[ad_1]

This article was co-produced with Dividend Sensei.

Investors in REITs should always focus on three things:

Quality assets. A sure dividend. A proven and competent management team.

Here's how you generate excellent total returns.

That's why we are impressed by Brookfield Property (BPY) (BPR) – double ticker symbols – we'll explain it later. His strengths and skills are at the rendezvous. That's why I consider it's one of the best high-yield real estate investment funds you can buy today. And with a quality level of 9/11 (taking into account the security of the dividends, the business model and the quality of the management), I consider it a good sleep choice at night … a stock of quality SWAN capable of provide sure dividends and even rising a recession.

And that does not matter if the course of action takes a hit. Which will probably be.

Even better, despite an impressive 33% recovery from the December lows, the Brookfield property remains significantly understated. It currently offers a 30% discount on book value, which in itself probably underestimates at least 5% of its true intrinsic value.

This means that in the long run, I am confident that management will not produce its overall compound annual growth target returns of 12% to 15% – calculated based on its performance plus dividend growth of 5% to 8%. % – but could even reach 15% or more over the next five years if the economy does not falter along the way.

Photo source

Brookfield Property: The king of global real estate has a solid long-term growth plan

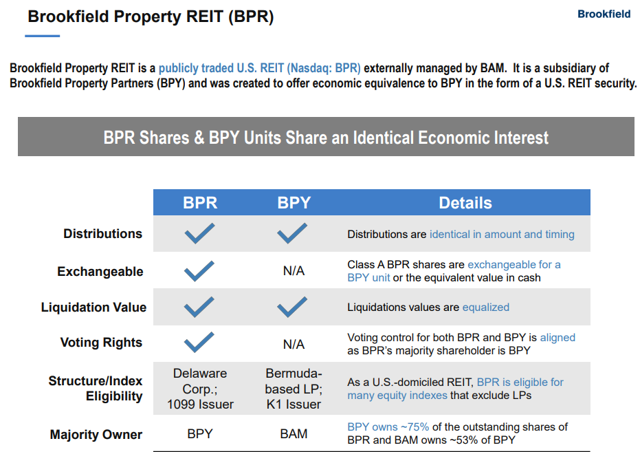

First, it is important to clarify the difference between Brookfield Property Partners and Brookfield Property REIT, which was created as part of last year's $ 15 billion general growth real estate acquisition. . Since GGP's shareholders were investors in REITs, Brookfield created an equivalent REIT to integrate more easily.

As Brookfield explains, BPY and BPR are economically the same, with identical dividends / distributions and the same rate of payment growth.

Brookfield Property REIT (NASDAQ: BPR) is a subsidiary of BPY, provide investors with economic equivalence to BPY units but in the form of a US REIT security. Dividends on BPR Shares are identical in amount and timing to distributions paid for BPY Units, and BPR Shares are exchangeable for BPY Units or their cash equivalents (1).

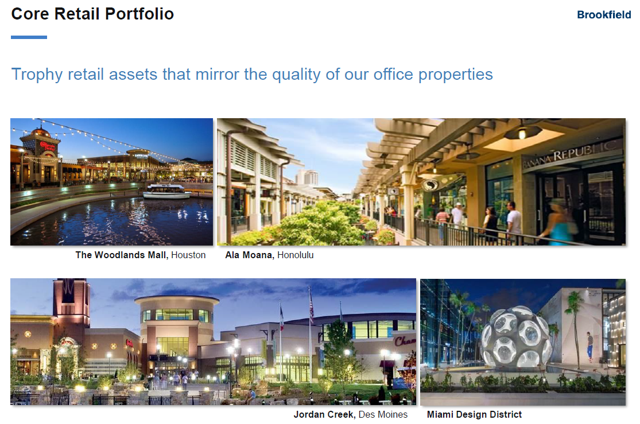

As evidenced by the two series of images below, these are stunning shopping centers.

Source: BPY website

(Source: salary supplement)

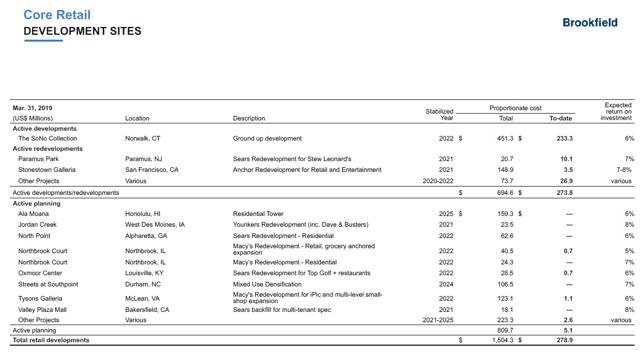

Brookfield owns 8% of all Class A malls in America. In these centers, sales per square foot rose 3.7% to $ 765. For the context, it's higher than Simon Property (NYSE: SPG). Brookfield's policy is to limit reorganizations to 10% or less of assets in order to implement prudent risk management.

For example, in the retail sector alone, Brookfield is currently working on $ 1.5 billion of redevelopments that are expected to yield cash returns of 6% to 8%. This is well below its capital cost of 4.5%. And with respect to core office buildings, the REIT has approximately $ 4.5 billion in new developments expected through to 2025, of which capital returns on capital are expected to be approximately 7%. .

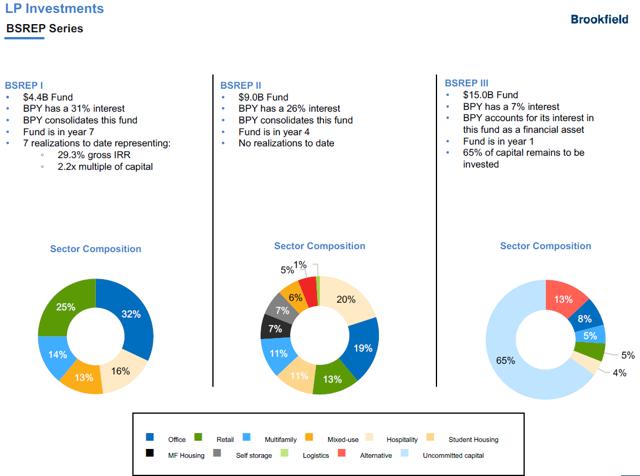

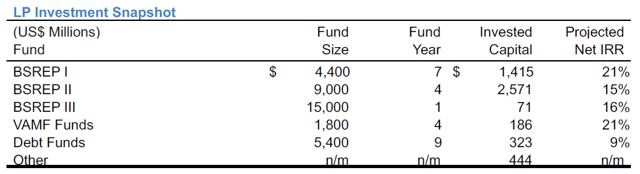

The remaining 20% of the assets are in the limited partnership portfolio (ie venture capital), where Brookfield Property investors may participate in six investment funds managed by Brookfield Asset Management (BAM). .

Brookfield invests in highly undervalued properties generating stable cash flows. This is a good start, but the company believes it can improve these real estate assets and then sell them for profit, achieving an annualized return of 15% to 21% for investors.

It is also interesting to note that these limited funds give Brookfield Property exposure to almost every sector in this sector. In addition, the first seven asset sales of the BSREP 1 fund generated over 29% annualized returns for investors, 8% above management's target.

(Source: salary supplement)

Over the next five years, the limited partnerships are expected to generate $ 5 billion in cash flow and earnings.

(Source: Investor Presentation) – Capital gains of $ 0.61 per unit / share in 2018 However, although Brookfield's record on profitable real estate transactions is legendary, it is literally the "Buffett" of global real estate, but what investors would like most is the The REIT's track record for steady growth in its operating cash flow from its core real estate portfolio.

(Source: Investor Presentation)

While many investors have been disappointed with Brookfield Property's price performance over the years, management ultimately can only control its own operations and fundamentals. Its long-term goal was to generate long-term payments growth of 5% to 8%, supported by strong growth in cash flow per share, and has been successful since its IPO in 2014.

(Source: investor presentation)

More importantly, management – which has so far delivered on its dividend promises – is expected to generate approximately 8% growth in long-term operating cash flow per share over the next four years.

(Source: investor presentation)

As a reminder, this is the second largest cash war treasure of REIT-dom, behind the $ 7 billion Simon Property Group. That's enough to fund Brookfield Property's development backlog.

(Source: investor presentation)

If the reduction in NAV were to decrease by then, annual returns of up to 25% would be possible in the next few years. For the record, these are literally Buffett returns from this first-rate REIT.

In other words, the Brookfield Property offers many opportunities to continue generating not only generous, secure and growing dividends, but also potentially a total return of 15% or more over the long term.

Rating / Total Return Potential: One of the best high-yield SWANs you can buy

yield: 6.6% (compared with an average of 5% over five years) FFO TTM distribution ratio: 91% (compared with an average of 81% in the REIT sector and a 90% security limit) Dividend security rating: 4/5 Distribution ratio, including real estate gains: 66% Debt / annualized EBITDA:10.2 (versus a sector average of 5.8) Corporate debt / EBITDA: 0.3 Interest coverage ratio: 1.7 (vs a sector average of 3.4) Corporate interest coverage ratio: 55.8 Credit rating: BBB Average cost of interest: 4.5% Direction of dividend growth: 5% -8% (supported by cash flow growth of 7% to 9%) Expected total return (no valuation change): 11.6% to 14.6% Management's long-term total return target: 12% -15% Total Return Potential Adjusted for Valuation: 14.3% to 20.3%

The first thing I look at when analyzing a dividend stock is the security of dividends. After all, the last thing I want to own or recommend is a performance trap that will have to reduce its payments during a recession and send the stock price to collapse to boot.

At first glance, BPR's distribution ratio looks dangerously high and, in fact, I will have to see it drop over time, otherwise the security of the REIT will be degraded. However, this temporarily high ratio is explained by the large number of shares that Brookfield had to issue when buying GGP. And, for the record, this was the last major procurement management plan to be made using its undervalued equity. That's why Brookfield is now buying shares at extremely high prices.

In addition, the payout ratio, which takes into account profitable sales of assets, is only 66%, which is well below levels that would bother me about a possible dividend reduction.

One of the most frightening aspects of the Brookfield property, at least at first glance, is the total debt of $ 45.8 billion. This results in a very high leverage ratio, well above the average of 5.8 in the REIT sector. Similarly, the interest coverage ratio initially appears to be 1.7, which is below the security limit for REITs of 2 or more.

However, 97% of Brookfield Property's debt is real estate debt, which is self-amortizing, automatically amortizing, with only $ 1.2 billion at the corporate level, of which the shareholders are responsible. In other words, Brookfield's approach to debt is to use the commercial equivalent of mortgages to finance its acquisitions and investments.

In the event that something goes wrong and a property can not fund its own debt service charges, Brookfield surrenders the keys and borrowers can not use the REIT's overall cash flow. This creates a firewall around funds from operations, or cash flow from operations, and makes the dividend much more secure than the payout ratio and the balance sheet might initially look like.

(Source: Investor Presentation)

In addition, management plans to reduce this debt to $ 40 billion by achieving a standard industry debt-to-capital ratio of 50% and a lower leverage ratio, which is ahead of schedule.

Does this mean that there is no risk associated with this debt? No, as I will explain later in the section on risks, a $ 44 billion essentially non-recourse debt carries its own risks. That's why most REITs choose to use a lower leverage level. But the fact is that I consider Brookfield Property's dividend security to be 4/5. As mentioned before, this means that I give it a level 9 SWAN quality level, with a 2/3 business model and 3/3 management quality.

Another thing I always focus on is the valuation, and the Brookfield property remains one of the top performers in the industry, probably because of fears about its debt.

P / FAP annualized: 13.2 (vs an average of 16.4 REITs) P / NAV: 0.7 (book value $ 28.95) Fair value P / Morningstar (DCF model): 0.83

While there are many ways to value an REIT, whatever it is, the Brookfield property is trading at a very attractive valuation. Morningstar's conservative discount cash flow model estimates it is undervalued at 17%, which is the least undervalued fair value estimate I have seen.

As a precaution, I believe Brookfield is currently undervalued by 17% to 30%, making it a very good buy under my first order rating scale. Of course, this is only for those who are comfortable with its risk profile and high volatility in stock prices.

Risks to consider

As I mentioned earlier, there are certainly risks to keep in mind before investing in the Brookfield property.

(Source: salary supplement)

In the first place, the debt which, without being dangerous from the point of view of the dividend, still has negative aspects to take into account. Brookfield's policy is normally to use long-term fixed rate bonds in local currency to minimize interest rate fluctuations and reduce the interest rate risk of its business model.

However, due to the use of variable rate debt to finance the GGP acquisition, 35% of the debt is currently floating rate, which could expose Brookfield Property to interest rate risk if Short-term rate (according to the London Interbank Offered Rate), or LIBOR) increases significantly in the future.

The good news is that in today's global economy, where central banks do not raise rates, the risks are minimal. However, in the long term, investors will want to ensure that management converts this variable rate short-term debt into long-term debt. Fortunately, that's the plan.

In the first quarter, BPR issued seven-year fixed-rate bonds worth $ 1 billion, which will be used to repay a portion of variable-rate debt used to fund the company's cash and cash equivalents. acquisition of GGP. Management is therefore on track to reduce the floating rate risk.

What about the 65% of Brookfield's debt that is fixed at a fixed rate? Well, here too, there are interest rate risks.

(Source: Ycharts)

Even though the Fed may not be increasing rates, corporate bond yields are determined by the market and BBB rated interest rates can be extremely volatile. The end-2018 correction led to a massive rise in yields due to fears on the financial markets. This was not surprising given the fact that investors are often nervous when stocks plummet.

Fortunately, fears of a recession are easing for the moment because of continued strong economic growth. This has resulted in the return of BBB rates to much lower levels, lower than BPR's average effective interest rate. Financing growth with non-recourse debt should not be a problem under normal economic conditions. But if recession fears rise again (for example, due to the failure of US-China trade negotiations), corporate bond markets could tighten, which would make Brookfield's business much more difficult to implement its growth model.

What is the big macroeconomic risk for Brookfield right now? It depends on the progress of trade negotiations. Goldman Sachs' note earlier this week estimated 60% likelihood of reaching an agreement by Friday, leading to no US tariff increases or retaliation from China. .

However, if this estimate proved to be wrong, Barclays estimated that the increase in the initial $ 200 billion import tariff could have a negative impact of 0.5% on Chinese GDP growth and that the 25% tariff reduction on all Chinese imports would slow annual growth by 1%.

According to Moody's Analytics, US economic growth would not be better. The Moody's model estimates that tariffs of 25% on all Chinese imports – for which Goldman estimates a 10% probability – would cause a 1.8% slowdown in US economic growth due to large-scale Chinese retaliation and from a massive disruption of the supply chain in the US economy.

(Source: Cleveland Federal Reserve)

A few weeks ago, the Cleveland Fed recession / GDP growth model forecast a recessionary probability of 31% by April 2020. It also predicts economic growth of 2.3% this year. It's based on the 10-year quarterly yield curve, an advanced economic indicator and the most accurate recession forecasting tool ever discovered.

But fears of this week's trade war have led to a new reversal of the curve to -0.5bp by the time I write these lines.

(Source: CNBC)

During the last seven recessions, if the curve remained negative for 10 consecutive trading days, a recession occurred on average after about 10 months. This means that the confirmation period of the recession could be counted, although this is only due to commercial fears. He will probably return to positive territory. The cancellation of the recession clock should result in an agreement soon.

(Source: New York Federal Reserve)

The reason I mentioned the risk of recession and the yield curve, is that before the crisis, the risk of recession was already at its highest level in 10 years and close to levels that preceded the last three economic downturns. .

Although I am not worried about a Brookfield dividend reduction during a recession, as I have already explained, management's ability to generate long-term cash flow growth per share of 7% to 9%. % is needed to keep the dividend up, while reducing the payout ratio and further deleveraging could be much more difficult. That's because it takes about $ 1.5 billion in capital recycling a year, which will not be possible if a recession results in a significant drop in global commercial real estate prices.

Investors need to keep in mind another major risk for BPR, which is also linked to the company's heavily indebted balance sheet. As my colleague from the United States, Michael Boyd, recently explained, the value of Brookfield Property's net assets could be hard hit during a recession: a 40% decline if average capitalization rates increase by 90%. base points.

He says:

Whether we like it or not, REITs' market valuations tend to follow NAV, even though cash flows are not fundamentally affected. Having long been on one of the most indebted REITs in the market, Brookfield investors accept greater sensitivity to asset price trends. For those who are more risk-averse, I would personally like to own REITs with similar real estate quality and lower debt profiles, even if that meant giving up some of this juicy reduction in the current net asset value.

It's important to remember that my own SWAN rating on the Brookfield property is 100% whether or not I'm confident the dividend will be maintained during a recession. He has zero to do with the stability of a price of action could be.

Brookfield's highly indebted balance sheet means that the net asset value could be hit hard depending on the severity of the upcoming recession.

Will the global nature of the portfolio help to isolate it a bit, because the world economy should not contract? Sure. But investors must be prepared for BPR / BPY to fall sharply during any future economic downturn and any subsequent bear market. (And, of course, no recession has led to a bear market since the Second World War.)

That is why I do not stop pounding the table for good risk management and a good asset allocation. I can not repeat it enough: No dividend stock is a bond alternative.

While first-class REITs tend to fall less, the leverage of BPY / BPR means that the results may not be the same.

If you need stable or recoverable assets to sell during a recession to finance expenses, for example when retirees do not respect the 4% rule, you must: need have enough money / bonds to avoid selling stocks that are likely to drop significantly.

The Brookfield property, as we saw in the December 19.8% correction, may and will likely end up trading at a shockingly understated level, given that its NAV discount has reached 50%. % on December 24 and its yield, 8.8%.

Here are the empirical rules of risk management that I recommend to most investors. These are based on decades of market research, as well as the personal experience I have gained, as well as that of mutual fund managers.

Conclusion: High yield investors with a strong tolerance for volatility should consider buying a Brookfield property today

For high quality, undervalued REITs, volatility-tolerant investors do not have better choices than the Brookfield property. The REIT's world-class assets, outstanding asset management, strong growth, and low-growth growth capital make this grade 9 SWAN one of Wall Street's best values today.

Do not forget that, faced with the growing risk of recession, it is essential to note that no dividend stock is a bond alternative and that almost all stocks fall during corrections and bear markets. . Whether or not the current freakout of the trade leads to a recession, no one can know it.

That's why it's important to focus on quality REITs that will be able to sustain dividends throughout the business cycle and as part of a well-designed portfolio with an asset allocation that matches your risk profile.

Am I confident in the security of BPR / BPY dividends? Yes. I like the current valuation, its 30% discount on NAV and its long-term return potential of 15% or more? You bet.

While I am happy to recommend today this high quality, undervalued REIT, I can not emphasize enough that the biggest risk is the high leverage, which is an integral part of Brookfield's core model. . Anyone who is not comfortable with the type of volatility that this leverage can generate by the value of the stock's assets / prices should avoid this REIT in favor of SWAN's quality REITs such as Simon Property Group.

Note: We recently upgraded BPY to a strong buy after a recent 6% decline. Market readers were first informed of the change.

Note from the author: Brad Thomas is a Wall Street writer and that means he's not always right with his predictions or his recommendations. Since this also applies to his grammar, please excuse any typos that you may find. In addition, this article is free and its sole purpose is to facilitate research, while providing a forum for second-level thinking.

Invest with the best REIT and the first financial analyst looking for alpha

"Your articles should be mandatory in high schools and colleges, as a separate topic on real estate investments."

"Always well written, factual and very entertaining, and you've done it the hard way."

"Brad is the key REIT specialist, and he has provided excellent insights on which I have read and interpreted my own DD."

"Brad Thomas is one of the most read authors on Seeking Alpha and, over the years, he has developed a trusted brand in the REIT industry."

We offer this special offer so you can sleep well at night …

![]()

Disclosure: I am / we are long BPY. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link