[ad_1]

Sources tell Charlie Gasparino of FOX Business that James Chanos of Kynikos Associates has contacted the White House to lobby the need for the short sale.

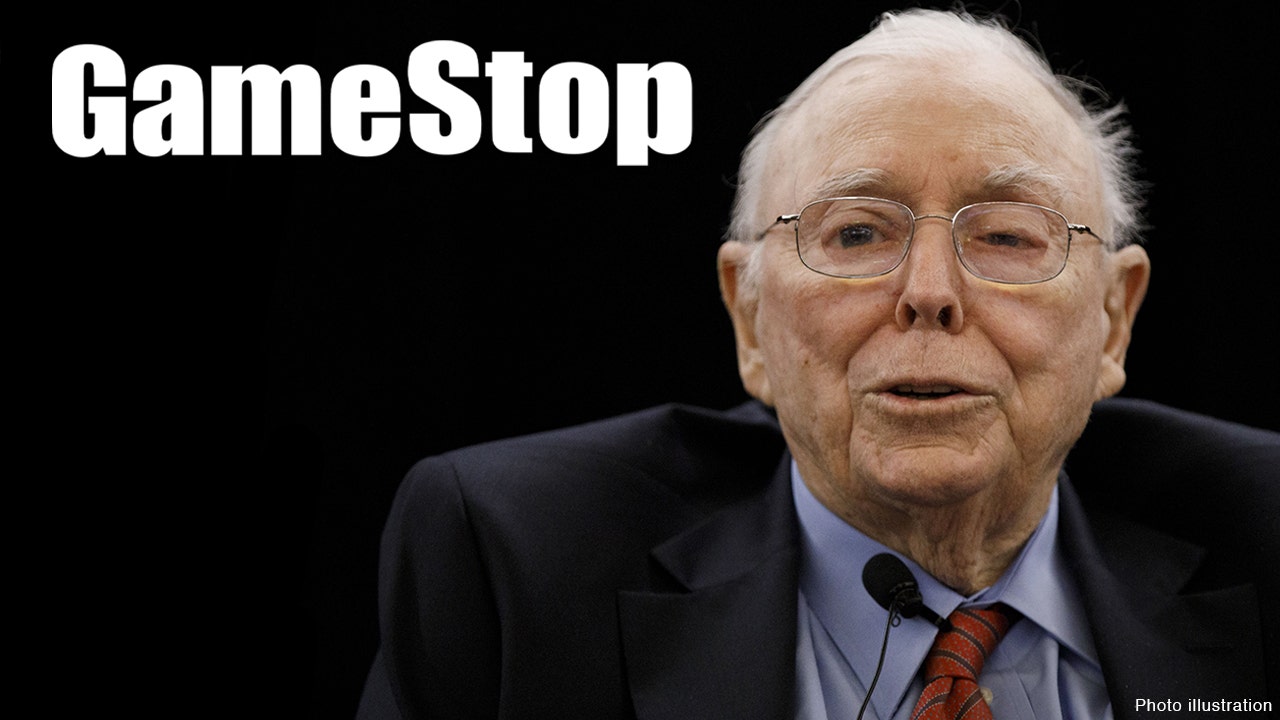

Berkshire Hathaway vice chairman Charlie Munger warned on Wednesday that nothing is ever truly free – at least when it comes to Robinhood and other brokerage apps that try to lure amateur investors with trading promises commission-free on their platforms.

“Robinhood transactions aren’t free. When you pay for the order flow, you are probably charging your customers more and pretending to be free,” the 97-year-old investor said at the Daily Journal’s annual shareholder meeting, broadcast live by Yahoo Fiannce. “It’s a very dishonorable, low-level way of speaking. And no one should believe that Robinhood trades are free.”

GAMESTOP FIASCO A CHANOS DEFENDING SHORT SELLERS IN WASHINGTON

Munger blamed brokerage apps for allowing the recent trading frenzy on stocks, including GameStop, by bringing together “a large number of people who use liquid stock markets to gamble like they would when betting on racehorses.” .

“The frenzy is fueled by the people receiving commissions and other income from this new group of players,” Munger said. “And of course when things get extreme you have things like that short squeeze.”

He also compared commercial activity to the historic South Sea bubble of 1720.

“You will remember when the first bubble appeared, which was the South Sea bubble in England in the 1700s. It took such a toll when it exploded,” Munger said. all businesses for decades thereafter. It only created the most ungodly mess. “

“Human greed and aggression from the brokerage community therefore create these bubbles from time to time. I think the wise stay apart from them, ”he added.

CLICK HERE TO LEARN MORE ABOUT FOX BUSINESS

Robinhood has been accused by critics of “gambling” by investing through its app after the platform began restricting titles, including GameStop. The move was prompted by Reddit’s WallStreetBets, a speculative investing discussion board that began buying call options from the struggling retailer, causing the company’s shares to rise and hurt sellers. uncovered from the market.

Following backlash from Main Street and Wall Street, Robinhood rolled back its trade restrictions. However, this opened the company to a hearing with the House Financial Services Committee and an investigation by the Department of Justice now investigating possible market manipulation.

| Teleprinter | security | Latest | Change | % Change |

|---|---|---|---|---|

| GME | GAMESTOP | 91.71 | +46.74 | + 103.94% |

“It’s really stupid to have a culture that encourages gambling so much in actions by people who have the mindset of racing bettors,” Munger said. “And of course that’s going to create problems, as it has been.”

“And I have a very simple idea on the subject. I think you should try to make your money in this world by selling other people things that are good for them,” Munger continued. “And if you sell them gambling services where you make a profit, like a lot of these new brokers who specialize in attracting players. I think that’s a dirty way to make money. think we’re crazy to allow this. “

A Robinhood spokesperson did not immediately return FOX Business’s request for comment.

[ad_2]

Source link