[ad_1]

This year, the stock market rally in the face of a deadly pandemic has been remarkable, so a strong December seems to follow.

But a “fairly severe” drop in stock may have already started, if not in a week or two, warns our call of the day, from the True Contrarian Blog and Managing Director of the newsletter, Steven Jon Kaplan. He says there are plenty of signals pointing this out if investors know where to look.

“What I notice the most are investors rushing into the stock market and registering record inflows, while insiders have never sold more heavily than they did in November 2020,” said Kaplan told MarketWatch in an interview and emails.

He notes “strong sales” across the board through J3 Information Services Group, a website that tracks the buying and selling of business executives, known as insiders. This means that “most savvy investors realize that a big drop is coming … and they prepare for it by reducing risk,” he says.

Kaplan says “a lot of things are going to go down 30% or 40%”, and thinks we’re in a bear market, so suggests looking at the pullbacks between 2000 and 2003 to get a sense of what lies ahead.

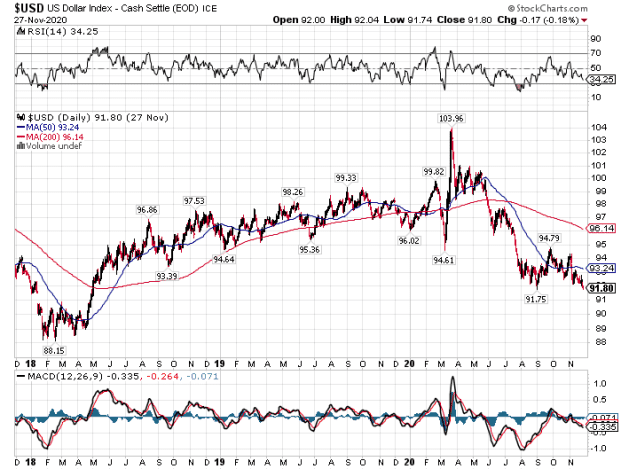

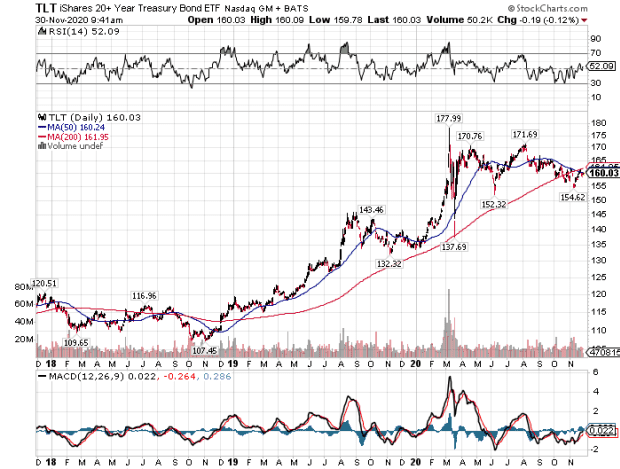

“We also have safe haven assets like TLT TLT,

(iShares 20+ Year Treasury Exchange Traded Fund), the DXY US dollar index,

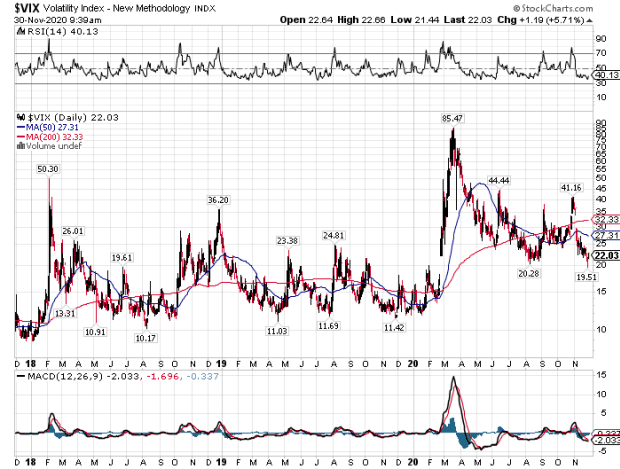

and VIX VIX,

(which measures the volatility of stocks) forming important bases in what looks like preparation for big rallies, ”he said. “Usually when these ‘Three Musketeers’ go higher, almost everything else will come down soon.”

He says those three assets all rose ahead of the March stock sell-off, then gave a “pre-warning” of a rebound before stocks hit bottom on March 23.

“TLT started to decline from its all-time high on March 9, 2020; VIX began to drop from its highest point since 2008 on March 18, 2020; the US dollar index began to decline from a three-year high on March 20, 2020, ”he said.

US dollar index.

Kaplan / True Contrarian

IShares 20+ Treasury Bond ETF.

Kaplan / True Contrarian

Cboe volatility index.

Kaplan / True Contrarian

To prepare for the coming pullback, Kaplan suggests cutting stock positions, especially in the popular large-cap tech sector, or picking up safe-haven assets like the TLT iShares Treasury fund.

Kaplan predicts that it will take four or five months to flush out investors who bought excessively high stocks and reward insiders who exited, before the rebound begins. Then investors can watch for signals like insider buying and, of course, the big three.

“When the ‘Three Musketeers’ peak and start falling again, perhaps in late winter or early spring 2021, this could be a signal to buy the larger small and mid-cap value stocks. dumped which will benefit from a subsequent surprise. “Over the past year or so, the trend in inflation is rising and interest rates are rising,” Kaplan says.

The steps

ES00 futures contracts,

DJIA,

COMP,

are up around 1% overall, with European SXXP stocks,

climbing as well. Asian stocks were dragged higher by a 2% jump for the Chinese CSI 300,000 300 index,

after a privately-made gauge hit a decade-long high in November. Bitcoin BTCUSD,

continues to soar.

The buzz

AdaptHealth AHCO Home Care Equipment Company,

announced a deal to buy AeroCare, a respiratory and home medical equipment distribution company, in a deal valued at just over $ 2 billion.

Zoom ZM,

posted another successful quarter, but the video conferencing group’s shares are down.

Exxon XOM Shares,

are on the rise, as the oil company announced a plan to restrict its focus on promising oil fields.

The Institute of Supply Management’s Purchasing Managers Index for November, and Markit’s, as well as construction spending, are all due out around 10 a.m.

At the same time, Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin will testify before the Senate Banking Committee. In comments prepared before the appearance, Powell said the Fed’s actions so far this year have helped boost the economy by $ 2 trillion.

Racing driver Lewis Hamilton has tested positive for COVID-19 as the United States rushes to nearly 100,000 patients hospitalized with the disease.

Random readings

Consumer goods giant Unilever UN,

trying four-day weeks in New Zealand.

The penguins of the London Aquarium never tire of the holiday movie “Elf”.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent out at approximately 7:30 a.m. Eastern Time.

[ad_2]

Source link