[ad_1]

The map is a thin block of aluminum with your name engraved with laser. There is no credit card number, CCV code or signature. This card was born in Cupertino – and these details prevent an elegant design.

That's the Apple Card: the credit card that Apple publishes both in the form of tangible credit card and virtual card in Apple Pay, together with Goldman Sachs and Mastercard. Announced at the Cupertino party and scheduled for this summer, Apple Card marks a strategic shift for the technology group: do not just sell consumers new, brilliant gadgets; Sell them also attractive credit lines.

Regarding the features of the Apple Card, some are excellent, such as the absence of annual fees or late fees on payments. Similarly, interest rates will not increase with missed payments and Apple and its partners have agreed not to sell your expense data. Others are doing very well, like 2% on purchases and 3% on Apple purchases. Interest rates will range from 13.24% to 24.24% (based on your personal credit score at the top of the rate base in the March Federal Reserve data). But that is Apple. It's not just about promising you an old credit card. She promises a credit card "designed for a healthier financial life," according to Jennifer Bailey, vice president of Apple Pay. As such, the card offers all kinds of practical visual metrics designed by Apple to help you limit your expenses. This is a crucial problem in 2019. We are on the brink of a recession. 41.2% of Americans have $ 5,700 in credit card debt and less than half of Americans have the cash needed to deal with a $ 1,000 emergency.

But can the design of UX and Apple's services really change the way people use their credit cards? To answer this question, I spoke to David Gal, professor of marketing at the University of Illinois at Chicago and an expert in behavior economics. (I've also talked to an insider in the credit business, under the guise of anonymity.) According to Gal, the Apple card has positive ideas and potentially ugly ideas. But in the end, it probably will not make a dramatic difference in the way we spend money. That's why even Apple will probably not be able to revolutionize this kind of product.

In terms of money, it is difficult to change behavior

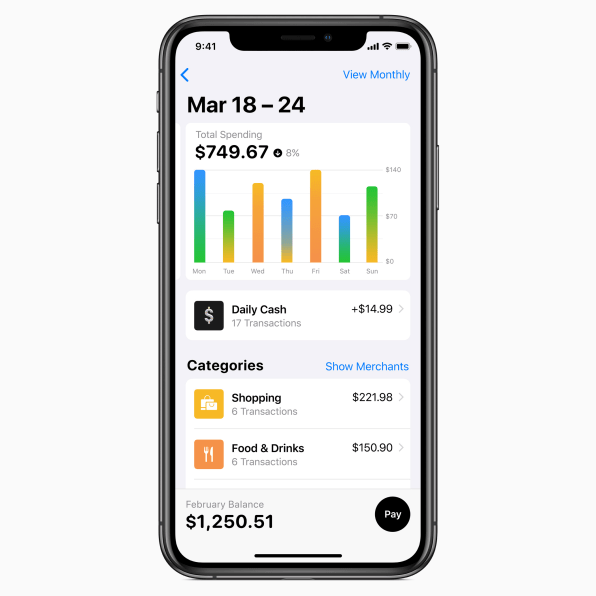

One of the key features of the Apple Card is that it displays and manages its data in an extremely transparent manner. An algorithm works over the phone to sort your expenses into clear, color-coded categories, breaking them down into a beautiful gradient bar chart. Your monthly payments look like inverted fitness goals on the Apple Watch. By sliding your thumb around these bright circles, you can reduce your full monthly payment to an interest-bearing partial payment. As and when, a number appears inside the ring, indicating in dollars the amount of interest you will pay.

These tools are clear, neat and practical. This type of analysis can be developed and understood in a few seconds. Gal is quick to point out, however, that they are not entirely new. Banks and credit card companies have been creating similar graphics for a decade. Maybe not as clearly as Apple, but that's what happened and it did not really affect the net result of consumer credit. "Consumer habits are very rooted," says Gal. "I do not think there is much evidence that change the interface. . . consumers will be clearly motivated to repay their debts. "

For example, Gal highlights the transition from paper billing to digital billing, making it easy to pay for credit card bills without dramatically changing the way people use their credit cards. "Credit companies were afraid that people would know when they should pay," he says. "Credit card companies earn a lot in late fees. But that did not affect much the behavior of consumers. In other words, user-friendly credit management still did not make debt a problem for users. Gal is therefore skeptical about the ability of Apple Card, regardless of the simplicity and intuitiveness of the user experience. is.

Will the Apple card behave like a debt subscription service?

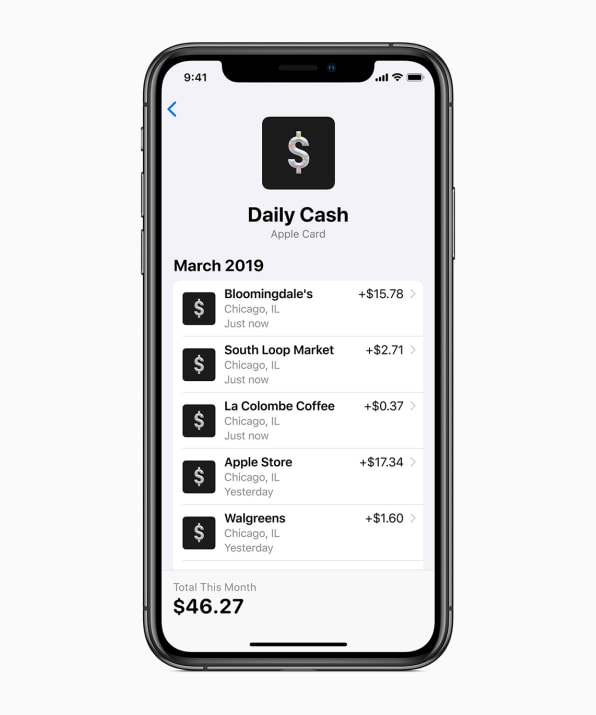

Apple has not conducted any consumer research to determine the behavioral behavior of Apple Card. Instead, his decisions are based on common sense, which may not make much sense if one looks at the psychology of the user. For example, the Apple Card will pay users a daily 2% reward on all their purchases rather than forcing them to wait a month for a bigger refund reward, like many credit cards. This is a consumer – friendly decision: give someone back their money right away because it is the right thing to do. But consider the science of rewards and you'll find that short-term rewards are very motivating for driving behavior.

In other words, this feature could encourage Apple card users to spend more often by rewarding them more often, at a time when we should all probably save our money. Gal thinks that the argument that the Apple card could encourage people to spend more money by rewarding them is quite valid. But he believes that giving people such small and consistent rewards, rather than a large lump sum, could end up giving their consumers a sense of emptiness. "I feel that, in a sense, the reward is so low that I will not notice it," he says.

One of the other worries is that the interface of the Apple card greatly facilitates the sliding of the finger and the decrease of the amount of your payment. Could it be as well is it easy to reduce your payments, and therefore increase your interest?

Combined with the constant micro-rewards of the card and the ability to pay your balance in two-week periods rather than a month, I can not help but wonder if the Apple Card will look like a service. subscription for debts. Will you feel natural to always have some money and pay a little interest, a habit known in the industry as revolving credit? "Revolving credit is the easiest way to make money," says industry insider, saying that Apple Card could end up favoring a lingering debt. "Late fees are a form of income that makes people angry and mean. But the interest is hidden. In other words, fees make us feel like we're broke, but the interest can easily become a discrete and persistent financial burden.

The Apple card has all the time to evolve.

If Apple wants to treat its users ethically and promote healthier consumption habits, the designers of the company could do a lot with the Apple card as the product evolves. Gal emphasizes that reconciling short-term spending goals with long-term transparency (which helps consumers understand the debt repayment process) can really improve consumer spending.

"My research, and other experts have recommended in the past, that consumers tend to be motivated by the perception of progress. If consumers feel they can go into debt, [you can] divide that into more manageable tasks, "he says. "Maybe Apple could break it down if, every month, you pay that amount over a 20-month period, you pay your debt. If they had an application that showed progress in debt repayment, it could be useful for consumers. "

Apple has not yet launched such a feature in Apple Card (or Apple Pay), but it's easy to imagine Apple doing it in the future. The company could easily take advantage of the fact that the iPhone and Apple Pay are evolving to become a remarkably context-aware spending tool (Google Pay being aimed at Android users) in order to help users to adopt healthier behaviors. To do this, society will have to resist the temptation and become the only company in the credit sector that does not roughly monetize consumer debt. And maybe that's the biggest challenge Apple has ever faced.

[ad_2]

Source link