[ad_1]

Photographer: Michael Nagle / Bloomberg

Photographer: Michael Nagle / Bloomberg

They know about stretched valuations and all that needs to be done to keep stocks higher. And yet, rather than shying away from the sparkling markets, many investors are only getting started now.

The reason, it seems, is how far out of the market they were before the last and biggest stage of the race, the one that started in March 2020. It took so long for the appetite to build up. for risk recovers, JPMorgan Chase & Co Research shows pushing it to past highs levels could mean at least another 26% rally for the S&P 500.

“This bull market is still very young,” said Jim Paulsen, chief investment strategist at Leuthold Group, “it’s not even a year old yet, and given the large output gap in the US and from the high unemployment rate, further improvements in the economy should keep the stock market on the rise for a few more years. “

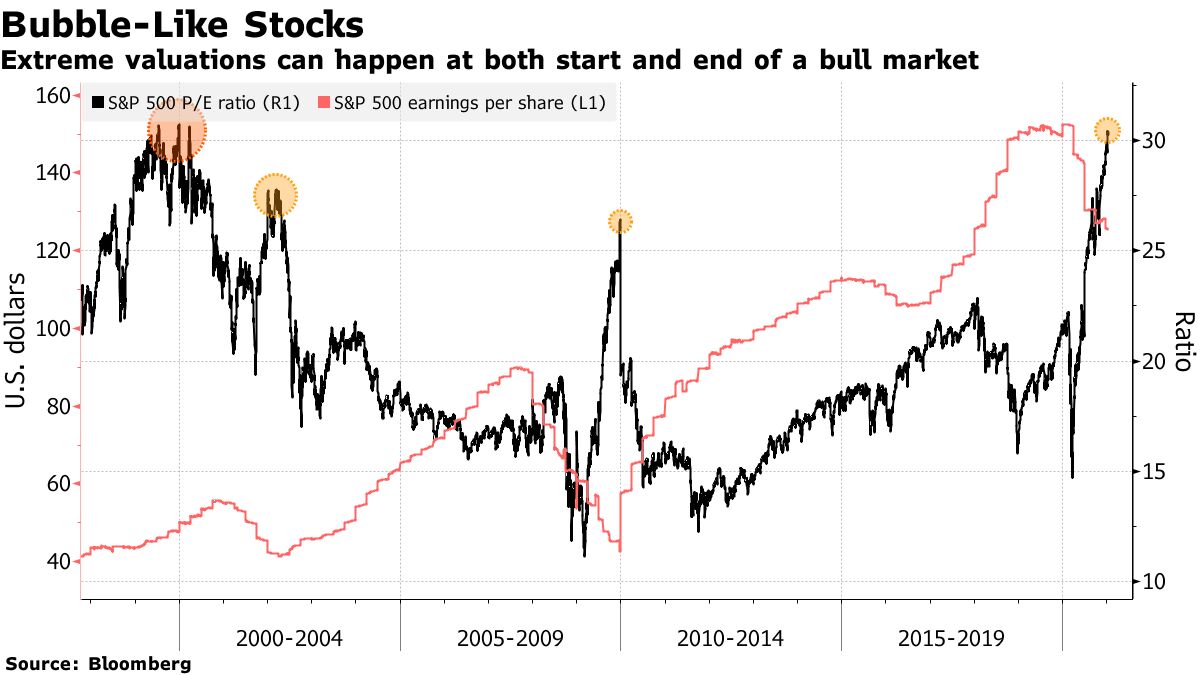

In Paulsen and others’ worldview, there are many things that look like hurdles today, including high valuations, paving the way for improvement that could support a rally. After the recessions of 1992, 2002 and 2009, they note, price-earnings ratios fell as growth resumed and stocks still managed to rise – in each case with help from the Federal Reserve.

Warnings that the market is ripe for a crash grow louder as a 70% 10-month rally pushed the S&P 500 price-earnings ratio to levels not seen since the dot era -com.

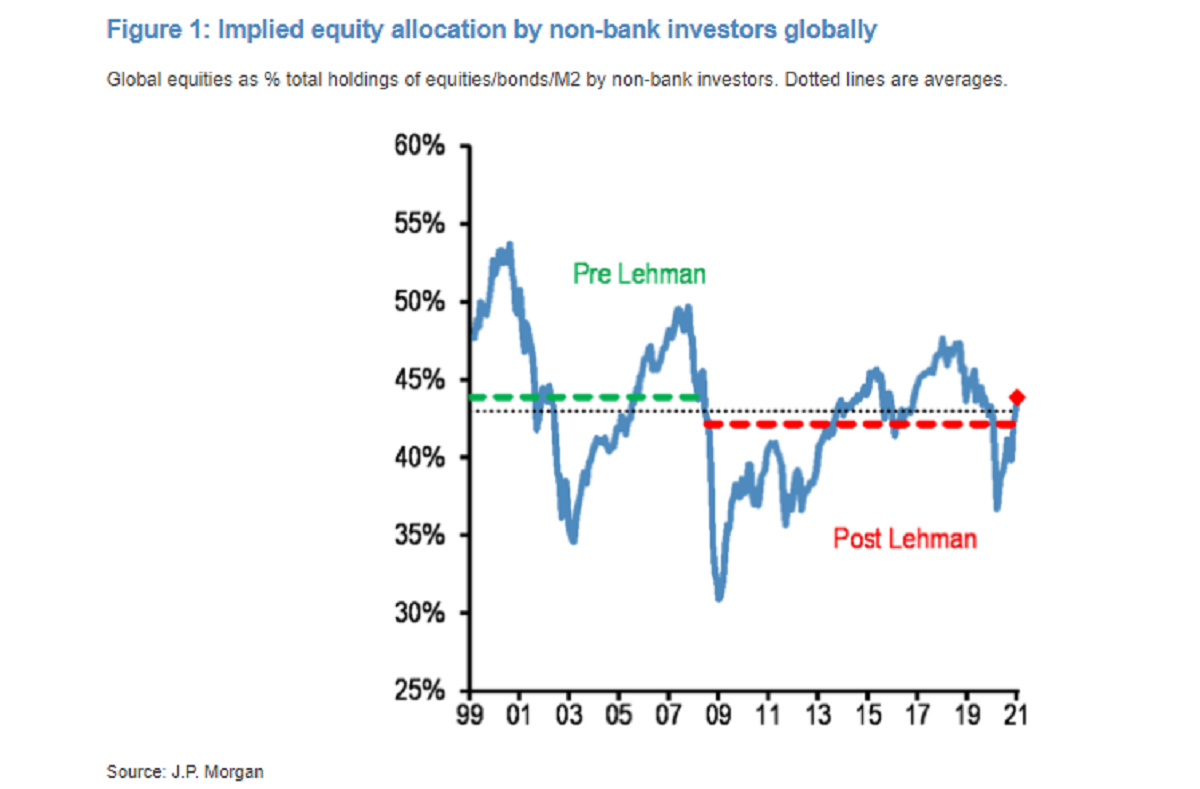

And while the turning point cannot be predicted, the JPMorgan study suggests that the end of the rally is probably far away. Strategists led by Nikolaos Panigirtzoglou developed a model to track investors’ holdings of stocks versus bonds and cash over time. At 43.8%, current exposure to equities is down from the peak of 50% seen before the global financial crisis of 2007-2009 and is below values approaching 55% in the dot-com era.

According to the team’s calculations, even a slight return to the last bull market peak of 47.6% – reached in January 2018 – would result in a 26% appreciation for the S&P 500.

“There is still room in the current bull market,” said Panigirtzoglou. “Certainly that margin is created by consistently above-average bond allocations, rather than cash allocations that have already fallen to the low end of last year’s range.”

Investors, who had stocks avoided in favor of fixed income during most of the last bull market, start to heat up Until stocks. In the last two months of 2020, equity funds attracted a record $ 190 billion in new money, according to data compiled by Deutsche Bank AG. Still, this is paltry compared to total outflows of $ 725 billion since the start of 2018.

The valuation of equities is about to weaken. S&P 500 companies, emerging from a pandemic-induced recession, are in the process of Ending a string of profit declines, revenues are expected to grow double-digit this year and next.

“These are companies that grow faster than general economic growth and command much higher multiples,” said Robert Zuccaro, founder of Target QR Strategies whose $ 50 million Golden Eagle Growth Fund jumped 121% Last year. “If you look at a historic 16 times multiple based on an industrial company, you’re going to be out of the stock market when the market goes up.

Of course, a lot depends on controlling the coronavirus. While the vaccine distribution has boosted sentiment, a full recovery is not guaranteed. Again young investors, some armed with cash distributed in the form of tax aid, swarm with securities and bullish options for quick profits.

The foam sign, along with charts showing extreme momentum in benchmarks like the Russell 3000 Index, make Sam Stovall cautious. CFRA Research’s chief investment strategist recently received phone calls from his two nieces who have never invested in stocks and now want to buy stocks.

“It’s like Markus Rudolf and Joe Kennedy looking to get advice from their bootblack,” Stovall said in an interview on Bloomberg Radio and Television. “It’s a concern that the market needs a summary of earnings.”

But that doesn’t mean the end of the bull market is imminent. The average bull cycle has lasted about five years since the 1930s, with the shortest cycle spanning at least two years.

“I wouldn’t stay here and say this is another year where you might expect a 30% or 40% return, but I am optimistic that this will provide a good backdrop for risk-based assets during at several quarters, ”said John Porter, head of equities at Mellon Investments. “It is irrefutable how important the role of the Fed is. And as an investor, you must respect these forces in the market. “

– With the help of Claire Ballentine

[ad_2]

Source link