[ad_1]

Shares are expected to enter the new year at an all time high when the first day of trading for 2021 kicks off in Asia on Monday. Bitcoin’s relentless rally continued.

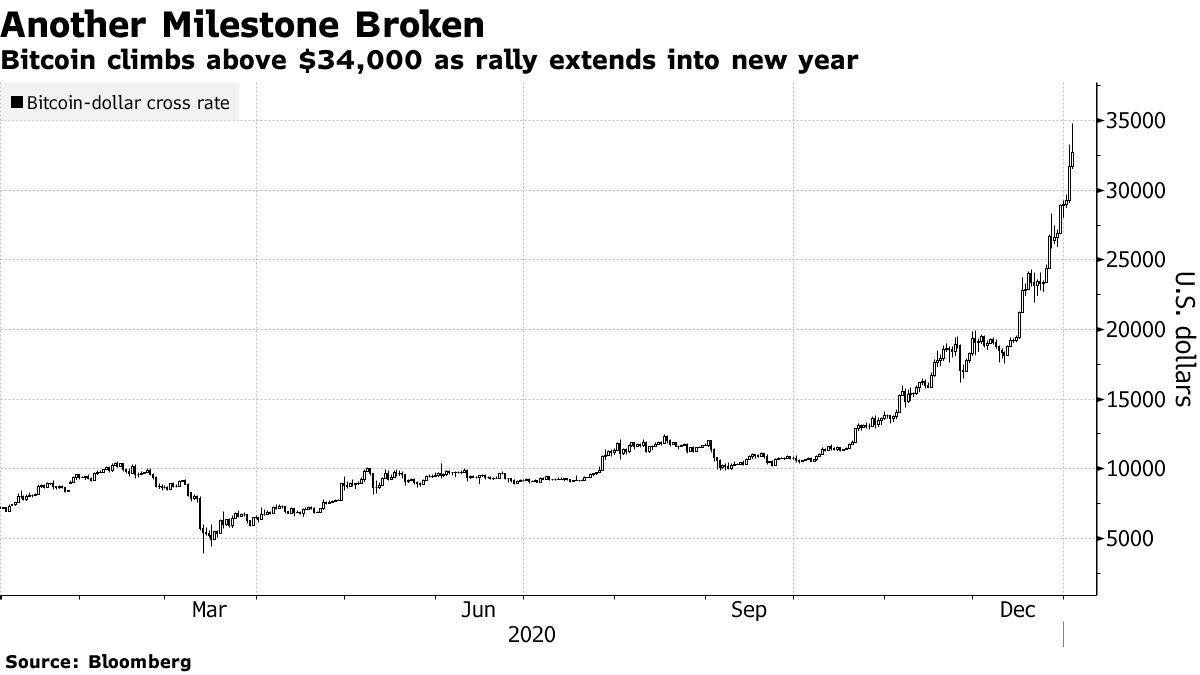

The S&P 500 Index and the Dow Jones Industrial Average closed at all-time highs on December 31. Most markets around the world were closed on January 1. Bitcoin surpassed $ 34,000 on Sunday just weeks after taking another major milestone. The dollar opened mixed against its G-10 peers when trading began in Sydney. The pound fell as the UK faces a tighter lockdown to stem the tide of the coronavirus.

Chinese equities will be the focus, as could Chinese oil majors next in line for delisting in the United States after the New York Stock Exchange announced last week that it would cut the Asian nation’s three largest telecommunications companies. China’s benchmark CSI 300 closed at a five-year high last week.

Stocks kick off the new year with rich valuations as widespread vaccine distribution in 2021, central bank support, and government aid are expected to boost economic growth and boost corporate profits . The MSCI Global Equity Index finished at a record high after rising 14% last year.

Meanwhile, the cryptocurrency frenzy shows no signs of slowing down. Bitcoin rose about 50% in December for the biggest monthly jump since May 2019.

OPEC has warned of the risks to the oil market of the resurgence of the pandemic, a day before the group and its allies meet to consider a further increase in production.

On the coronavirus front, the rollout of the US vaccine is picking up speed after a slow start and could be fully on track within a week or so, said Anthony Fauci, the country’s top infectious disease expert. New York’s cases slowed a day after the state passed a total of 1 million infections. British Prime Minister Boris Johnson said tougher lockdown measures in England, including school closures, would likely be needed as cases of the new variant of the virus continued to rise.

What to watch this week:

- The energy ministers of the OPEC + alliance are holding their monthly virtual meeting on Monday to decide to add up to 500,000 barrels per day to production.

- China’s Caixin manufacturing PMI expected Monday.

- In the United States on Tuesday, the state of Georgia is holding a second round for two seats in the United States Senate that will decide control of the chamber.

- The US Congress meets to count the electoral votes and declare the winner of the 2020 presidential election on Wednesday.

- The FOMC minutes came out on Wednesday.

- The US unemployment report for December is due on Friday.

Here are the main movements in the markets:

Stocks

- The S&P 500 Index rose 0.6% on Thursday.

- The futures of the Nikkei 225 had changed little before.

- Futures on the Australian S & P / ASX 200 index fell 1.2% earlier.

- Hong Kong’s Hang Seng Index futures fell 0.2% earlier.

Currencies

- The yen was at 103.19 to the dollar.

- The offshore yuan rose 0.1% to 6.4962 per dollar.

- The Bloomberg Dollar Spot Index rose 0.1% on Thursday.

- The euro rose 0.2% to $ 1.2240.

- The British pound slipped 0.1% to $ 1.3662.

Obligations

- The yield on 10-year Treasury bills fell one basis point to 0.91%.

Basic products

- West Texas Intermediate crude was little changed at $ 48.52 per barrel.

- Gold was at $ 1,898.67 an ounce.

[ad_2]

Source link