[ad_1]

Gold prices ended Tuesday 's session up $ 10.92 an ounce after rebounding from its lowest level since mid – December while the dollar rallied. is weakened. Gold extended its gains after the market penetrated the resistance of $ 1246. It is expected that today 's trading volume will be reduced as US financial markets are closed for Independence holidays. Traders are waiting for the publication of the minutes of the June US Open Market Committee meeting that are being released on Thursday and Friday's usage data to get an idea of legislators' forecasts for 2 more types increases this year. year.

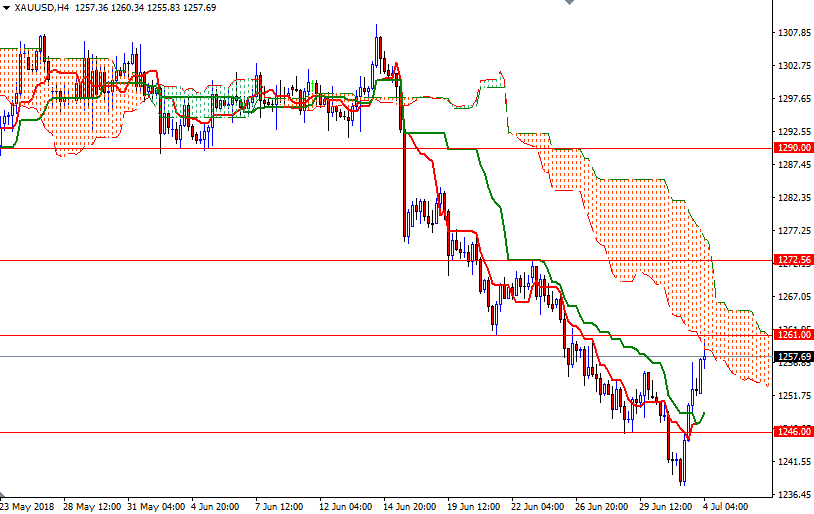

Short-term charts are slightly bullish at this time, with the market trading above the Ichimoku clouds in the M30 and H1 periods. In addition, we have a bullish crossover of the Tenkan-Sen lines (9-period moving average, red line) and Kijun-Sen (26-period moving average, green line). However, keep in mind that we have a 3 month bearish trend on the daily chart. The 4 o'clock Ichimoku cloud is above us, so the bulls will have to overtake the 1259.40-1262 area if they intend to test the 1266/5 area. A break above 1266 will signal that the XAU / USD will read 1272.56-1270.

[ad_2]

Source link