[ad_1]

Chinese company Tianqi Lithium Corp. Overcame a major hurdle in its bid to buy a $ 4.1 billion stake in SQM, the world's second largest producer of minerals used in electric vehicle batteries. On Thursday, the Constitutional Court of Chile declared an appeal inadmissible, asking whether an agreement between Tianqi and the National Economic Prosecutor (FNE) went far enough to protect SQM's trade secrets against its Chinese competitor.

Tianqi agreed. If you buy a 24% interest in SQM from Nutrien Ltd. before December 13, a decision by the Chilean court to investigate this agreement could have delayed the sale process beyond that deadline. Nutrien will sell its stake in antitrust requirements set by India and China for a prior merger.

"Nutrien and Tianqi are waiting to conclude the transaction before the end of the year, as previously announced," the two companies announced in a joint statement. Shortly after the announcement of the court decision

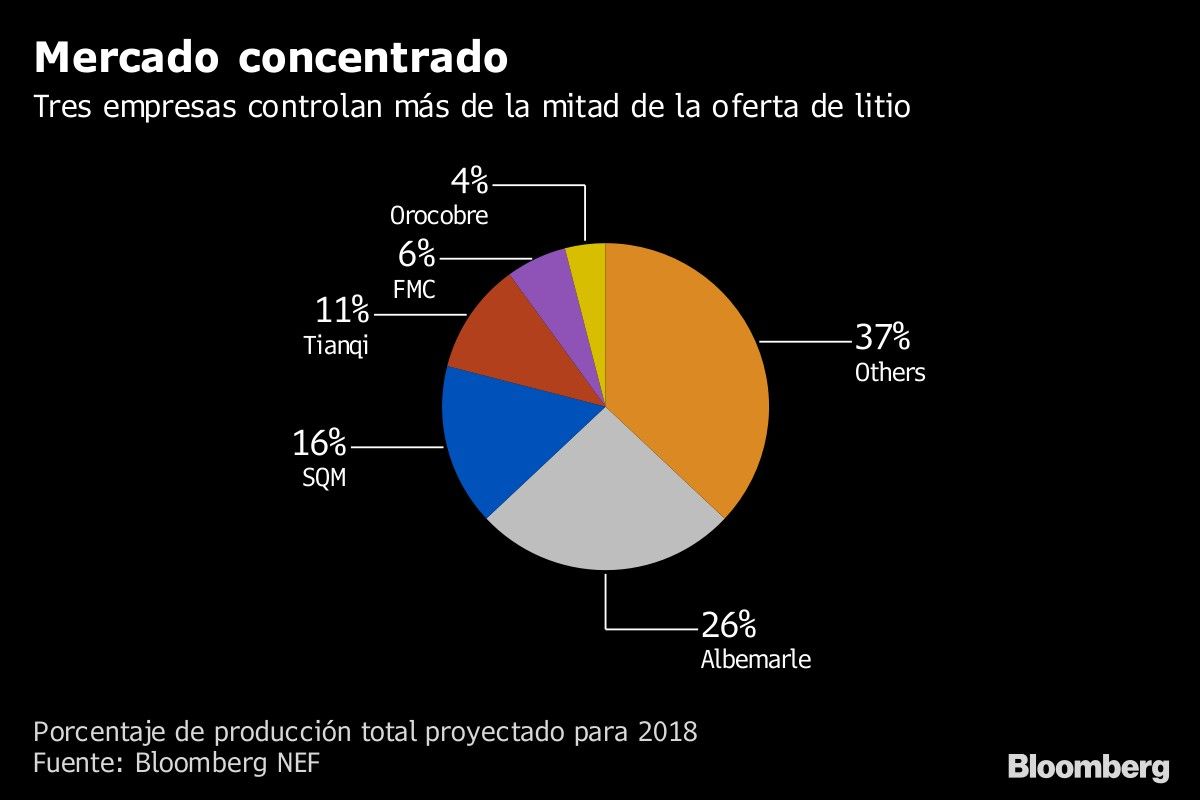

The Chinese public company's takeover bid on minority interests was causing concern for the antitrust authorities of Chile because of market shares on Tianqi and SQM lithium, formerly Soc. and Minera de Chile SA. Last month, the FNE announced the conclusion of an agreement with Tianqi comprising a series of provisions to avoid concentration in the global lithium market.

SQM and its main shareholder and former president, Julio Ponce, expressed their concern about the FNE's decision. The representatives of SQM shareholders did not immediately respond to requests for comment.

Tianqi shares, which fell 46% this year, posted little change on Friday in Shenzen. SQM shares rose 2.7% Friday, shortly after the opening of the local market. The Solactive Global Lithium Index, which monitors lithium producers and consumers, lost 0.7%.

[ad_2]

Source link