)

More stories like this are available at bloomberg.com

Subscribe now to stay ahead of the game with the most trusted source of business information.

© 2021 Bloomberg LP

[ad_2]

Source link