[ad_1]

Villere and company portfolio manager Sandy Villere on the state of the economy affecting how best to allocate capital.

The rally in the US Treasury market is coming to an end, and the impending sell-off could drag the stock market down, strategists warn.

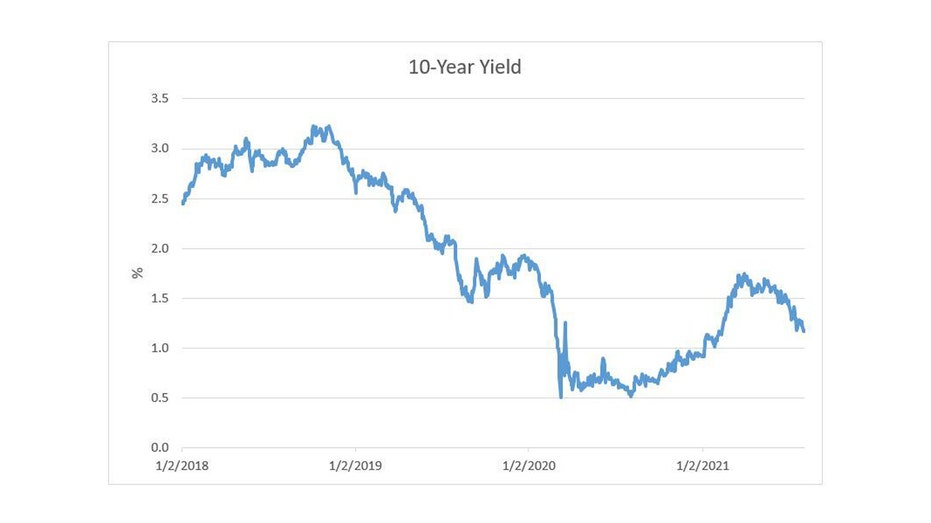

Strong demand for Treasuries in recent weeks has pushed the benchmark 10-year yield below 1.20% after peaking at 1.8% in March. The drop came amid declining US Treasury issuance that left investors struggling with limited supply.

US Treasury yields fall as bond prices rise.

“US government bond techniques dominated everything in the last quarter,” Deutsche Bank strategist Jim Reid said in a recent note to clients.

FED TAPER COULD THROW THE STOCK MARKET FOR A LOOP

“There are signs that this will subside over the next few weeks,” he added. “So much so that if yields are still ultra-low by the end of September, there will be real evidence that something more structural is keeping yields as low as they are.”

Citigroup strategists, led by Robert Buckland, say the lack of widening credit spreads indicates that all is well in the global economy.

A coming rebound in issuance, the ongoing economic recovery and the likely reduction in the Fed’s asset purchase program “push back 10-year bond yields towards 2%,” the strategists wrote. Federal Reserve Chairman Jerome Powell said last month the central bank was still “a long way” from cutting asset purchases and raising interest rates.

The impact of rising returns on the stock market depends on what happens to actual returns, or inflation-adjusted ones, according to Citigroup strategists.

They predict that the 80 basis point hike in the 10-year rate, from 1.2% to 2%, will be accompanied by a 70bp hike in real rates.

Source: Dow Jones Market Data, ICE Closes and Ryan ALM

This increase in real returns could prove “difficult” because of the close relationship between real returns and stock market performance, the strategists wrote.

Growth stocks “appear particularly sensitive to real returns,” wrote the strategists, who lowered their outlook for US stocks to “neutral.” Growth stocks were instrumental in the S&P 500 rising 98% from its March 2020 lows.

Goldman Sachs strategists now assume the 10-year yield will “rise modestly” to 1.6% by the end of the year. Their previous forecast was for the 10-year to hit 1.9%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Assuming the passage of tax reform, they believe the S&P 500 will rise 7% to 4,700 by the end of this year, with high-margin growth stocks the winners.

However, they warn of a scenario where interest rates rise more than expected due to an improving economy, persistent inflation and a Fed tightening give the S&P 500 a fair value. implied by 4,350, or 1% below current levels.

[ad_2]

Source link