[ad_1]

The Tesla Elon Musk roadster is launched in space (photo via Newsweek).

Collision protection comes into play for Tesla

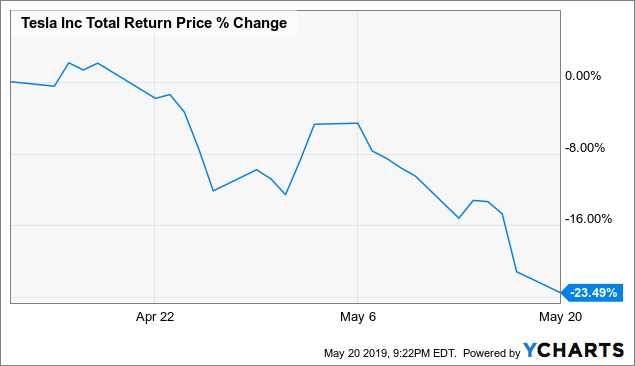

Last month, I introduced to Tesla shareholders (TSLA) two ways to protect themselves in the event of a fall in their stock. Since then, Tesla shares are down more than 23%.

Data by YCharts

Now let's take a look at how the hedges have improved this slide and briefly discuss action plans for Tesla covered.

The optimal coverage for the month of April

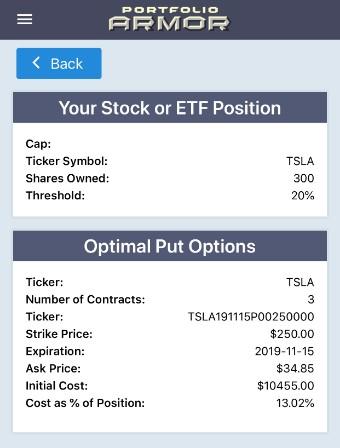

On April 12, these were the best, or at least expensive, ways to protect Tesla from more than a 20% drop by mid-November (screenshot via the Portfolio Armor app for iPhone) .

Note that the cost of sales protection was high: $ 10,455 or 13.02% of the value of the position (calculated conservatively, using the sell price of the put options).

Let's look at how this coverage reacted downwards by 23.5%.

How did the optimal hedge react?

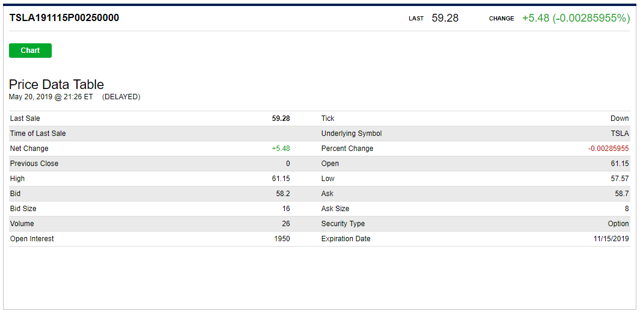

Here is an updated quote on these put options at Monday's close (via CBOE):

How this hedge improved the Tesla drop

TSLA closed at $ 267.70 on April 12. A shareholder who held 300 and who was covered with the put options above then held $ 80,310 of TSLA stock plus $ 10,455 in put options. The net value of the position was $ 80,310 + $ 10,455 = $ 90,765.

TSLA closed at $ 205.36 on Monday, May 20, down more than 23% from its April 12 close. The shares of the investor were worth $ 61,608 on Monday, and put options, $ 17,535, using the midpoint of the gap. Thus, the net value of Monday's closing position was $ 61,608 + $ 17,535 = $ 79,143. $ 79,143 represents a decrease of 12.8% from $ 90,765.

The April optimum necklace hedge

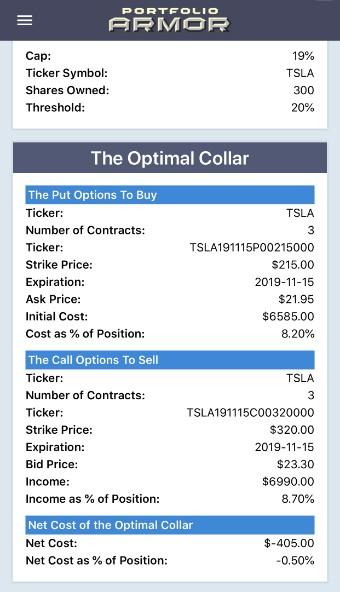

On April 12, it was the optimal pass to protect against a fall of more than 20% of the TSLA by mid-November, without however limiting your possible increase to less than 19% by then.

In this case, the net cost of the hedge was negative, which means that you would have earned a net credit of $ 405, assuming you bought the put options and sold the purchase options at the worst of their respective margins.

How this optimal cervical hedge reacted

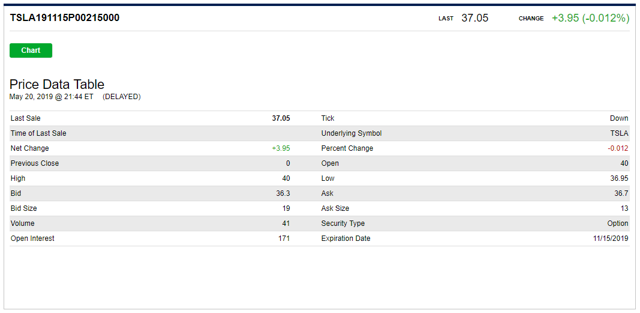

Here is an updated quote on the leg put on the collar (note that the striking is different from that of the first hurdle):

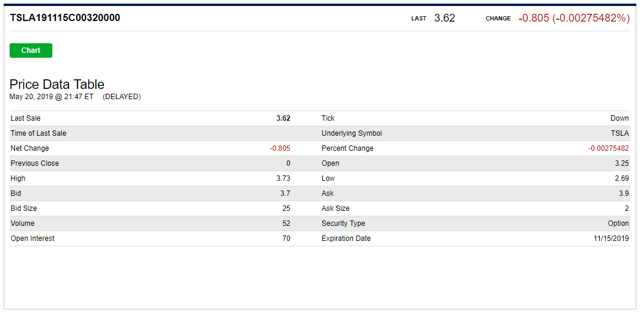

And here is an updated quote on the call leg:

How this hedge improved the Tesla drop

Remember that TSLA closed at $ 267.70 on April 12th. A shareholder who owned 300 and who was covered with the necklace above then held $ 80,310 in TSLA shares, $ 6,585 in put options, and if the investor wanted to buy to close the short position, he would would have cost $ 6,990. Thus, the net value of the April 12 position was ($ 80,310 + $ 6,585) – $ 6,990 = $ 79,905.

Since TSLA closed at $ 205.36 on Monday, May 20, the investor's stock was worth $ 61,608, the put options were worth $ 10,950 and it would have cost $ 1,140 to buy his options. purchase, using the midpoint of the gap in both cases. So: ($ 61,608 + $ 10,950) – $ 1,140 = $ 71,418. $ 71,418 represents a decrease of 10.6% from $ 79,905.

More protection than promised in both cases

Although Tesla fell by approximately 23.49% from April 12 to May 20 and both covers were designed to protect against a drop of more than 20%, the optimal coverage position was only 12, 8% and the optimal cervical cover position was reduced by 10.6%. In both cases, the time value of the put options provided a bit more protection than expected because the hedges were structured to protect against the intrinsic value alone.

And now?

It depends on you and it will probably depend in part on your vision of Tesla's prospects from here. If you are a subscriber to Seeking Alpha Essentials, you can check out Tesla's new quantitative classification (I went into the details of these quantitative assessments based on a presentation that I attended with the creator last week in this article). Tesla's current ranking is distinctly bearish, while Seeking Alpha's contributors and Wall Street analysts are neutral on the stock, overall. The good thing about the cover, though, is that it gives you options (no pun intended). You do not have to worry about the amount of fuel that Tesla could still give up because your disadvantages are strictly limited. You can go out now, for less loss; you can buy to close the call leg of your collar to remove your protective cap if you are bullish; and if you are even more optimistic, you can sell the put options you like and buy more Tesla shares. In any case, you have the time to let the dust settle and decide on your action, without the worry of an uncovered investor.

This article was about risk management, but my Marketplace service associates this process with a security screening process that has exceeded the expected annual rate of 4.66%, as you can see in the last table of my last update. performance day of Bulletproof Investing.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link