[ad_1]

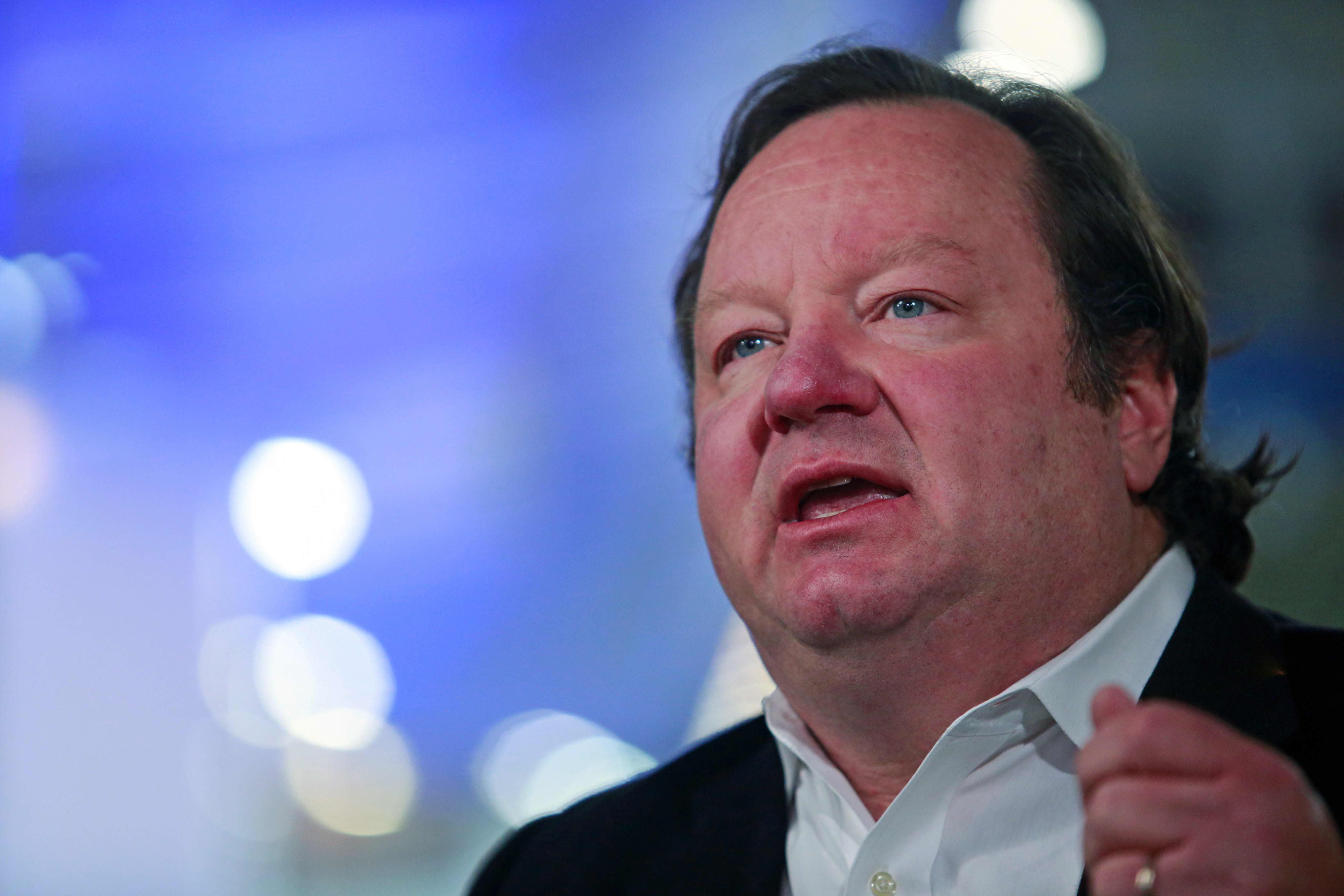

Robert Bakish, President and CEO of Viacom International Media Networks, will speak at an interview with Bloomberg Television at the Mobile World Congress in Barcelona, Spain, on Tuesday, March 3, 2015. The event, which generates several hundred million euros of revenue for the city Barcelona each year also means that the whole world for a week is turning back to Europe for the latest technology, despite an ecosystem in delay.

Pau Barrena | Bloomberg | Getty Images

CBS and Viacom continue to follow the merger talks and are now turning to August 8 as the internal deadline for agreement, according to people familiar with the matter.

Although a transaction can be announced sooner or later! – CBS and Viacom share Aug. 8 as both companies release their second quarter results. This makes it a natural goal for a merger that has been speculating for over a year, said people who have asked not to be named because the discussions are private.

Both companies have agreed from a conceptual point of view that an agreement to gain scale makes sense, the people said. Grouping to compete with Netflix, Disney, Comcast and others is a story that has been pushed by majority shareholder Shari Redstone, who is prohibited from proposing a merger of the companies itself – a disposition stemming from A lawsuit that she settled with CBS Corp. . Redstone wants the combination of CBS and Viacom to be even bigger as it prepares to renew expensive broadcasting rights for the NFL in the coming years. She attended the Allen & Co. conference at Sun Valley last week, an annual event allowing companies to start thinking about future acquisitions.

The price of the transaction, which will come in the form of a merger exchange ratio, has not been discussed and will not be addressed until all strategic and management issues are addressed. not resolved, according to people familiar with the subject.

Last year, CBS and Viacom were about to announce a merger with a trading ratio of 0.6135 CBS shares for each class B share of Viacom. This deal was ultimately sabotaged by management problems, but these issues were resolved when Les Moonves stepped down as CBS CEO last year in the midst of allegations of sexual misconduct.

This time, the boards of directors of CBS and Viacom will not reach an agreement on the exchange rate until all the other elements of the transaction are defined, said the officials.

Viacom wants the ratio to increase slightly over the previous year, as the media company headed by Managing Director Bob Bakish outperformed CBS over the past year and avoided a power outage with AT & DirecTV T earlier this year, which had already been in surplus in 2018. Issues such as the direction and composition of the board of directors could alter the exchange ratio in one way or the other. another, although the ratio probably does not move drastically, said the people.

Nevertheless, part of Viacom's outperformance could be explained by the renewal of the merger and acquisition premium. And Viacom agreed to reduce distribution fees to guarantee the agreement with DirecTV.

Viacom has increased about 5% in the last 12 months. CBS is down 11 percent in the same period.

Bakish is expected to be the leader of a merged company, as CNBC has previously announced. While the CBS Board of Directors is concerned about Viacom 's leadership under Bakish, the combined boards of both companies will likely work with Bakish to appoint other officers instead of the company. 39 require some of its leaders to be pre-arranged under an agreement, officials said. The role of CBS CEO Joe Ianniello is still unclear, the people said. His contract as CEO of CBS expires at the end of December.

New streaming strategy

Beyond leadership decisions, the main points of discussion around an agreement relate to a growth strategy for the merged company, said officials. A CBS-Viacom could close quickly – perhaps by the end of 2019 – because National Amusements controls both companies, said two people.

After the closing of the transaction, the company may want to proceed quickly to acquire another company, such as Starz, which has already discussed the sale to CBS.

New leaders will also need to plan a streaming strategy to fight Disney, AT & T WarnerMedia and others. CBS 'streaming service, CBS All Access, has over 8 million subscribers and estimates that it will have 25 million by 2022.

Viacom owns Paramount Pictures and owns the film rights to "Star Trek", "Mission Impossible" and "The Godfather". It also has popular children's shows such as "SpongeBob SquarePants", broadcast on Nickelodeon from Viacom, and "South Park", a property of Comedy Central.

A combined service with CBS could be attractive as a competing product, or CBS-Viacom can focus on selling its programming to existing services and collecting license fees. Although both are possible, senior managers will need to decide which strategy to focus on.

Watch: Giants of media and technology react to war continuously

[ad_2]

Source link