[ad_1]

The Kraft Heinz Company (KHC) has launched a bomb with its latest report on the fourth quarter results of 2018, including brilliant write-downs, a reduction in dividends and even an audit by the SEC to a good extent. 3G Capital's simple cost-cutting plan for most of their acquisitions does not seem to work in the current consumer era, where tastes are evolving even faster than companies can reduce their costs. Companies need to innovate and grow according to the changing needs of consumers, and General Mills Inc. (GIS) is a good example of how to change and grow with its acquisition of Blue Buffalo, a leading sales force after the transaction.

The private equity firm Capital Capital of Jorge Paulo Lemann and Berkshire Hathaway (BRK.A) (BRK.B) of Warren Buffett bought Heinz in 2013 as part of a $ 23 billion transaction at 72, $ 50 per share. Then, in 2015, Kraft merged with Heinz, where Kraft shareholders received shares of the combined company with a special dividend of $ 16.50 per share. Little did they know that in 2019, the company's shares accounted for about half of the price of a few years ago.

Data by YCharts

3G Capital's business model typically involves integrating a new acquisition into its conglomeration and drastically reducing costs, as it seeks to become more efficient while eliminating legacy positions. company that might no longer be needed. Apparently, some of Kraft Heinz's divisions that had been too deeply cut in recent years were its research and development and innovation departments.

This has pushed Kraft Heinz to play ketchup (or is it a catch-up?), Consumer tastes have evolved in recent years as continuous advances in movements of naturalization and biological and animal life. Kraft Heinz's inability to track trends means that she is starting to lose market share due to competition with new innovative products, even though her overall consumption continues to grow slowly. This means that management expects to see pressure on short-term margins on some of its major brands as it is difficult to maintain pricing power when competition continues to impinge on its brands. traditional. If you take into account the rise in commodity prices in many commodities in the industry because of the persistent tariff and trade "war" with China, there is little room for maneuver for packaged foods. Thus, even though management has seen average growth in single-digit consumption in some key brands in 2018, this has not been enough to prevent the company from canceling more than $ 15 billion in value for its major brands. in its report on the results of the fourth quarter of 2018..

With 2019 here and the results of armageddon unveiled, the question is whether Kraft Heinz can right the ship's bar and return to value creation rather than a future decimation, even if it maintains a massive debt. The management plan is to launch in the market in 2019 its largest portfolio of innovations ever supported by marketing budgets while trying to maintain some of its best performing margins in key products. This trend contrasts sharply with 3G Capital's significant cost savings over the past five years, which is probably one of the reasons why the market has sold Kraft Heinz's shares so abruptly as a result of its recent fourth quarter report. Management can say whatever it wants, but processes like this one, especially against the tide, often take several years to materialize before materializing.

Kraft Heinz's fourth quarter report was only the tip of the iceberg for its shareholders. In addition, its annual dividend rate was reduced by 36%, along with the subpoena issued by the SEC as part of an investigation into Kraft Heinz's accounting policies. Kraft Heinz plans to meet all these challenges while continuing to try to solve the problem of its total debt of more than $ 32 billion, with just a little over a billion dollars in cash, which leaves him fewer options than he had the financial ability. Head to the market to simply try to buy a growing business. Kraft Heinz's debt may require divestments in the near future, including the possible sale of its Maxwell House coffee franchise.

This perfect storm of bearish information not only annihilated Kraft Heinz's shareholders, but also many industry peers, because the sales button is a much larger and easier button for many investors to use. It could also mean that there is a short-term buying opportunity for investors who want to "take advantage of the immediate" among some of Kraft Heinz's peers who have been hit by the bad news, though that they are much more likely to change consumer tastes. One of my favorites in the field, especially for recent Kraft Heinz sellers, is General Mills, who has had a slight retreat from the recent highs of Kraft Heinz's bad news, although he has already recovered much of the lost value.

Data by YCharts

General Mills has 8 iconic brands generating global revenue of billions of dollars each. Many of them are also subject to changes in consumer tastes, according to the latest report from the company conference, CAGNY.

General Mills Conference Slide CAGNY

However, General Mills is moving much better over time, as its retail sales have seen double-digit growth for Häagen-Dazs since the beginning of the year, as they focus on natural and organic trends, with new flavors and higher prices for ice cream. simple pure ingredients. Other innovations in its product lines include first-half launches, such as Cheerios Oat Crunch, YQ Yogurt, Annie's bunny rabbits and Betty Crocker mugs, as well as new items in the second half, such as than the Cinnamon Toast Crunch churros and the Go-Gurt dunkers. Compare that with the transcription of Kraft Heinz's conference call, in which they only talk about the big innovation coming up with very little, if any, detail.

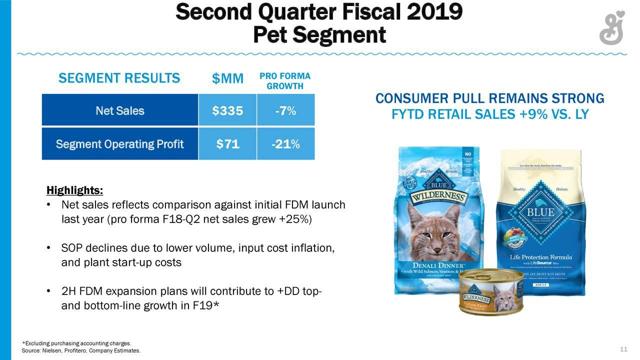

The major asset of General Mills is the acquisition of the $ 8 billion Blue Buffalo dog food, which took place a little over a year ago. year. Blue Buffalo capitalizes on the global trend in animal humanization and is positioned as the # 1 natural pet food brand in the world. Blue Buffalo's retail sales increased by approximately 9% in 2018 and, in the last half of 2019, General Mills plans to develop new customers in the food, drug and the mass (NYSEARCA: FDM), which could double its total volume (NYSE: ACV). end-of-year distribution and lead Blue Buffalo to double-digit growth by the end of fiscal 2019.

Slide from General Mills 2019 Q2 slide

Time will tell when the acquisition of Blue Buffalo by General Mills will begin to bear fruit, but after a year of integration, the growth and potential of the brand are easier to see than the more vague promises from the direction of Kraft Heinz. The tastes and preferences of consumers are changing rapidly and investors should consider removing dead weight, like Kraft Heinz, if they have not already done so, and investing more in a business-driven on growth and innovation in the food and pet service industries like General Mills. One day, Kraft Heinz could be a good buy, or Warren Buffett might decide to completely take over the business in the coming years, but I would think that there is a decent chance that the shares will pass the rest of 2019 without success, unless there are great advances in the trade and tariff war, while the market is eager to see if the company's management can revive its innovation after years of cost reduction. Good luck to everyone.

Disclosure: I am / we are long GIS. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link